If you are dealing with a home insurance claim and someone has mentioned a “loss assessor”, it’s normal to wonder what that actually means, whether it is worth paying for, and whether it’s simply “another insurance person”.

In one sentence: a loss assessor is an independent professional you appoint to represent you (the policyholder) in a property insurance claim. They help to evidence the damage, interpret the policy, value the loss, and negotiate a fair settlement for you.

This guide explains what a loss assessor does, how they differ from an insurer’s loss adjuster, and when using one is likely to be helpful in the UK.

Important: This article is general information, not legal advice. Coverage and outcomes depend on your policy wording, the cause of loss, and the evidence available.

The problem: why insurance claims can feel one-sided

Most homeowners claim rarely. Insurers, adjusters, and repair networks handle claims every day. The imbalance is usually about familiarity, time, and process — not intelligence.

Common frustrations homeowners report include:

- Unclear next steps or changing requirements (photos, invoices, drying logs, contractor scopes).

- Slow progress when multiple parties are involved.

- Disagreement about what is “damaged” versus “pre-existing”, or what is “necessary” versus “optional”.

- Cash settlement offers that do not seem sufficient to complete repairs.

- The emotional load of running a claim while trying to keep life normal.

In practice, claims often succeed or fail on the basics: documentation, scope, causation, policy interpretation, and whether the insurer considers the evidence supports the amount being claimed.

