Home Insurance Claim Starter Pack

A free Northern Ireland home insurance claim starter pack: a step-by-step checklist, simple evidence plan, and key questions to ask early so you stay organised and avoid avoidable delays.

Welcome to our dedicated hub for all things related to property damage insurance claims. If you’re discovering the challenges of a home insurance claim or seeking professional advice on maximising your claim, you’ve come to the right place.

As Northern Ireland’s premier Loss Assessor service, we’re committed to providing you with the expert guidance and resources you need to ensure your insurance claim is handled with precision and care.

In this collection of helpful articles, you’ll discover valuable tips, in-depth explanations, and real-life case studies about property damage insurance claims.

A free Northern Ireland home insurance claim starter pack: a step-by-step checklist, simple evidence plan, and key questions to ask early so you stay organised and avoid avoidable delays.

If you are close to appointing a loss assessor, the biggest uncertainty is often what the process will actually be like in practice. This page explains what happens when you appoint PCLA as your loss assessor, setting out the typical stages of working together, what we do at each point, what we need from you, and what you can expect in return. It also covers communication, fees, and what you are — and are not — committing to, so there are no surprises.

If your home has been damaged and you’re facing an insurance claim, it’s normal to feel unsure about what to do first and what really matters. This step-by-step guide explains the home insurance claim process in Northern Ireland in plain language, helping you understand the order of events, avoid common pitfalls, and recognise when additional support may be helpful. You do not need to understand everything at once — only the next sensible step.

If you’re part-way through a home insurance claim and something doesn’t feel clear, a second opinion can help. PCLA offers a free initial claim review, starting with a phone call to understand your situation and assess whether we can genuinely add value. If appropriate, this is followed by a free on-site property damage survey. You’ll receive a straightforward view of where you stand, what may be missing, and your most sensible next step — with no pressure to proceed if we’re not the right fit.

After you report property damage to your insurer, the most difficult part is often the waiting. You may have a claim reference but little sense of when an inspection will happen, who is handling the claim, or what should come next. This guide explains what typically happens after you report a home insurance claim in the UK, what delays are normal, what is not, and how to ask the right questions to get clarity without escalating matters unnecessarily.

If you have damage to your home and you’re unsure whether to make an insurance claim or pay for repairs yourself, the decision is rarely straightforward. It usually comes down to the true cost of repairs, how your policy excess and cover apply, and the risk of hidden or worsening damage if issues are dealt with piecemeal. This guide walks through those factors using simple examples to help UK homeowners make a proportionate, informed decision.

If your home insurance claim has been reduced or rejected, the next step is not to argue in general terms. It is to understand the insurer’s stated reason, the evidence they relied on, and how that decision fits with your policy. This guide explains the most common technical reasons insurers give for reducing or refusing property claims, how to read the decision properly, and how homeowners in Northern Ireland can respond in a calm, structured, and effective way.

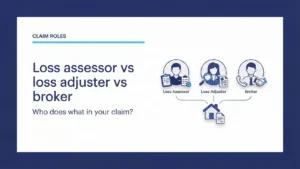

When you’re dealing with damage to your home, it’s common to find yourself speaking to several people with very similar-sounding job titles. That confusion can lead to a costly assumption that everyone involved is acting for you personally. This guide explains the difference between a loss assessor, a loss adjuster, and an insurance broker by focusing on two practical questions: who appoints them, and who they ultimately work for. Once those points are clear, the roles, and their limits, make much more sense.

Most home insurance claims do not fail suddenly. They drift. For many homeowners, that drift shows up as slower progress, unclear explanations, or decisions that do not quite make sense. This guide sets out five warning signs that experienced claims professionals recognise early, explains why they matter, and outlines sensible next steps if several apply to your situation — without blaming insurers or encouraging conflict.

If you’re part-way through a home insurance claim and it feels like everything has slowed down, you’re not alone. Claims often move in stages, with inspections, decisions, and approvals followed by quiet gaps that can feel like nothing is happening. This guide explains how long home insurance claims typically take in the UK, why delays occur, and what you can do at each stage to prevent your claim from drifting.

Learn when a loss assessor is likely to add value, when you can safely handle it yourself, and how to sense-check complexity, friction, and what’s at stake.

If you are dealing with a home insurance claim and someone has mentioned a “loss assessor”, it can be unclear what that actually means. This guide explains what a loss assessor does, how they differ from an insurer’s loss adjuster, and when appointing one is likely to be helpful for UK homeowners.

