When a Claim “Feels Wrong” — and Why That Matters

Most home insurance claims do not fail overnight. They drift.

For many homeowners in Northern Ireland, that drift shows up as a vague sense that progress has slowed, explanations are thin, or decisions are being made without much clarity. The difficulty is knowing whether that feeling reflects normal friction in the claims process — or whether the claim is genuinely going off track.

This guide is designed to help you make that distinction. It sets out five common warning signs that experienced claims professionals recognise early, explains why they matter, and outlines sensible next steps if several of them apply to your situation.

It is not about blaming insurers or encouraging disputes. It is about recognising patterns early, while you still have options.

Why Otherwise Straightforward Claims Go Off Track

Most problematic claims start out as ordinary ones. Delays and disputes usually arise from a small number of underlying issues rather than a single dramatic event.

Common causes include:

- Incomplete damage investigations early on;

- Assumptions made before all evidence is available;

- Communication gaps between different handlers or departments;

- Pressure to move claims forward before scope is fully agreed.

On their own, none of these automatically mean something is wrong. Problems tend to emerge when several occur together — and are left unchallenged.

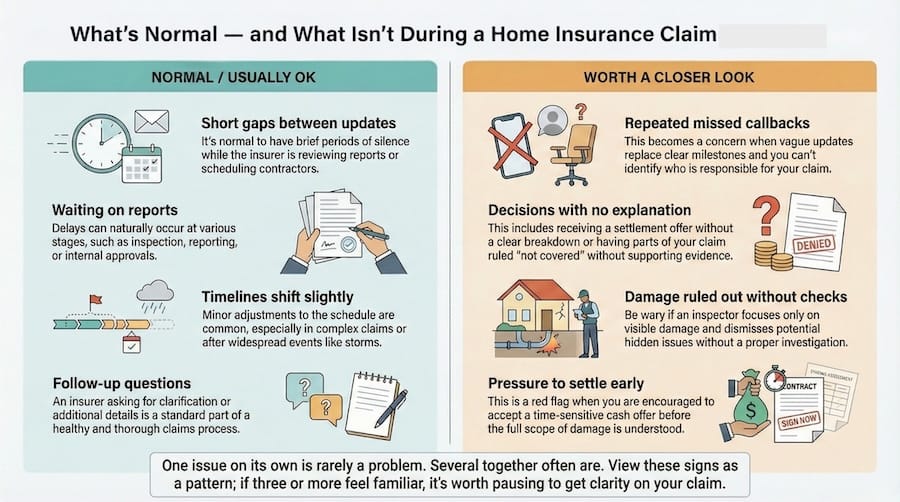

The signs below should be viewed as a pattern, not a checklist where one issue equals failure. If three or more feel familiar, it is usually worth pausing and taking stock.

What’s Normal — and What Isn’t During a Home Insurance Claim

Sign 1: You’re Getting Vague Updates or Missed Callbacks

What this usually looks like

Updates that say little more than “the claim is ongoing”, calls promised but not returned, or repeated reassurance without any concrete progress.

When this can still be normal

Short periods of silence can happen while reports are being reviewed or contractors are being scheduled, particularly after storms or widespread incidents.

When it becomes a concern

When vague updates replace clear milestones, or when you cannot identify who is actively responsible for progressing your claim. Over time, lack of clarity often leads to decisions being made without your full involvement.

A sensible next step

Ask for a clear summary of where the claim sits, what is outstanding, and what the next specific step will be. Reasonable claims processes should be able to explain this plainly.

Sign 2: The Full Extent of Damage Hasn’t Been Properly Investigated

What this usually looks like

An inspection that focuses on visible damage only, with little consideration of hidden or secondary effects — such as moisture behind walls, damage beneath floors, or knock-on issues caused by delays.

When this can still be normal

Some damage genuinely only becomes apparent over time, particularly with escape of water or storm-related claims.

When it becomes a concern

When early assumptions are treated as final conclusions, or when additional damage is dismissed without explanation. Claims that settle on partial assessments often lead to underpayment or future disputes.

A sensible next step

Ensure that decisions are being made on evidence rather than assumption. If parts of the damage have not been examined or explained, it is reasonable to ask how they were ruled out.

Sign 3: The Settlement Offer Seems Low, but You Can’t Get a Clear Explanation

What this usually looks like

You receive a figure, but not a breakdown. Questions about how it was calculated lead to generic responses rather than itemised reasoning.

When this can still be normal

Initial figures may change as information is clarified or additional reports are reviewed.