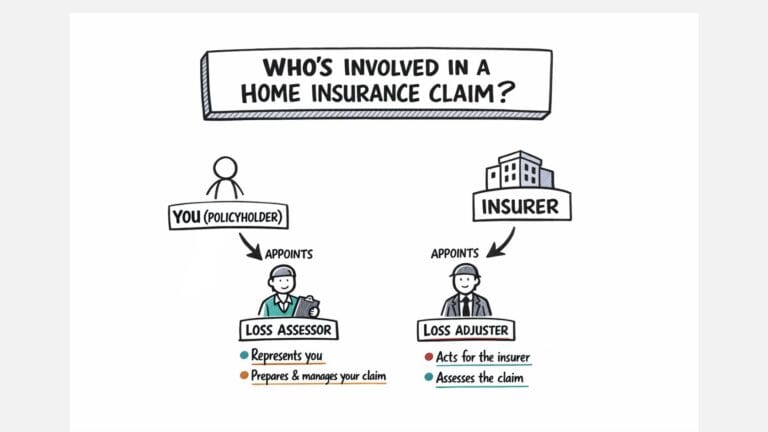

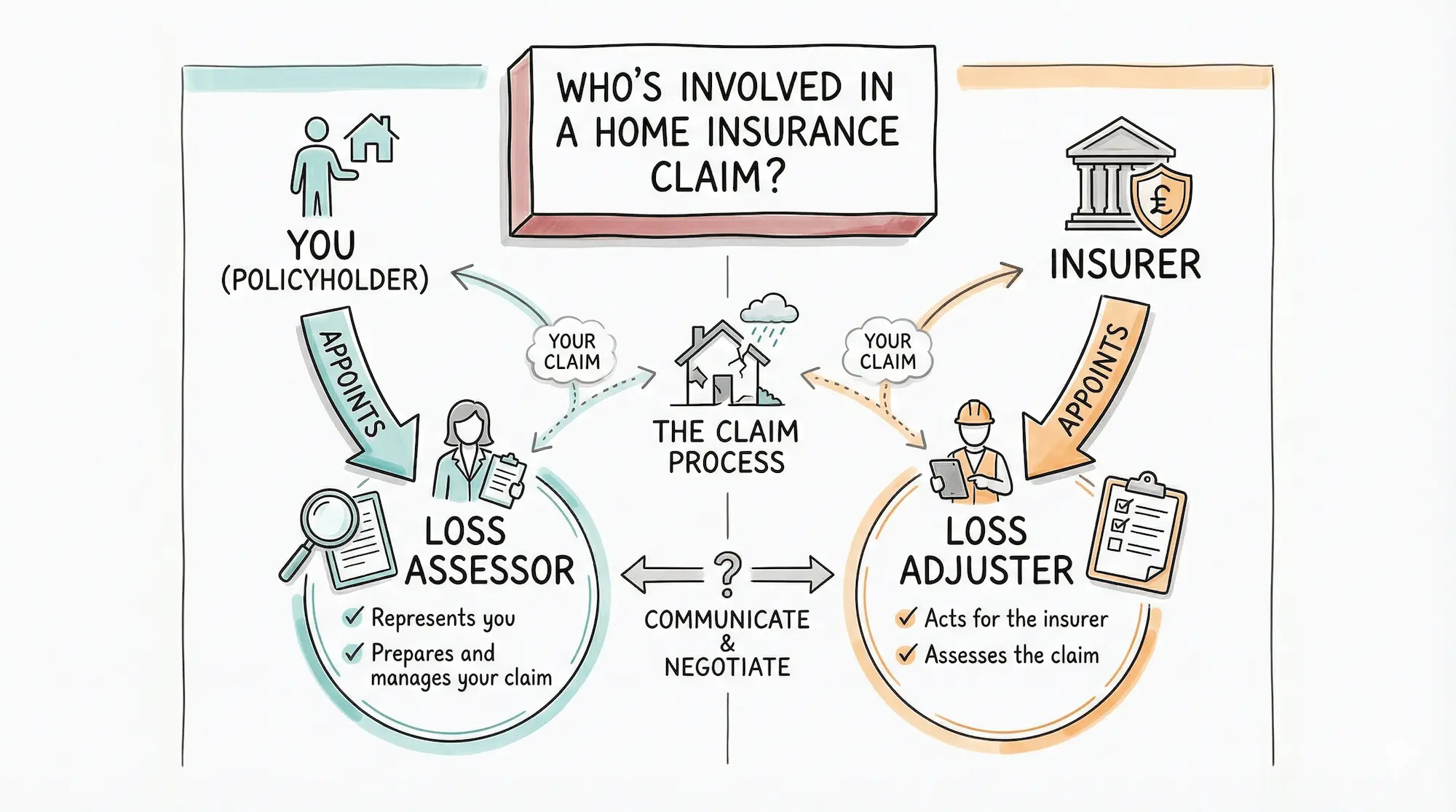

Who’s who in a property claim?

Your insurer

Your insurer is the company you pay premiums to. They decide whether the policy responds and what they will pay, based on the policy terms, the cause of loss, and the evidence.

The loss adjuster (appointed by the insurer)

A loss adjuster is often appointed by the insurer on larger, more complex, or higher-value claims. Their role is to investigate and assess the claim for the insurer and help the insurer reach a coverage and settlement position.

Note: They are not generally there to prepare your claim for you in the way a representative would.

The loss assessor (appointed by you)

A loss assessor is a professional you appoint to represent you (the policyholder). Their role is to manage the claim on your behalf: evidence, scope, valuation, negotiation, and progress-chasing.

In the UK, many reputable loss assessors operate as FCA-authorised firms. Regulation does not guarantee outcomes, but it does set conduct expectations and accountability for regulated activities.

“who’s on whose side” diagram:

What a loss assessor actually does day-to-day

A good loss assessor’s work is practical and evidence-led. Typical tasks include:

1) Assessing and documenting the damage

- Site visits, photographs, and clear damage notes.

- Identifying what is affected (including hidden or secondary damage where evidence supports it).

- Helping you record the timeline: what happened, when, what you did to limit damage, and what changed after.

For escape of water claims, technical documentation is often decisive because drying, moisture movement, and concealed damage are commonly disputed.

2) Interpreting the policy in plain English

- Checking which sections apply (buildings, contents, alternative accommodation, trace and access if relevant).

