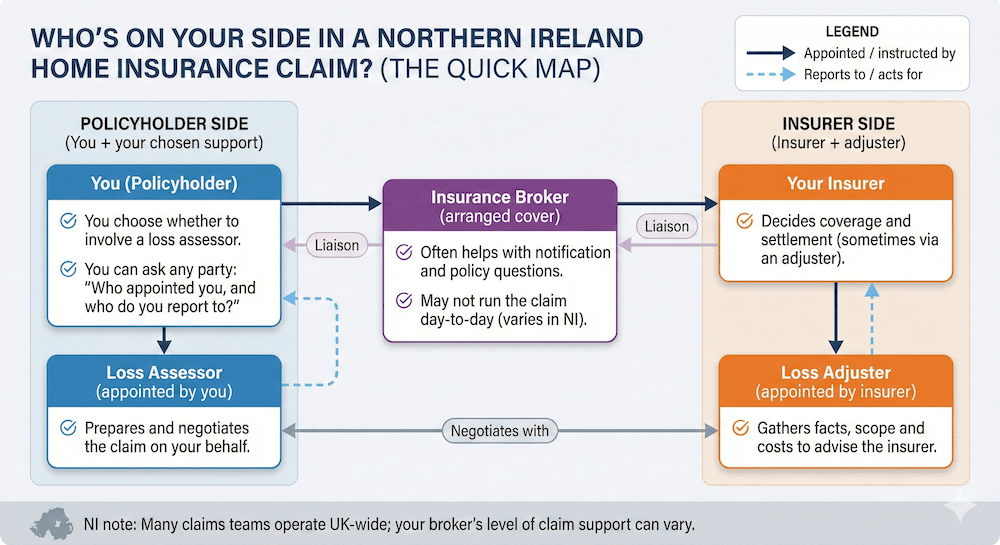

When you’re dealing with damage to your home, you may suddenly find yourself speaking to people with very similar-sounding job titles. That confusion is common, and it can lead to a simple but costly misunderstanding: assuming everyone involved is “on your side”.

A useful way to cut through the noise is to follow two things:

- Who appointed them;

- Who pays them and what duty they owe in practice.

Once you understand those two points, the roles tend to make sense.

Why these job titles are so confusing

Three factors cause most of the confusion:

- The words sound interchangeable:

“Assessor”, “adjuster”, “broker” all feel like professionals who “handle the claim”.

- Everyone uses the language of fairness and help:

Insurers, brokers, and claims professionals will often talk about “helping the claim progress” or “reaching a fair settlement”. That does not necessarily mean they are acting as your personal representative.

- Claims involve cooperation, so the lines look blurred:

In a typical claim, these roles can interact frequently. Cooperation can look like advocacy even when it isn’t.

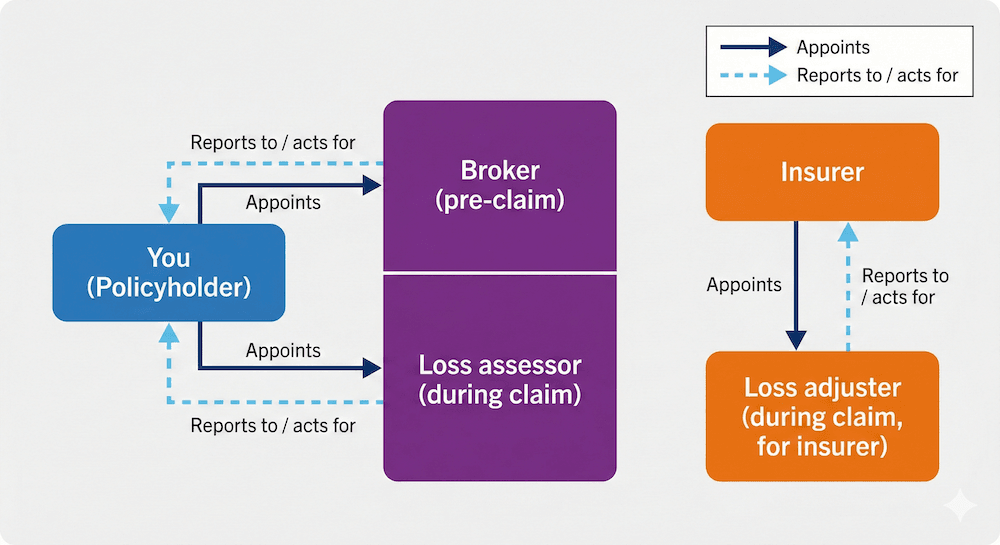

Who works for whom: the simple version

In most UK home insurance claims, the quickest way to orient yourself is this:

- Loss adjuster: usually engaged by the insurer to assess the claim and report back.

- Broker: engaged by you to arrange insurance, and may support you during a claim, but they are not always set up to “run” a claim end-to-end.

- Loss assessor: engaged by you to manage and negotiate the claim on your behalf.

