People search “does home insurance cover accidental fire” when something has gone wrong unexpectedly — a kitchen fire, electrical fault, or accidental ignition. Most UK policies cover fire damage, but outcomes depend on policy wording, evidence, and whether exclusions apply. Here’s what’s commonly covered and what to do to support your claim.

Key Takeaways

- Fire damage is generally covered by standard home insurance policies in the UK, with average claim payouts ranging from £10,200 to £11,000.

- Coverage encompasses structural repairs, personal belongings, damage incurred by emergency services, and temporary accommodation if the home becomes uninhabitable.

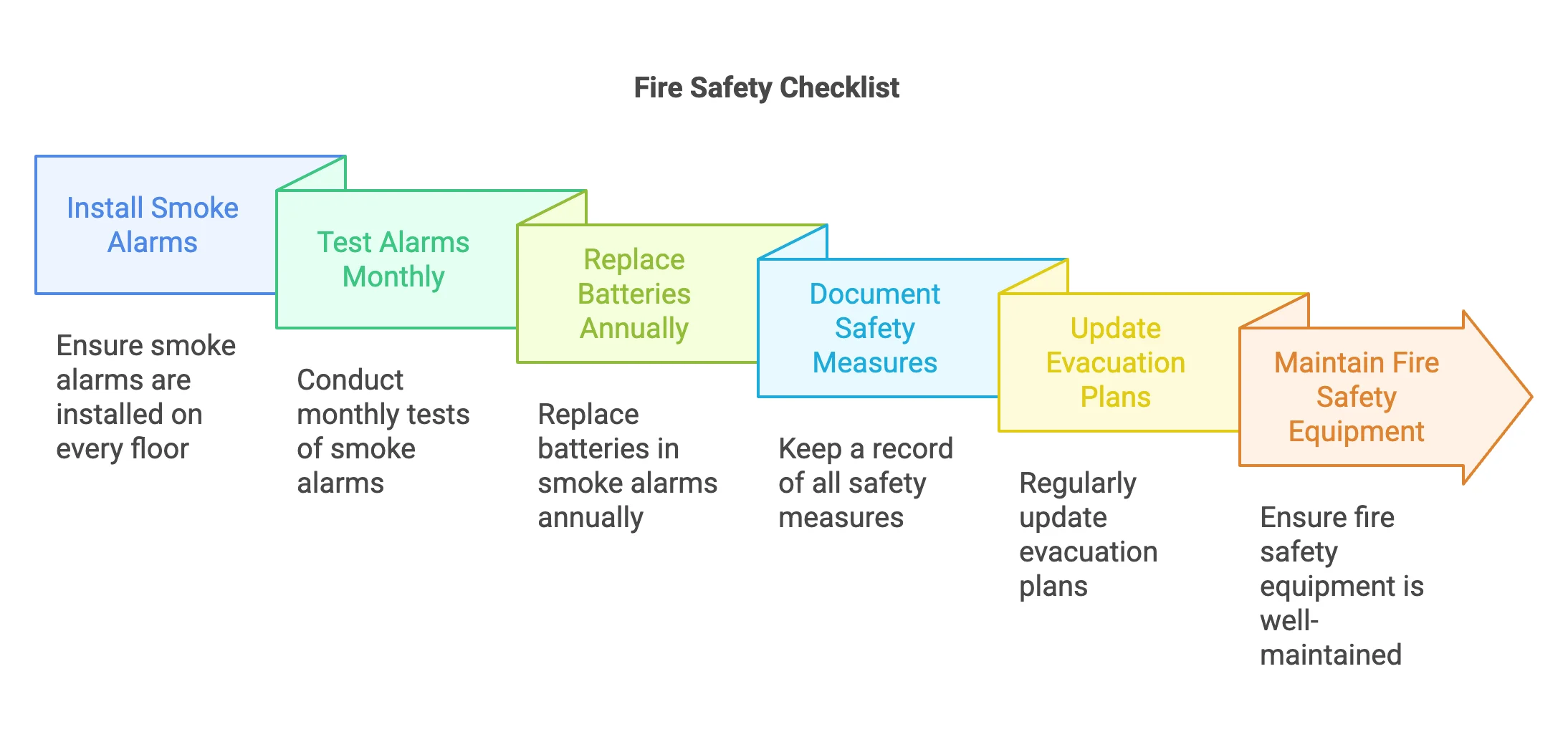

- It is crucial to have working smoke alarms and appropriate fire safety measures in place, as non-functional detectors could result in a claim being rejected.

- Timely documentation, including photos, videos, and detailed records of the damage, enhances insurance claims and assists with the processing.

- High-value items may require additional coverage beyond standard policy limits to ensure comprehensive protection against fire damage.

Understanding Fire Coverage in Standard UK Home Insurance

In the realm of protecting your home in the UK, understanding fire coverage is absolutely vital. Most standard home insurance policies include comprehensive protection against fire damage, covering both your property and possessions. The average claim payout ranges from £10,200 to £11,000.

Your insurance premiums may depend on your commitment to fire safety. Most policies require you to maintain working smoke detectors and properly maintain your home’s electrical systems. This helps protect both your property and your coverage.

Common causes such as cooking accidents, electrical faults, and lightning strikes typically fall under your policy’s protection. However, it is important to review your coverage regularly to understand any exclusions and ensure you have adequate protection for your specific situation. It’s crucial to note that non-functional fire detectors could result in your claim being rejected.

Related: Recent data shows that air fryer-related insurance claims have reached an average of £29,555 in Northern Ireland homes – find out how to prevent these costly accidents.

Key Types of Fire-Related Damage Your Policy Protects

Standard UK home insurance policies provide comprehensive protection against various types of fire damage, encompassing structural repairs and damage to personal belongings.

The coverage generally includes damage caused by emergency services during firefighting efforts, such as water damage from fire hoses or forced entry by firefighters.