Most homeowners worry about the wrong risks. Based on a year of real claims, this article explains what actually causes home insurance damage — and why everyday issues like hidden water leaks matter more than dramatic events.

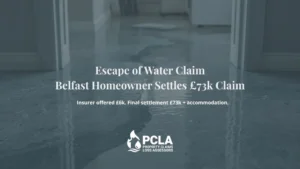

A routine insurance claim turned into a major success for one Belfast homeowner when PCLA uncovered hidden water damage that the insurer’s first inspection missed — increasing the offer from £6,000 to £73,000 and securing paid alternative accommodation.

A Mansewood homeowner was offered just £700 for severe water damage — until PCLA stepped in. Our Glasgow loss assessors secured a £10,900 payout, ensuring full repairs and peace of mind. Learn how our independent team fights insurers and delivers fair settlements for homeowners across Glasgow.

Hidden clauses in your home insurance policy could cost you thousands. This guide highlights the most common exclusions and limitations that insurers use to reduce payouts—and what you can do to protect yourself.

Facing a home insurance claim in Northern Ireland? The choice between cash settlement and reinstatement isn’t just about money – it’s about control, time, and peace of mind. Here’s what you need to know before deciding.

Discover how the indemnity principle affects your home insurance claims in Northern Ireland. Learn what fair compensation really means and how to protect your interests.

Discover why your ‘duty of disclosure’ is crucial for protecting your home insurance in the UK. From past claims to renovations, learn exactly what you must tell your insurer – and when – to ensure your coverage stays valid. This article will help homeowners understand their responsibilities and avoid the common pitfalls that could void their insurance protection.

When disaster hits, the last thing you want is to get lost in confusing insurance terms and policy exclusions. Many homeowners face this challenge, often unaware of obstacles that can weaken their claims. Issues like unreported risks and the hidden effects of property modifications can all add to the complexity. Continue reading to learn about the five important things your insurer won’t tell you and why hiring a loss assessor might be the smartest move for your home.

For many homeowners, the stress of a home insurance claim doesn’t come from the damage – it comes from the insurer. This blog explores the five most common frustrations people face, from delays to disputes, and includes a real example from Omagh where PCLA helped a homeowner turn things around.

Think your home insurance claim is too small to worry about? Many Northern Ireland homeowners only realise the true cost once repairs are underway – and by then, it’s often too late to go back. This post explains why even a minor leak deserves expert attention, and how PCLA helped one Bangor couple boost their claim from £12k to over £18k.

As Northern Ireland embraces air fryers for economical cooking, a disturbing trend emerges. With 48% of NI homes now owning these appliances—far exceeding the UK average—the rise in devastating fire incidents is causing alarm. Recent data shows the average air fryer fire claim reaching £29,555, with one catastrophic case causing £80,000 in damage. Discover the hidden risks in your kitchen and learn how to protect your home and family…

A costly oil tank leak could void your home insurance – discover what UK homeowners must know before disaster strikes.

If you’ve experienced a house fire, then you’ll need to understand the insurance claim process. These essential tips will ensure quick, fair settlements and maximise your insurance benefits. Read on to ensure your home recovery is smooth and stress-free.

This blog looks into the challenges domestic oil spills pose for Northern Ireland homeowners, offering prevention tips and emphasising the importance of professional assistance. Learn why expert help is crucial for maximising your insurance claim and safeguarding your home against potential environmental and financial impacts.

Domestic oil tanks are common in Northern Ireland homes but carry risks of costly leaks. Learn practical prevention steps, explore real case studies, and get expert advice on managing oil leaks effectively to protect your property and finances.

Water damage is a silent intruder that can devastate a home before its full impact is realised. A single plumbing leak can lead to structural damage, ruined finishes, and complex insurance issues, particularly in open-plan homes. At PCLA, we’ve witnessed the far-reaching effects of such damage. Take, for example, a case from Ardboe in May 2024, where a seemingly minor leak spiralled into disaster, affecting the dining room and hallway. Discover how leaks in one room can wreak havoc in another and learn how to protect your home from similar fates.

When bathroom water cascades through your ceiling, the damage can be devastating. Through this Belfast case study, discover how professional loss assessors transformed an inadequate insurance offer into a comprehensive settlement. Learn the crucial steps for protecting your rights and securing fair compensation for water damage in your Northern Ireland home.

When storms strike Northern Ireland, knowing the right steps to take can make the difference between a successful insurance claim and a frustrating ordeal. PCLA’s comprehensive guide walks you through crucial post-storm actions, from immediate safety measures to documenting damage effectively. Learn how professional loss assessors can help you secure the settlement you deserve.