Quick comparison table

| Dimension | Loss Adjuster | Insurance Broker | Loss Assessor |

|---|---|---|---|

| Who appoints them | Typically the insurer | You (before any claim) | You (during a claim) |

| Who pays them | Typically the insurer | You may pay fees; they may also be remunerated in connection with the policy | You (usually from settlement, per agreed terms) |

| Who they represent | The insurer’s process and position | You, within the scope of the broker relationship | You (as your claim representative) |

| Core job | Investigate, validate, scope, and recommend settlement | Arrange cover; explain the policy; may help you communicate with the insurer | Prepare, evidence, and negotiate the claim; manage the process for you |

| Best for | Insurer-led claim assessment | Getting the right cover in place and guidance | Complex, high-value, time-consuming or disputed claims |

Practical note on transparency:

UK rules require insurance intermediaries to provide customers with key information about the firm, including how to verify their register status and whether they are representing the customer or acting for the insurer. (Source: FCA Handbook)

Follow the money / follow the duty

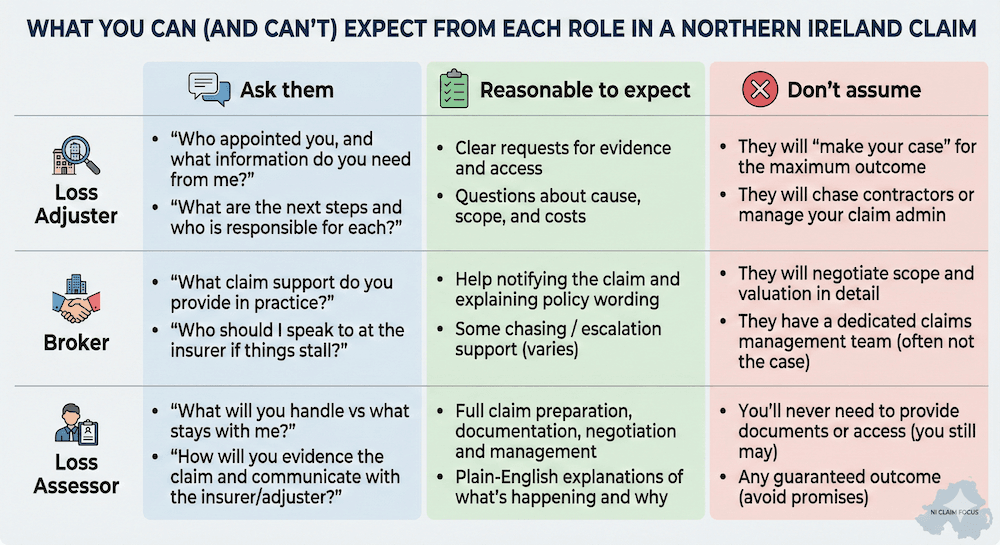

What a loss adjuster does (typically for the insurer)

A loss adjuster is a claims professional brought in to investigate and assess a claim. In home insurance, this often happens when the claim is higher value, complex, or likely to involve specialist assessment (for example, a serious escape of water, a fire, or subsidence concerns).

Typical activities include:

- Inspecting the damage and asking detailed questions;

- Checking likely cause and whether it matches insured perils;

- Reviewing what the policy covers and any relevant limits/conditions;

- Recommending an approach to scope, repair and settlement;

- Requesting evidence and documentation.

From a policyholder’s perspective, the most important point is this: a loss adjuster is not automatically your personal representative. They are part of the insurer’s claims process and will report back to the insurer. The Chartered Institute of Loss Adjusters describes the early stages as involving detailed questioning and information gathering as part of the process. (cila.co.uk)

What this means for you: A loss adjuster can be professional, helpful and efficient — and still not be acting as your advocate. Their job is to assess and recommend within the insurer’s framework.

What a broker does (before and during a claim)

An insurance broker’s primary role is typically before anything goes wrong:

- Finding and arranging suitable cover;

- Explaining key terms, exclusions, and optional extensions;

- Helping you set sums insured correctly;

- Supporting renewals and changes.

What brokers can do during a claim

Many brokers will provide some level of claim support, such as:

- Helping you notify the insurer and providing initial guidance;

- Explaining what the insurer is asking for and why;

- Chasing progress and keeping communication moving;

- Helping clarify policy wording and next steps.

However, in our experience, many brokers do not have a dedicated claims management function. Where that’s the case, they may default to the insurer’s process (including the insurer’s loss adjuster) or the client handling the claim directly.

A practical question you should ask your broker

Rather than focusing on percentages or industry norms, ask for clarity on who is being paid by whom, and what that means in practice.

UK rules require insurance intermediaries to explain the nature of their remuneration for a contract — for example, whether it is a fee paid by the customer, commission included in the premium, another type of benefit, or a combination. (FCA Handbook)

You can ask your broker:

- “How are you paid for arranging this policy?”

- “Do you receive any remuneration connected to this policy, and if so, what type?”

