Home Insurance Claim Starter Pack

A free Northern Ireland home insurance claim starter pack: a step-by-step checklist, simple evidence plan, and key questions to ask early so you stay organised and avoid avoidable delays.

Clear, practical resources for homeowners dealing with property damage and home insurance claims.

If you’ve reported damage (or you’re deciding whether to), these guides explain what typically happens next, what to prepare, and when it may help to get support. They’re written to reduce uncertainty and help you make steady, informed decisions at each stage.

PCLA is an independent loss assessor that acts for the policyholder. These resources are educational and don’t replace advice from your insurer or policy documentation.

A free Northern Ireland home insurance claim starter pack: a step-by-step checklist, simple evidence plan, and key questions to ask early so you stay organised and avoid avoidable delays.

If you are close to appointing a loss assessor, the biggest uncertainty is often what the process will actually be like in practice. This page explains what happens when you appoint PCLA as your loss assessor, setting out the typical stages of working together, what we do at each point, what we need from you, and what you can expect in return. It also covers communication, fees, and what you are — and are not — committing to, so there are no surprises.

If your home has been damaged and you’re facing an insurance claim, it’s normal to feel unsure about what to do first and what really matters. This step-by-step guide explains the home insurance claim process in Northern Ireland in plain language, helping you understand the order of events, avoid common pitfalls, and recognise when additional support may be helpful. You do not need to understand everything at once — only the next sensible step.

If you’re part-way through a home insurance claim and something doesn’t feel clear, a second opinion can help. PCLA offers a free initial claim review, starting with a phone call to understand your situation and assess whether we can genuinely add value. If appropriate, this is followed by a free on-site property damage survey. You’ll receive a straightforward view of where you stand, what may be missing, and your most sensible next step — with no pressure to proceed if we’re not the right fit.

After you report property damage to your insurer, the most difficult part is often the waiting. You may have a claim reference but little sense of when an inspection will happen, who is handling the claim, or what should come next. This guide explains what typically happens after you report a home insurance claim in the UK, what delays are normal, what is not, and how to ask the right questions to get clarity without escalating matters unnecessarily.

If you have damage to your home and you’re unsure whether to make an insurance claim or pay for repairs yourself, the decision is rarely straightforward. It usually comes down to the true cost of repairs, how your policy excess and cover apply, and the risk of hidden or worsening damage if issues are dealt with piecemeal. This guide walks through those factors using simple examples to help UK homeowners make a proportionate, informed decision.

If your home insurance claim has been reduced or rejected, the next step is not to argue in general terms. It is to understand the insurer’s stated reason, the evidence they relied on, and how that decision fits with your policy. This guide explains the most common technical reasons insurers give for reducing or refusing property claims, how to read the decision properly, and how homeowners in Northern Ireland can respond in a calm, structured, and effective way.

