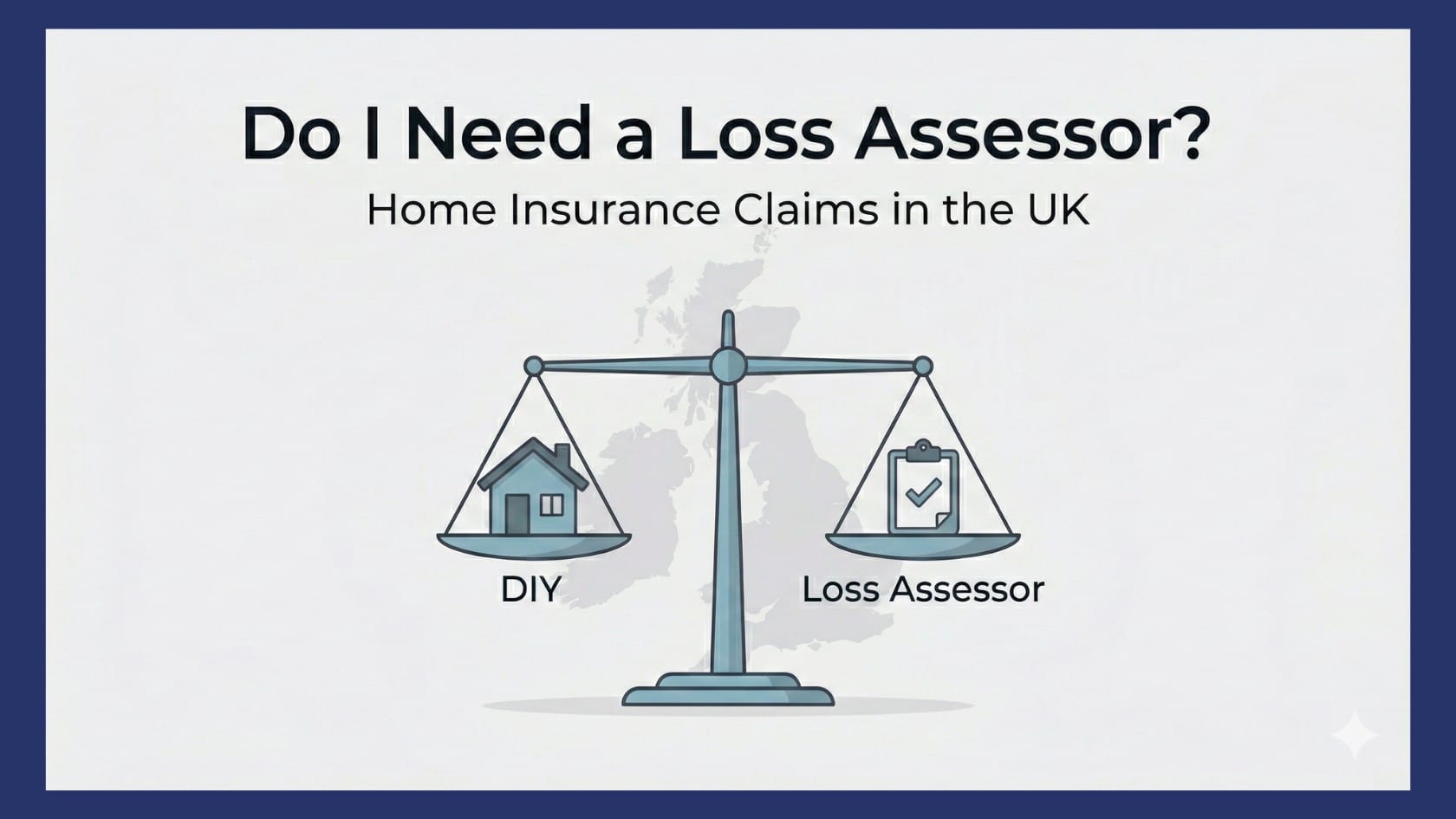

Do I Need a Loss Assessor for My Home Insurance Claim?

Learn when a loss assessor is likely to add value, when you can safely handle it yourself, and how to sense-check complexity, friction, and what’s at stake.

What Does a Loss Assessor Do?