Understanding these key protections enables homeowners to ensure they have sufficient coverage for both the structure of their property and its contents in the event of a disaster. If a home becomes uninhabitable after a fire, insurance typically covers temporary accommodation costs while repairs are completed.

Structural Fire Protection Coverage

While insurance policies may appear complex at first glance, structural fire protection coverage forms an essential cornerstone of home insurance in the UK.

Most policies provide comprehensive protection for both fire safety and the insurance implications that matter most to homeowners.

Standard coverage typically includes the repair or rebuilding costs for structural elements such as walls, roofs, and permanent fixtures damaged by fire.

Your policy usually extends to cover smoke and explosion damage as well, including professional cleaning and restoration services.

If your home becomes uninhabitable due to fire damage, insurers often provide costs for temporary accommodation.

In addition to the basics, policies generally include coverage for debris removal following a fire incident.

This ensures that you won’t face an additional financial burden during the challenging recovery period when dealing with fire-related property damage.

Important exclusions apply to any damage caused by intentional acts or negligence, so maintaining your property is essential for valid coverage.

Contents and Personal Belongings

Homeowners often wonder what personal belongings their insurance will protect after a devastating fire. Most standard contents coverage extends to everyday items such as furniture, electronics, and clothing that are damaged by flames or smoke. Your policy typically safeguards everything from your living room sofa to your wardrobe.

Personal belongings protection also includes appliances, home office equipment, and garden furniture. However, high-value items such as jewellery or art collections may require additional coverage beyond standard policy limits. To ensure fair compensation, it’s essential to document all possessions thoroughly with photos and descriptions.

Remember that insurers often cover temporary living expenses if a fire renders your home uninhabitable. This can provide peace of mind during the recovery process.

The effectiveness of your policy depends on factors such as safety compliance and proper maintenance – having working smoke alarms can strengthen your coverage position.

Emergency Services Response Damage

Fire brigades and emergency responders work tirelessly to save homes, but their lifesaving efforts can sometimes result in additional property damage.