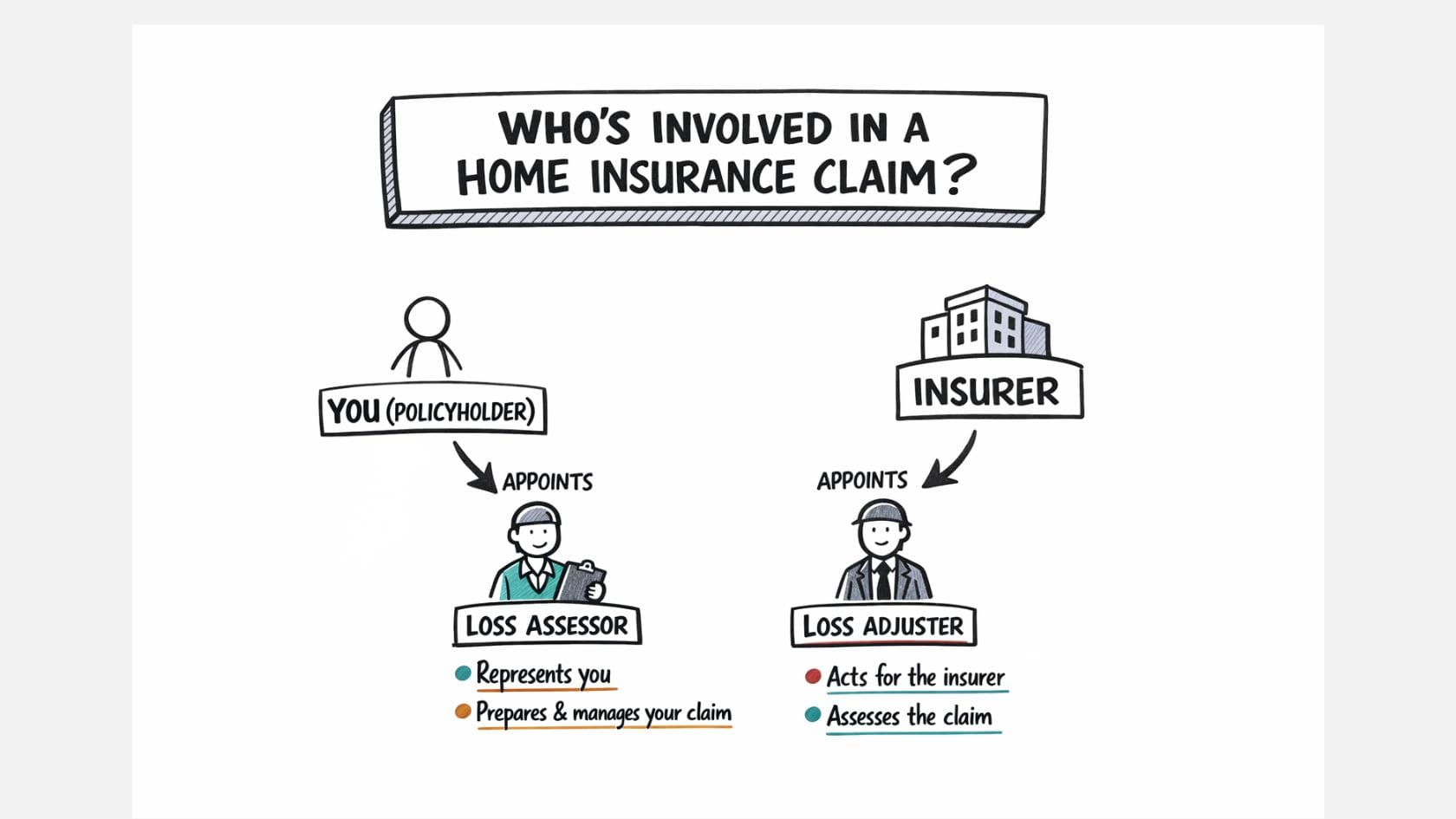

When you’re dealing with damage to your home, it’s common to find yourself speaking to several people with very similar-sounding job titles. That confusion can lead to a costly assumption that everyone involved is acting for you personally. This guide explains the difference between a loss assessor, a loss adjuster, and an insurance broker by focusing on two practical questions: who appoints them, and who they ultimately work for. Once those points are clear, the roles, and their limits, make much more sense.

Most home insurance claims do not fail suddenly. They drift. For many homeowners, that drift shows up as slower progress, unclear explanations, or decisions that do not quite make sense. This guide sets out five warning signs that experienced claims professionals recognise early, explains why they matter, and outlines sensible next steps if several apply to your situation — without blaming insurers or encouraging conflict.

If you’re part-way through a home insurance claim and it feels like everything has slowed down, you’re not alone. Claims often move in stages, with inspections, decisions, and approvals followed by quiet gaps that can feel like nothing is happening. This guide explains how long home insurance claims typically take in the UK, why delays occur, and what you can do at each stage to prevent your claim from drifting.

Learn when a loss assessor is likely to add value, when you can safely handle it yourself, and how to sense-check complexity, friction, and what’s at stake.

If you are dealing with a home insurance claim and someone has mentioned a “loss assessor”, it can be unclear what that actually means. This guide explains what a loss assessor does, how they differ from an insurer’s loss adjuster, and when appointing one is likely to be helpful for UK homeowners.