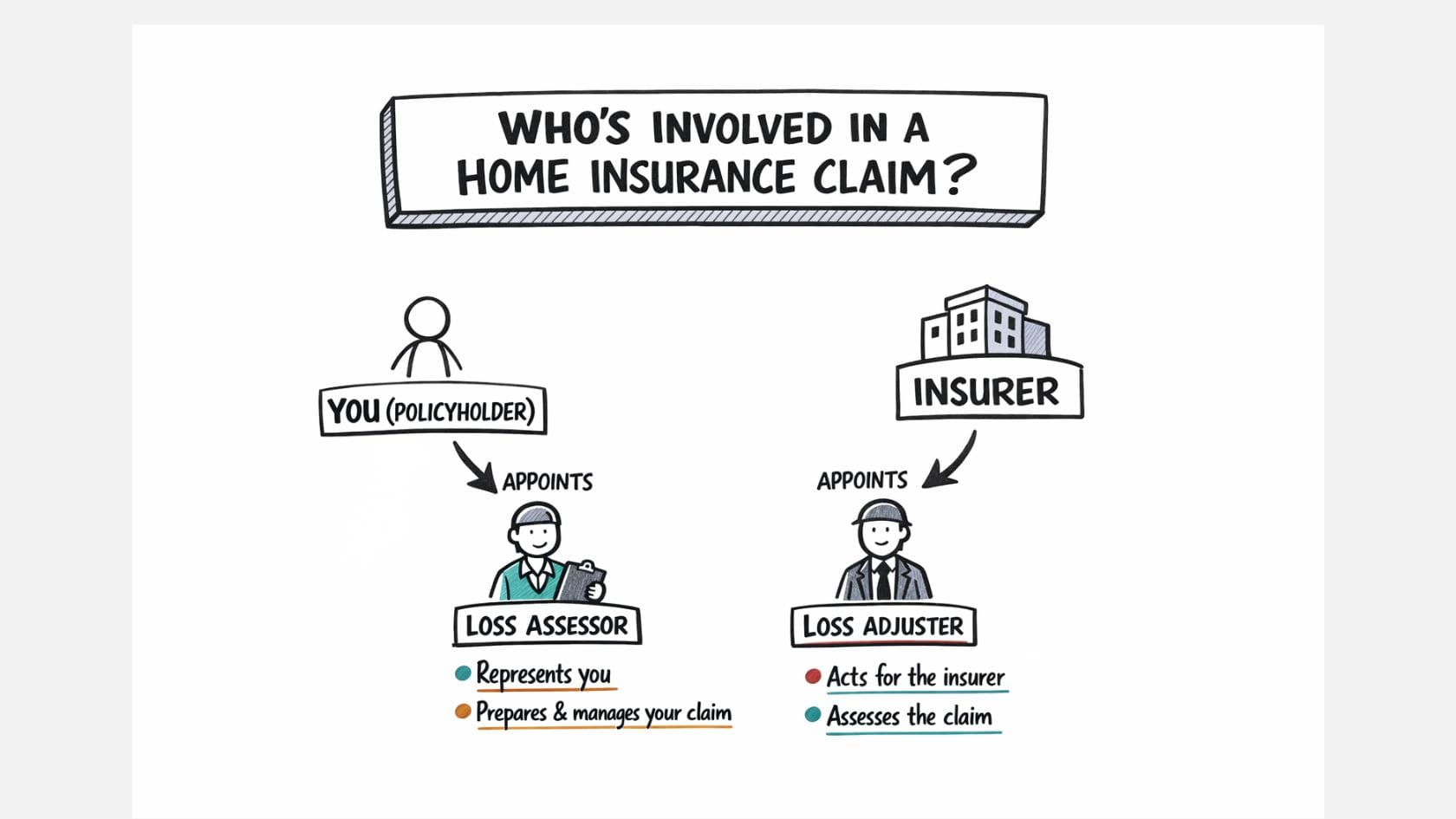

If you are dealing with a home insurance claim and someone has mentioned a “loss assessor”, it can be unclear what that actually means. This guide explains what a loss assessor does, how they differ from an insurer’s loss adjuster, and when appointing one is likely to be helpful for UK homeowners.