Fortunately, most home insurance policies in the UK cover emergency response damage alongside fire-related claims.

Common types of emergency response damage include:

- Forced entry damage to doors and windows

- Water damage from fire hoses

- Structural damage from creating ventilation points

The insurance implications of emergency services damage are straightforward. Your policy typically covers necessary interventions by firefighters and first responders. Professional cleanup services ensure proper restoration after smoke and soot damage occurs.

This includes repairs for broken doors, water-damaged walls, and holes made in the roof. To ensure a smooth claims process, document all damage thoroughly with photographs and maintain a detailed record of emergency service interactions.

Remember to file your claim promptly to avoid potential coverage issues.

Essential Steps to Take After Fire Damage Occurs

When a fire damages your home, prompt and thorough documentation becomes your most valuable ally in the insurance claims process.

However, most people will be stressed and worried about their family and their home. In most cases we would recommend calling and asking for professional support. A claims management service will send a Loss Assessor to fully document and evidence your claim. They work for you, so they will deal with the insurance company and handle all of the paperwork. However, if you have the time and the skills here are the steps you should take ASAP.

Homeowners should immediately photograph and video all damage while keeping detailed records of emergency services, temporary repairs, and displaced belongings.

Your insurance provider requires this evidence to process your claim efficiently, so contacting them right away with comprehensive documentation will help ensure you receive appropriate compensation. Engaging qualified loss assessors can provide expert guidance in documenting damages and strengthening your claim.

Document Everything Immediately

Documentation serves as your lifeline after experiencing fire damage. Every photograph, receipt, and written record strengthens your insurance claim and protects your interests.

Start documenting damage before any cleanup begins – this creates a clear illustration for the insurance company and helps secure proper compensation.

Professional companies like Insurance Claim Recovery Support can provide expert guidance through the documentation process.

- Capture detailed photos and videos of all affected areas, including structural damage, smoke residue, and damaged belongings.

- Create an extensive inventory list with estimated values, dates of purchase, and the condition of items.

- Keep all receipts for emergency repairs, temporary accommodation, and replacement necessities.

Taking these steps immediately after the fire helps maximise your claim potential. Most insurance companies appreciate thorough documentation, which often leads to faster claim processing and fairer settlements.

Related: Learn the essential steps to take immediately after a house fire in the UK

Call Insurers Without Delay

Swift action can make all the difference when dealing with a fire insurance claim.

After ensuring everyone’s safety, your next priority should be contacting your insurer through their insurance hotline. Most insurance companies operate 24/7 emergency lines specifically for situations like this.

When you call, be prepared to provide essential details about the incident. This includes the date, time, and location of the fire.

Your insurer will guide you through the initial steps of the claims process and may arrange for temporary accommodation if it’s covered by your policy.

Remember that prompt notification can significantly impact your claim’s success.

Your insurer can also advise on immediate actions to prevent further damage and protect your property while the claim is being processed.

Consider working with a professional Loss Assessor for support during your initial meeting with the insurance company’s Loss Adjuster.

Know more: Find out how to file your house fire claim efficiently

Common Factors That Could Affect Your Fire Damage Claim

Several essential factors can influence whether a fire damage claim will be successful and how much compensation homeowners receive. Understanding these causal factors helps prevent potential claim denials and ensures maximum coverage when disaster strikes.

Key elements that typically affect fire damage claims include:

- Proper maintenance and safety measures, such as functioning smoke alarms and regular electrical inspections

- Prompt reporting of the incident to insurance providers with thorough documentation

- Compliance with policy requirements and exclusions

The type of fire also plays a significant role in determining coverage. While accidental fires from cooking or electrical issues are generally covered, intentional fires or those resulting from negligence may be excluded. Loss of use coverage provides essential support for temporary housing expenses while your home undergoes repairs.

Additionally, properties in high-risk areas might require special consideration or additional coverage options.

