“Water pipe insurance” is often shorthand for buildings insurance cover that responds to burst pipes or escape of water. Cover depends on whether the damage was sudden or gradual, and whether there’s evidence of maintenance issues.

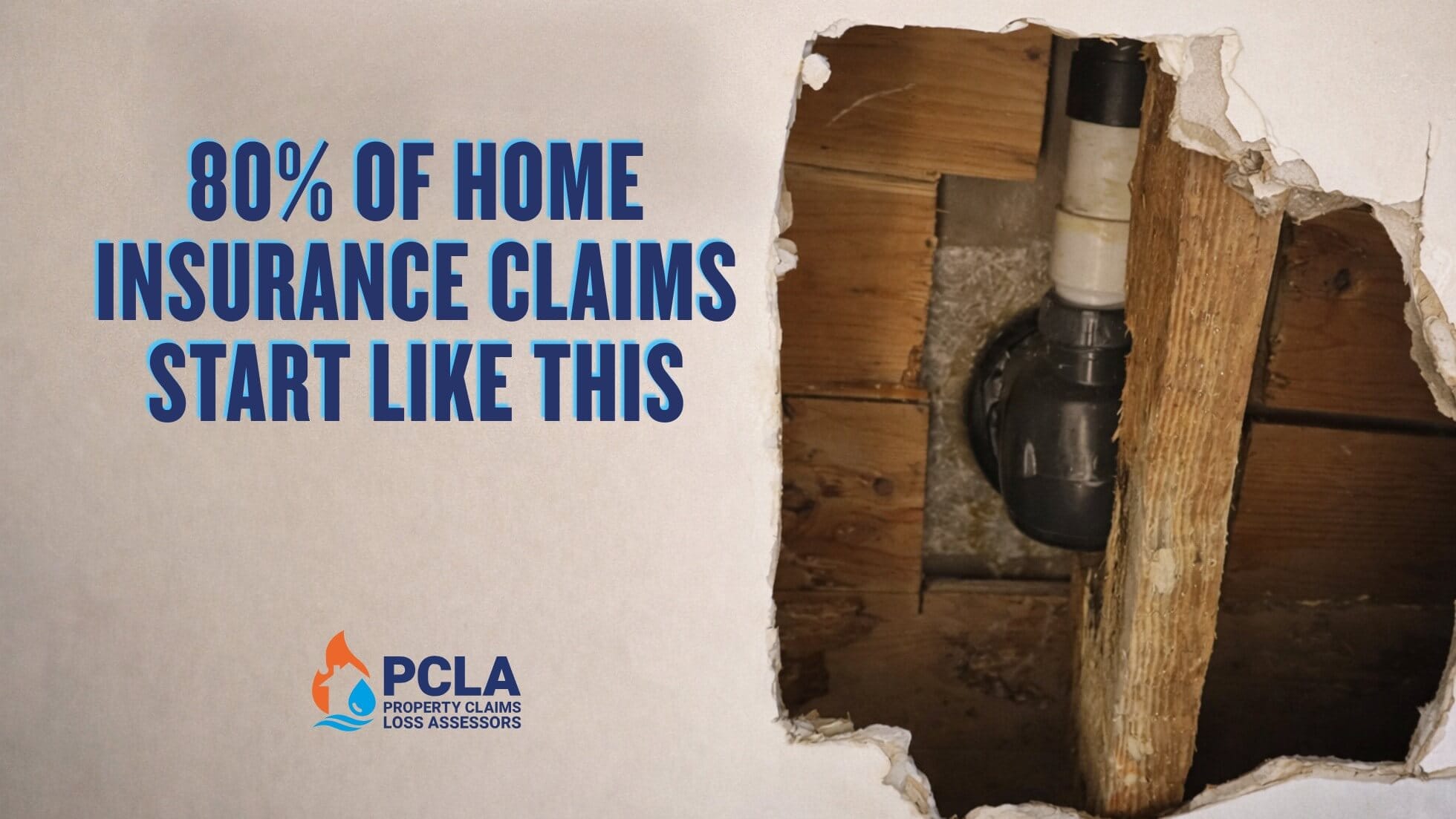

Burst water pipes can be a homeowner’s worst nightmare. Not only can they cause significant damage to your property, but they can also lead to expensive repairs and an emotional toll as you navigate the aftermath.

One crucial question that often arises in such situations is: can you claim for burst water pipes on your home insurance? In this article, we’ll explore the different types of cover available in home insurance policies, particularly focusing on buildings and contents insurance, and guide you through the process of making a claim for burst pipes.

Understanding Home Insurance Policies

What is Home Insurance?

Home insurance is a policy designed to protect your property and possessions against various risks, including theft, fire, and water damage. In the UK, most home insurance policies fall into two primary categories: buildings insurance and contents insurance.

Buildings insurance covers the physical structure of your home and any permanent fixtures. This includes:

- The main structure of your home: This covers the walls, roof, and foundations.

- Permanent fixtures: Fitted kitchens, bathrooms, and built-in wardrobes are typically included.

- Outbuildings: Sheds, garages, and any other structures within the boundaries of your property.

- Services: This encompasses plumbing, electrical, and heating systems.

Contents insurance protects your personal belongings within the home. This can include:

- Furniture and appliances: Sofas, beds, and refrigerators are all covered.

- Personal items: Clothing, electronics, and valuables like jewellery.

- Outdoor possessions: Items in the garden or shed, such as bicycles or garden tools.

Understanding these two categories is vital because the type of insurance you have will dictate whether you can claim for damages caused by burst water pipes.

Can You Claim for Burst Water Pipes?

Coverage Under Buildings Insurance

When it comes to burst water pipes, buildings insurance is typically your best bet. Most policies cover damage caused by sudden and unforeseen incidents, known as perils, these include:

- Escape of water: This is the main peril that allows policies to cover damage caused by burst water pipes. It covers you for the damage caused by the water that has escaped due to the burst, but not for repairing the burst pipe itself. Escape of water claims are by far the most common type of claim made in the UK.

- Burst pipes due to freezing: In winter, if pipes freeze and subsequently burst, causing damage to your property. In this instance the repair to the pipe is typically covered, unlike a claim under the escape of water peril.

- Accidental damage: If a pipe bursts due to an accidental incident, like a DIY mistake, this might be covered. Again, in this instance the repair to the pipe is covered also, however, the incident or accident needs to be fortuitous and not related to any gradually operating cause.

However, it’s essential to read the policy wording carefully. Some policies may have exclusions or specific clauses regarding water damage. Generally, if the damage is sudden and not due to a lack of maintenance, you should be able to make a claim.

Coverage Under Contents Insurance

Contents insurance may also come into play if your personal belongings are damaged due to burst pipes. For instance:

- Damage to furniture: If water from a burst pipe damages your sofa or carpet, contents insurance may cover the costs of replacement or repair.

- Personal items: Electronics or clothing that are ruined due to water damage could also fall under contents coverage.

However, similar to buildings insurance, it’s crucial to check the specific terms and conditions of your policy to ensure you are covered.

Exclusions and Limitations

While many home insurance policies provide coverage for burst pipes, certain exclusions and limitations may apply. Common exclusions include:

- Negligence: If the damage results from neglecting to maintain your plumbing system (e.g., failing to insulate pipes during winter).

- Wear and tear: Damage that results from the natural ageing of materials may not be covered.

- Specific causes: Some policies may exclude claims related to specific causes of water damage, such as flooding or sewer backup.

- Unoccupancy: If going away from your property for a period of time, it is essential to understand how long the unoccupancy clause covers. Most policies state that if the property is unoccupied for more than 30 days, all the water going to the property needs shut off and all plumbing systems drained down. This is a common-sense approach as it prevents a burst causing damage whilst no one is near the property.

Steps to Take When You Experience a Burst Pipe

Experiencing a burst water pipe can be overwhelming, but knowing the steps to take can help ease the process. Below is an infographic illustrating the steps you should follow from the moment you discover the burst pipe to the final settlement of your claim.

Making a Claim for Burst Water Pipes

Step 1: Identify the Burst Pipe

As soon as you notice signs of a burst pipe, such as water pooling on the floor or a sudden increase in your water bill, it’s vital to act quickly. Turn off the water supply to prevent further damage.

Step 2: Document the Damage

Take photographs and videos of the affected areas. This documentation will be crucial when you make your claim. It’s also advisable to make a list of any damaged items, including their approximate value.

Step 3: Contact Your Insurer

Inform your home insurance provider as soon as possible. Most policies have a specified timeframe for reporting incidents, so prompt communication is key.

Step 4: Mitigate Further Damage

To protect your property and belongings, take reasonable steps to mitigate further damage. This might involve moving furniture out of the affected area or using towels to soak up excess water. However, only do what you can safely manage.

Step 5: Submit Your Claim

After documenting everything, complete the necessary claim forms provided by your insurer. Ensure all documentation is attached, including photographs, lists of damaged items, and any receipts for emergency repairs.

Step 6: Insurance Assessment

Your insurer may send an adjuster to evaluate the damage. This process can take some time, so be prepared for potential delays.

Step 7: Settlement

Once your claim has been reviewed and approved, your insurer will provide compensation for repairs or replacements. Depending on your policy, this may include direct payments to contractors or reimbursements for repairs you’ve made.

Tips for Successful Claims

- Know Your Policy: Familiarise yourself with your home insurance policy, including what is covered and any exclusions.

- Keep Records: Maintain a detailed record of all communications with your insurer and any expenses incurred due to the damage.

- Be Honest: Always provide accurate information when making a claim. Misrepresentation can lead to your claim being denied.

- Follow Up: If you don’t hear back from your insurer in a reasonable timeframe, don’t hesitate to follow up.

- Consider Professional Help: If your claim is complicated or disputed, you might want to consider hiring a claims management company for assistance.

Contact PCLA

At PCLA we deal with water damage claims day in, day out. We’re experts at helping people who have suffered water damage to their home or business following a burst water pipe, ensuring they receive everything they’re entitled to when making an insurance claim.

PCLA can undertake a free, no obligation review of your buildings insurance policy if you aren’t sure if you are covered. Call 028 9581 5318 and one of our friendly team will be on hand to help you.

Conclusion

In summary, you can claim for burst water pipes on your home insurance, provided you have the right type of coverage and the incident falls within your policy’s terms. Understanding the differences between buildings and contents insurance is essential, as both may play a role in your claim.

By following the steps outlined in this blog, from documenting the damage to submitting your claim, you can navigate the process more smoothly. Remember to stay informed about your policy, maintain thorough records, and communicate openly with your insurer.

Burst pipes are undoubtedly a hassle, but with the right preparation and knowledge, you can handle the situation effectively and ensure your home is restored to its former condition and remember, PCLA are always on hand to provide assistance if necessary.