- Reviewing exclusions and conditions that often drive disputes (maintenance arguments, gradual damage, unoccupancy, wear and tear).

- Explaining what the insurer is likely to ask for and why.

Many claim difficulties come from the gap between “what feels fair” and “what the wording supports”.

3) Preparing claim evidence and costings

- Building a coherent file: photos, invoices, engineer reports (if needed), contractor scopes, and valuations.

- Ensuring the scope is complete and consistent (not just patch repairs where evidence supports full reinstatement).

- Presenting the claim so it can be assessed without repeated back-and-forth.

4) Managing correspondence, negotiation, and progress

- Responding to insurer positions with evidence and clear reasoning.

- Challenging gaps in scope, unsupported assumptions, or unclear rationale.

- Keeping momentum through updates, timelines, and (where appropriate) interim payments.

5) Referencing claims-handling standards when relevant

Sometimes the issue is not only the technical merits of the claim, but the way the claim is being handled — for example unclear communication, repeated delay without a clear plan, or a lack of explanation for decisions.

A loss assessor can help by setting out (in writing) what information is needed, what has already been supplied, what decisions are outstanding, and what a reasonable next step looks like — keeping the discussion focused on clarity, evidence, and process.

When should you use a loss assessor?

This is a short checklist, not a guarantee of a better result. These are common signals that professional representation may be useful.

1) High-value or major damage

If repair costs are significant, small gaps in scope or valuation can become expensive.

Examples:

- Fire damage where smoke contamination affects areas beyond the obvious burn.

- Escape of water where floors, wall linings, or kitchen units appear to dry, but evidence suggests deeper impact.

2) Disputes, delays, or low offers

Consider support when:

- Settlement proposals do not reflect the work required.

- There is repeated disagreement about what is “necessary”.

- The claim has stalled with unclear next steps or shifting decision-makers.

3) You are time-poor, overwhelmed, or not confident in the process

Even where a claim is valid, weak documentation or inconsistent communication can slow progress and increase stress. A loss assessor’s value is often that they know what “good” looks like and how to evidence it.

If you want a fuller “DIY vs appoint” decision framework, read the related guide: Do I Need a Loss Assessor for My Home Insurance Claim in Northern Ireland?

When you probably don’t need one

It can be overkill where the claim is genuinely small and straightforward, and the insurer has already:

- accepted the claim promptly,

- agreed a clear scope,

- provided a workable route to reinstatement (or a reasonable cash settlement),

- and communication is smooth.

Examples might include minor accidental damage or a contained escape of water where only a small, clearly defined repair is required and agreed quickly.

A helpful way to think about it: you do not need professional help simply because you can appoint it. You need it when it materially reduces risk, complexity, or the likelihood of a poor outcome.

What does it cost, and who pays?

Typical fee models

Fee models vary. You may see:

- A percentage of the settlement (plus VAT where applicable),

- Fixed fees for certain defined tasks, or

- Stage-based fees (e.g., review only vs full representation).

Because terms differ materially, it is sensible to request clear written details on:

- what is included,

- what is excluded,

- when fees become payable,

- and what happens if you end representation mid-claim.

PCLA fees (as agreed in writing)

PCLA’s standard fee is 10% of the final settlement offer + VAT (subject to the terms agreed with you in writing).

- The fee is typically paid by the policyholder, not the insurer.

- It is not a guarantee of a higher settlement; it is the cost of professional representation and claim preparation.

- A sensible test is whether the likely net outcome (settlement scope, valuation quality, time saved, stress reduced, clarity restored) justifies the fee in your situation.

If you’re considering a cash settlement, it’s also worth understanding how insurers calculate it (rates, scope assumptions, and how VAT is treated under your policy and settlement route).

Real examples from Northern Ireland cases

Example 1: Escape of water in kitchen

- What happened: Leak from dishwasher caused water damage to floor and cabinets in the kitchen, as well as spreading to adjoining rooms.

- Initial insurer position: Appointed Loss Adjuster to evaluate the claim.