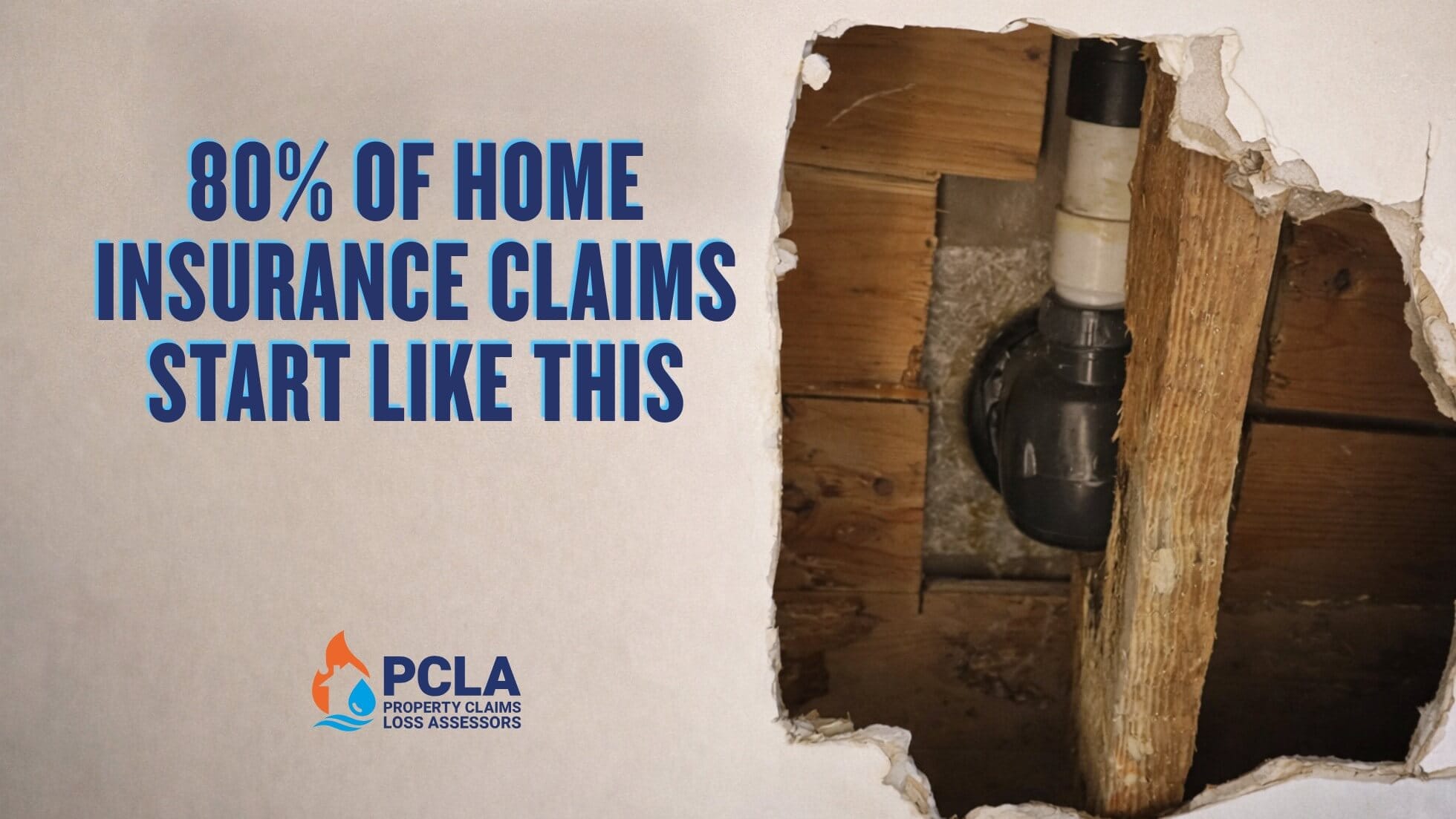

The Real Drivers of Home Insurance Claims (And Why Most Homeowners Are Looking in the Wrong Place)

Most homeowners worry about the wrong risks. Based on a year of real claims, this article explains what actually causes home insurance damage — and why everyday issues like hidden water leaks matter more than dramatic events.