When it becomes a concern

When you are asked to make a decision without understanding what the offer actually covers — or what it excludes. A reasonable settlement should be explainable in practical terms, not just justified as “within policy”.

A sensible next step

Before accepting or rejecting anything, ask for clarity on what the offer is intended to cover. Understanding scope is often more important than the headline number.

Sign 4: You’re Told “Wear and Tear” or “Not Covered” Without Detail

What this usually looks like

Labels are applied, but the reasoning behind them is not clearly explained or supported by evidence.

When this can still be normal

Some exclusions are valid and appropriate under many policies.

When it becomes a concern

When exclusions are stated without explanation, or when you are expected to accept them without understanding how they were reached. A decision may still stand, but it should be transparent.

A sensible next step

Ask for a clear explanation of how the conclusion was reached. This is about understanding the decision, not automatically challenging it.

Sign 5: You Feel Pressured to Accept a Quick Cash Settlement

What this usually looks like

An offer is presented as time-sensitive, or you are encouraged to settle before investigations or repairs are fully scoped.

When this can still be normal

Cash settlements can be appropriate where damage is minor, clearly defined, and well understood by all parties.

When it becomes a concern

When speed is prioritised over clarity. Once a settlement is accepted, it is usually final — even if further damage later comes to light.

A sensible next step

Take time to ensure you understand what you are agreeing to and what risks you may be retaining yourself.

What to Do If You Recognise Several of These Signs

If more than one of these situations feels familiar, the most constructive response is usually to pause rather than rush.

That often means:

- Clarifying what has and has not been assessed

- Asking for explanations before accepting decisions

- Making sure nothing is agreed simply to move things along

Early reflection tends to preserve options. Waiting until after a settlement is accepted often limits them.

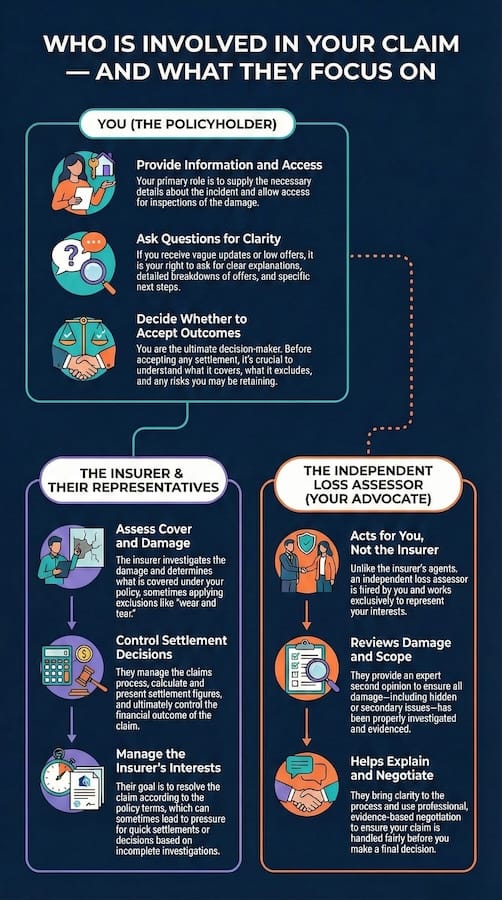

Getting a Second Opinion on a Claim in Northern Ireland

In some cases, homeowners choose to have their claim reviewed independently before accepting a settlement or moving into dispute.

A second opinion is not about confrontation. It is about understanding whether the claim has been properly scoped, evidenced, and negotiated — and whether anything material has been missed.

Independent loss assessors act for the policyholder, not the insurer, and focus on evidence-based assessment and professional negotiation. Many homeowners find that reassurance alone is valuable, even where no further action is needed.

If you would like a professional review of your current claim, you can request a second opinion from a Northern Ireland–based loss assessor such as PCLA. This is typically done before any final decisions are made.

Frequently Asked Questions

Is it normal for a claim to slow down partway through?

Yes. Delays can occur at inspection, reporting, or approval stages. The issue is not delay itself, but lack of clarity about why it is happening and what comes next.

Does asking questions harm my claim?

Reasonable requests for explanation or clarification should not prejudice a claim. Clear communication is part of a healthy process.

Can I get help without formally disputing my claim?

Yes. Many issues are resolved through review and clarification without escalating to formal dispute.

What if I have already accepted an offer?

Once accepted, settlements are usually final. This is why understanding scope and reasoning beforehand is important.