- Key issue: Client appointed PCLA. Evidence indicated damage extended to: subfloor/wall linings/kitchen units; scope needed to reflect reinstatement needs.

- Outcome: Client was offered a full settlement which enabled them to restore their kitchen and repair the floor throughout.

- What changed the trajectory: Clearer scope, documented moisture impact, and structured evidence submission.

Example 2: Fire and smoke damage.

- What happened: Fire in kitchen, but water damage and smoke spread to adjoining rooms and throughout the house.

- Initial insurer position: Fire damage claims are always complex. A Loss Adjuster was appointed by the insurer and the client needed an independent survey for their own peace of mind. They appointed PCLA to manager their claim.

- Key issue: Smoke contamination and reinstatement standards across multiple rooms.

- Outcome: Fire damage claims take longer than other claims, but for good reason. In this case we needed to make sure the client was going to get a settlement offer that made their home liveable again. We were able to negotiate a settlement that got the client everything they were entitled to under the terms of their policy.

- What changed the trajectory: Detailed scope, photographic record, and structured submissions aligned to policy wording.

How PCLA works with you from first call to final settlement

A simple process description usually reads best:

- Initial call and claim review

What happened, where the claim is at, and what documents exist.

- Policy and claim position check

High-level review of relevant policy sections and the insurer’s current stance.

- Site visit and evidence plan

Documenting damage and agreeing what evidence is needed next.

- Scope and valuation

Preparing a schedule of works and costs aligned to reinstatement needs.

- Submission and negotiation

Presenting the claim in a structured way and handling insurer queries.

- Settlement and next steps

Confirming what has been agreed, how payment is made, and what happens if reinstatement works follow.

FAQs

Is a loss assessor the same as a loss adjuster?

No. A loss adjuster is typically appointed by the insurer to assess the claim for the insurer. A loss assessor is appointed by you to represent you in the claim.

Are loss assessors regulated in the UK?

Many reputable firms operate as FCA-authorised businesses for relevant regulated activities. Regulation does not guarantee outcomes, but it does create accountability and conduct standards.

Can I appoint a loss assessor after my claim has already started?

Often, yes. Many policyholders appoint help once a claim is delayed, disputed, or becomes more complex than expected.

Will using a loss assessor delay my claim?

Not inherently. Done well, professional representation can reduce delays by improving documentation, clarifying scope, and making decision points easier for the insurer to address. As with any service, it depends on how it is handled in practice.

Do loss assessors deal with contents claims as well as buildings claims?

Many do. Whether it is helpful depends on the value and complexity of the contents element and what evidence is available (proof of ownership, replacement values, condition, and so on).

Do I have to use my insurer’s contractors?

Policies and claims routes differ. Some insurers offer managed repair; others offer cash settlement; some do both. What you can insist on (and how) depends on the policy wording and the claim circumstances.

What documents should I have ready if I want advice?

A policy schedule (and any endorsements if available), claim reference number, insurer correspondence, photos/videos, any scopes/estimates/offers, and a short timeline of what happened and what has been agreed so far.

Is a loss assessor “worth it” for smaller claims?

Sometimes, but often it is unnecessary if the claim is straightforward and progressing smoothly. If you want a structured decision guide, see: Do I Need a Loss Assessor for My Home Insurance Claim.

Next steps if you think you might need help

If you are considering a loss assessor, you can make the first conversation more productive by having:

- Your policy schedule (and any endorsements if available),

- The claim reference number and insurer correspondence,

- Photos/videos taken as close to the incident as possible,

- Any estimates, scopes, or settlement offers received,

- A short timeline: when it happened, what actions you took, who attended, and what was agreed verbally (if anything).

If you would like PCLA to review your situation, the next step is a free claim review. The purpose is to clarify:

- where you stand,

- what the likely pressure points are,

- and whether professional help appears proportionate.

Call PCLA today, to learn more: 028 9581 5318.