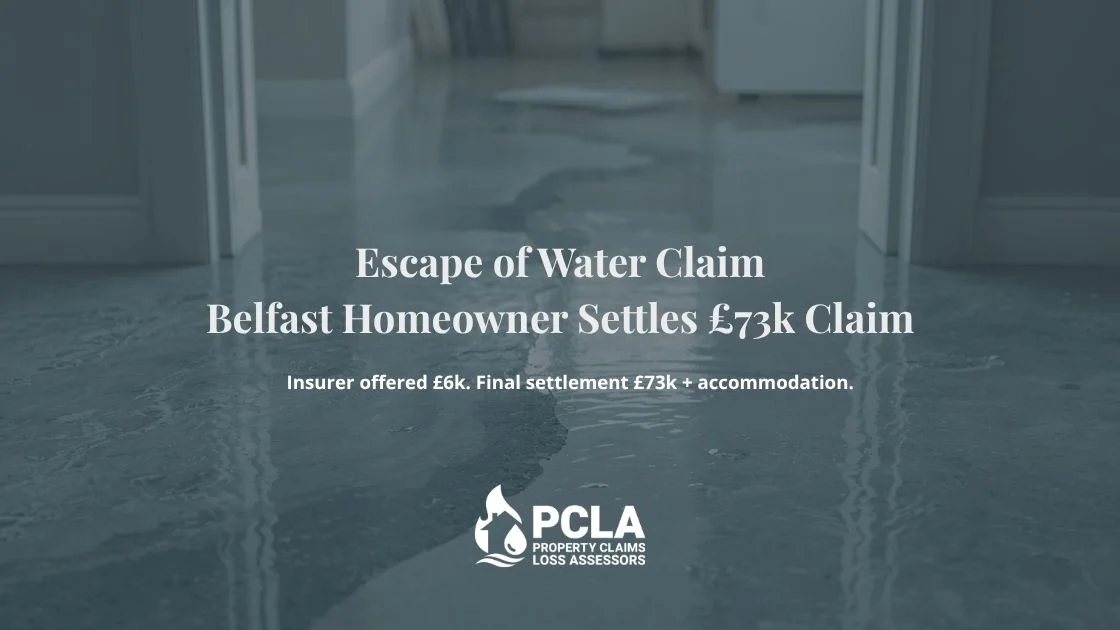

Escape of Water Claim in Belfast – From £6,000 to £73,000 Plus Alternative Accommodation

A routine insurance claim turned into a major success for one Belfast homeowner when PCLA uncovered hidden water damage that the insurer’s first inspection missed — increasing the offer from £6,000 to £73,000 and securing paid alternative accommodation.

Water Damage Insurance Claim in Mansewood, Glasgow – How PCLA Secured a £10,900 Settlement

A Mansewood homeowner was offered just £700 for severe water damage — until PCLA stepped in. Our Glasgow loss assessors secured a £10,900 payout, ensuring full repairs and peace of mind. Learn how our independent team fights insurers and delivers fair settlements for homeowners across Glasgow.

What Can Invalidate House Insurance? Common Claim-Killing Mistakes

Hidden clauses in your home insurance policy could cost you thousands. This guide highlights the most common exclusions and limitations that insurers use to reduce payouts—and what you can do to protect yourself.

Your Home Insurance Claim: Cash Settlement or Reinstatement?

Facing a home insurance claim in Northern Ireland? The choice between cash settlement and reinstatement isn’t just about money – it’s about control, time, and peace of mind. Here’s what you need to know before deciding.

Home Insurance Claims: What the Indemnity Principle Means for You

Discover how the indemnity principle affects your home insurance claims in Northern Ireland. Learn what fair compensation really means and how to protect your interests.

Your Duty of Disclosure: What You Must Tell Your Insurer

Discover why your ‘duty of disclosure’ is crucial for protecting your home insurance in the UK. From past claims to renovations, learn exactly what you must tell your insurer – and when – to ensure your coverage stays valid. This article will help homeowners understand their responsibilities and avoid the common pitfalls that could void their insurance protection.

5 Things Your Insurer Won’t Tell You (But a Loss Assessor Will)

When disaster hits, the last thing you want is to get lost in confusing insurance terms and policy exclusions. Many homeowners face this challenge, often unaware of obstacles that can weaken their claims. Issues like unreported risks and the hidden effects of property modifications can all add to the complexity. Continue reading to learn about the five important things your insurer won’t tell you and why hiring a loss assessor might be the smartest move for your home.