- “What claim support do you provide in practice — and what don’t you do?”

These are normal questions. A reputable broker should answer them clearly.

What a loss assessor does (for you)

A loss assessor is engaged by the policyholder to act as a claim representative — helping you prepare the claim properly, present it clearly, and negotiate with the insurer’s team (including any loss adjuster).

MoneySavingExpert.com describes a loss assessor as working for you, using their experience to help achieve the best possible settlement figure.

A loss assessor will typically:

- Assess and document all damage (including less obvious consequential damage);

- Help you gather and organise evidence (photos, inventories, reports, costs);

- Present the claim in a structured way that maps to policy language;

- Communicate directly with the insurer / adjuster to progress decisions;

- Negotiate scope, valuation, and settlement terms;

- Explain what is happening and what choices you have.

Where PCLA fits

PCLA acts for policyholders and is authorised and regulated by the Financial Conduct Authority (FCA).

Fees (PCLA): 10% of the final settlement + VAT.

Related: What Happens When You Appoint PCLA as Your Loss Assessor?

Typical scenarios and who does what

The aim here is to show how the roles can work together when expectations are clear.

Scenario 1: Kitchen fire with smoke damage

What usually happens:

- You notify the insurer (often with your broker’s help if you have one).

- The insurer may appoint a loss adjuster due to complexity and cost.

- Repairs and contents damage need scoping; smoke damage can spread beyond the obvious room.

Who does what:

- Broker: helps you understand cover (buildings vs contents), any limits, and how to notify/submit.

- Loss adjuster: inspects, validates, scopes, and recommends settlement approach to the insurer.

- Loss assessor: documents the full extent (including secondary smoke damage), prepares evidence, and negotiates scope and valuation so nothing material is missed.

Scenario 2: Escape of water (leak) affecting ceilings and floors

What usually happens:

- Mitigation (stopping the leak, drying) becomes urgent.

- The insurer may request evidence of cause and damage progression.

- There may be discussions about what is “trace and access”, what is reinstatement, and what is excluded.

Who does what:

- Broker: explains how to notify and what the insurer is likely to ask for.

- Loss adjuster: assesses causation, scope, and policy response.

- Loss assessor: helps ensure the claim includes all relevant heads of loss (and is evidenced properly), and manages negotiation where scope or valuation becomes contentious.

Scenario 3: Storm damage (water ingress, physical damage to the property)

What usually happens:

- The insurer may focus on storm event evidence, maintenance vs sudden damage, and the boundary between emergency works and permanent reinstatement.

Who does what:

- Broker: clarifies the insurer’s process.

- Loss adjuster: inspects and recommends an insurer position on scope and settlement.

- Loss assessor: helps evidence the timeline, the damage extent, and the practical repair scope, and negotiates where the initial scope doesn’t reflect the true reinstatement requirement.

Do you always need a loss assessor?

No.

A loss assessor is most useful when the claim is likely to be:

- High value (where small percentage differences become meaningful);

- Complex (multiple rooms, uncertain cause, specialist trades, drying and reinstatement sequencing);

- Time-consuming (you cannot realistically manage the admin, access, quotes, and insurer communications);

- Contentious (scope disagreements, valuation gaps, delays, partial acceptance).

You are less likely to need a loss assessor when:

- The damage is straightforward, low value, and easy to evidence;

- You have the time and confidence to manage the process;

- The insurer is progressing quickly and decisions are clear.

If you want a structured way to decide, use this guide: Do I need a loss assessor?

How PCLA works alongside your broker

It should not be “broker vs loss assessor”. In many cases, it’s collaborative.

In our experience:

- Brokers often want their clients looked after but may not have the capacity to run claims in detail.

- PCLA frequently supports clients referred by their broker.

- Clear roles reduce duplication: the broker remains the insurance relationship, while PCLA manages the claim preparation and negotiation.

A practical way to frame it is:

- Broker: insurance placement and policy guidance;

- PCLA: claim preparation, evidence, negotiation and day-to-day claim management;

- Insurer / loss adjuster: insurer’s assessment and settlement process.

Questions people ask when they’re trying to work out “who is on my side”

“The loss adjuster said they’re independent — does that mean they represent me?”

Not necessarily. “Independent” is often used to mean the adjuster is a specialist firm separate from the insurer operationally. The key question is: who appointed them and who do they report to?

“My broker says to deal with the insurer directly — is that normal?”

It can be, particularly if the broker doesn’t have a dedicated claims function. The important thing is to understand what support your broker will provide and what they won’t.

“How do I check if a firm is properly regulated?”

Insurance intermediaries must tell you whether they are on the Financial Services Register and how you can verify it. (FCA Handbook) If someone is offering regulated services, ask for their firm reference number and verify it.

A calm next step if you’re unsure

If you’re in a claim and you’re not clear who is representing you — or you suspect the claim is becoming harder to manage than expected — you can seek an independent view early.

Call PCLA today to request a free claim review.

Related guides: