Who Does a Loss Assessor Work For?

Discover who hires loss assessors and understand their crucial role in managing insurance claims. Learn how they work on behalf of policyholders to ensure fair settlements and protect your interests. Explore our detailed guide to make informed decisions in the insurance process.

Got Impact Damage? How UK Home Insurance Covers Vehicle Collisions and Falling Trees

Impact damage, caused by unpredictable incidents like a vehicle collision or fallen scaffolding, can lead to costly repairs. Typically covered by standard buildings insurance, understanding this coverage, including specific exclusions, is crucial. This article explores impact damage, its implications, and how Property Claims Loss Assessors can help in claim management.

How Home Insurance In The UK Protects You From Vandalism and Malicious Damage

Understanding home insurance can be daunting, especially regarding coverage for vandalism and malicious damage. This article clarifies these terms, details what’s included, highlights important exclusions, and explains how Property Claims Loss Assessors (PCLA) can assist during claims, ensuring you feel confident in your home’s protection.

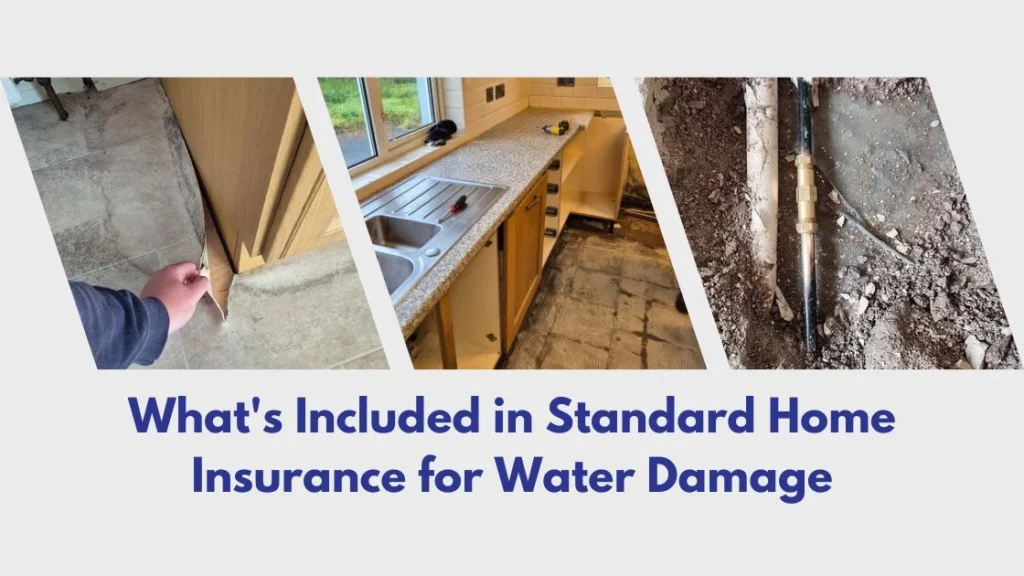

Home Insurance Essentials: Protecting Your Home from Pipe Leaks and Water Damage

Homeownership involves managing risks like water damage from leaking pipes, a common peril covered by buildings insurance. This article simplifies the complexities of water damage coverage, revealing common causes, necessary exclusions, and prevention tips. Learn how to protect your home and navigate insurance claims effectively.

Is Your UK Home Flood-Proof? Understanding Insurance Coverage for Rising Waters

Flooding poses a severe threat to homeowners, causing extensive damage and financial strain. With increasing weather unpredictability, understanding your buildings insurance coverage for flood damage is essential. This post discusses typical coverage, key exclusions, and how PCLA can assist homeowners in managing the aftermath effectively.

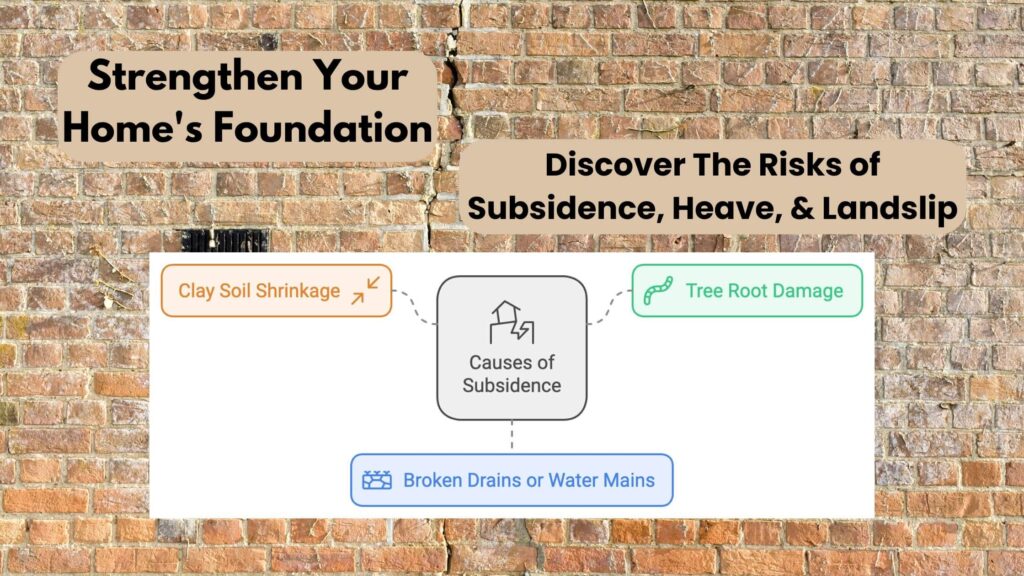

Building a Strong Foundation: How UK Home Insurance Covers You For Subsidence, Heave, and Landslip

Homeownership goes beyond providing shelter; it’s about ensuring security against unforeseen threats. In the UK, understanding buildings insurance coverage for subsidence, heave, and landslip is crucial. This article unpacks these geological risks, highlights potential exclusions, and emphasises comprehensive coverage’s role, alongside PCLA’s assistance in navigating complex insurance claims.

Storm-Proof Your UK Home: What Your Insurance Covers in Storm Damage Claims

Protecting your home investment is vital, and buildings insurance offers essential coverage against storm damage, which can incur hefty repair costs. This article details what a standard policy covers regarding storms, highlights potential exclusions, and provides real-life examples to help you fully understand and navigate your storm coverage.

Are You Protected? How UK Home Insurance Covers Oil Leaks in Heating Systems

Buildings insurance is crucial for protecting against various perils, with oil leaks from heating systems often overlooked. These leaks pose significant risks, causing structural damage and environmental contamination. This article examines the unique challenges of oil leaks, detailing typical insurance coverage and exclusions that could impact a successful claim.

UK Buildings Insurance: Are You Covered for Fire, Smoke, and Explosions?

Safeguarding your home from unexpected incidents is essential. Buildings insurance covers structural damage from perils like fire, smoke, and explosions, preventing financial strain and lifestyle disruptions. Find out more…

Perils Covered in a Standard Contents Home Insurance Policy

Protecting your personal belongings from unforeseen incidents is crucial for financial peace of mind. Contents insurance covers risks like fire, theft, and flooding, safeguarding what’s inside your home. This article outlines common perils, policy inclusions, and essential exclusions to ensure your valuables are thoroughly protected against potential disasters.