Maximising Your Settlement: Working With Loss Assessors

When a fire affects your home, collaborating with a loss assessor can greatly enhance your likelihood of obtaining fair compensation. These professionals possess expertise in claim negotiation strategies and have a deep understanding of the complexities of insurance policies.

| Loss Assessor Benefits | Their Role | Your Advantage |

|---|---|---|

| Expert Representation | Policy Interpretation | Maximum Coverage |

| Professional Negotiation | Evidence Gathering | Better Settlement |

| Claim Management | Dispute Resolution | Stress Reduction |

| Risk Assessment | Documentation Support | Time Savings |

Loss assessors manage the entire claims process, from the initial assessment to the final settlement. They collect evidence, oversee documentation, and negotiate with insurance companies on your behalf. Consider them as your personal advocate in the complicated realm of insurance claims. Their expertise often results in higher settlements and ensures that you do not overlook any covered damages. During the aftermath of a fire, they assist in calculating repair costs and obtaining accurate estimates from reputable contractors.

The True Cost of Fire Damage Claims in Britain

Understanding the true financial impact of fire damage in Britain reveals staggering figures that affect both homeowners and the broader economy.

Recent data shows the total economic and social cost of fire reached £12.0 billion, with property damage accounting for £2.0 billion.

The economic impact extends far beyond individual claims, encompassing:

- Average costs of £78,000 per fire incident attended by emergency services

- £4.6 billion spent nationwide on fire prevention measures in buildings

- £20,900 in marginal costs per fire excluding preventative measures

These figures highlight why investing in fire prevention is vital for protecting both property and finances.

When we consider that the average fire claim can devastate a family’s finances, it becomes clear why comprehensive insurance coverage remains essential for homeowners across Britain.

Related: Understand the differences between fire damage and smoke damage claims

Smart Prevention Strategies That Keep Your Policy Valid

Maintaining valid fire insurance coverage requires more than simply paying premiums on time. Savvy homeowners understand that insurance compliance begins with fundamental fire safety measures that protect both property and policy validity.

Installing and regularly testing smoke alarms forms the foundation of a robust prevention strategy. Equally important is the maintenance of electrical systems to prevent overloading and potential fire hazards. Many insurance policies stipulate these basic safety measures.

Kitchen safety warrants special attention, as cooking accidents remain a leading cause of house fires. Never leave cooking unattended, and ensure appliances are clean and well-maintained. Having a clear fire escape plan also reflects your commitment to responsible homeownership.

Regular documentation of safety measures and property maintenance helps demonstrate compliance with policy requirements, making any future claims process smoother and more likely to succeed.

Related: Discover common pitfalls that can lead to fire claim denials

Need Help with Your Fire Damage Insurance Claim?

Most UK home insurance policies cover fire damage, but ensuring your claim is successful can depend on proper documentation and fire safety measures.

PCLA’s experienced Claims Management Service will handle everything—from documenting damage and coordinating with loss adjusters to negotiating a fair settlement. Contact us today to find out how we can help you recover from fire damage.

Conclusion

While fire damage is generally covered under standard UK home insurance policies, successful claims depend on meeting safety requirements and maintaining proper documentation. With average payouts starting at around £10K, it’s essential to understand your policy details and ensure you have adequate coverage, particularly for high-value items.

Remember, working smoke alarms and proper fire safety measures aren’t just about protecting your property – they’re crucial for maintaining valid insurance coverage. By staying prepared and understanding your policy requirements, you can ensure you’re protected if the unexpected occurs.

Fire Damage Claim Support

Has fire damage affected your home? PCLA is ready to take the stress out of filing your claim. We offer a free, no-obligation survey and assess damage within 24 hours. With our no win, no fee promise, you pay only if your claim succeeds.

Our team handles all paperwork, site inspections, and discussions with your insurer, leaving you more time for your family. With certified insurance practitioners and qualified building surveyors across Northern Ireland, every pound you receive goes straight to you.