Structural issues like subsidence, heave, and landslip can undermine the stability of your home. Understanding how UK home insurance provides coverage for these ground movement risks is essential for protecting your investment and ensuring peace of mind.

Owning a home is more than just having a place to live—it’s about building a secure foundation for your future. A crucial aspect of this security is understanding how your buildings insurance protects you from unforeseen threats.

In the UK, these include subsidence, heave, and landslip—terms that may seem daunting but are vital to understand. These geological risks can pose significant challenges, leading to expensive repairs and disruptions.

This article, discusses these complex perils, outlines potential exclusions, and illustrates the importance of comprehensive coverage. Plus, discover the role of PCLA in effectively managing insurance claims, ensuring your home’s security against nature’s unpredictability.

What is Subsidence?

Subsidence is one of the most common and costly issues faced by homeowners, yet it remains poorly understood by many. Simply put, subsidence occurs when the ground beneath a building sinks or shifts downward, causing the foundations of the property to settle unevenly. This uneven settlement can result in structural damage, including cracks in walls, windows and doors that no longer close properly, and even potential instability.

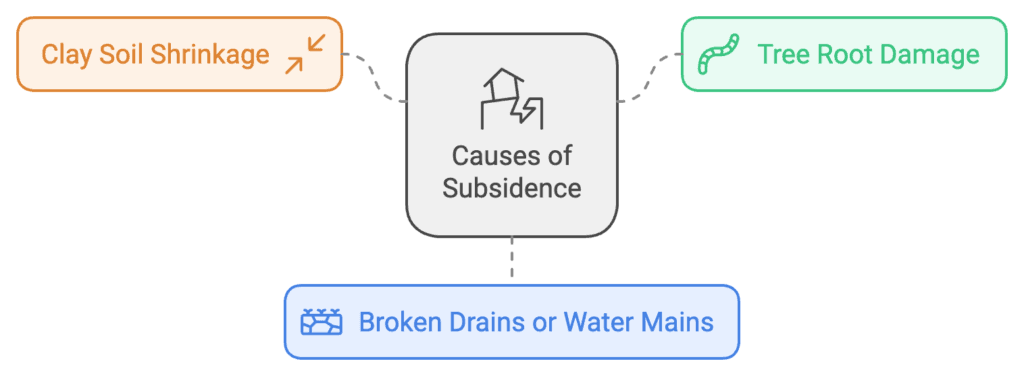

Causes of Subsidence

Subsidence is typically caused by changes in the soil beneath the property. The most common culprits are:

- Clay Soil Shrinkage: In the UK, properties built on clay-rich soil are particularly vulnerable to subsidence. During prolonged dry periods, clay soil can shrink as it loses moisture, causing the ground to shift.

- Tree Root Damage: Large trees and shrubs planted close to the property can also contribute to subsidence, as their roots draw moisture from the surrounding soil, leading to further shrinkage.

- Broken Drains or Water Mains: Water leakage from damaged pipes can wash away soil beneath the foundations, leading to a destabilised structure.

Signs of Subsidence

Recognising the signs of subsidence early is key to preventing further damage. Look out for:

- Cracks in the walls, especially those that appear diagonally and widen over time.

- Doors and windows that become difficult to open or close.

- Uneven or sloping floors.

Subsidence in Your Insurance Policy

Most standard home insurance policies in the UK do cover subsidence, but the level of cover and exclusions can vary significantly. Insurers will typically cover the cost of repairs necessary to stabilise the property and fix any structural damage. However, there are important exclusions to be aware of:

- Pre-existing damage: Insurers may not cover any subsidence-related damage that existed before you took out the policy.

- Preventable causes: Issues that could have been avoided, such as damage due to neglected maintenance (e.g., allowing tree roots to interfere with your foundation), might not be covered.

- Excess: Subsidence claims usually come with a higher excess (the amount you need to pay before the insurance kicks in) than other types of claims. It’s not uncommon for this excess to range from £1,000 to £2,500, depending on your insurer.

What is Heave?

Heave is another ground movement peril covered under most standard buildings insurance policies. While subsidence involves the ground sinking, heave refers to the opposite – the ground beneath a building expanding and pushing upward. This upward movement can also cause significant damage to the structure of a home, including walls, foundations, and floors.

Causes of Heave

Heave is most commonly associated with soil types that expand when they absorb water, such as clay. Some typical causes include:

- Soil Moisture Increase: If the soil around your property absorbs excessive water, either from rainfall or leaks, it can swell and push the foundations upward.

- Tree Removal: Removing trees that previously absorbed significant amounts of water from the soil can lead to the ground swelling as moisture accumulates.

- Frost: In some cases, freezing temperatures can cause the soil to expand, though this type of frost-related heave is relatively uncommon in the UK.

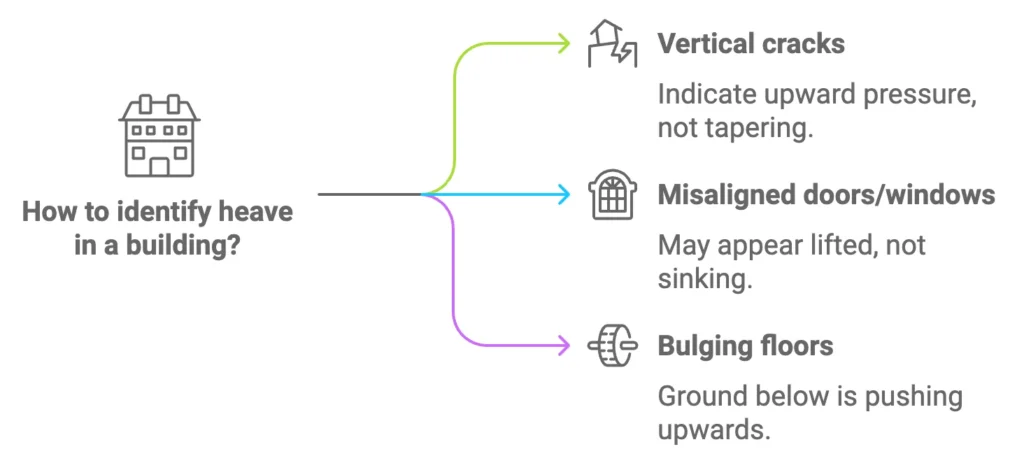

Signs of Heave

Detecting heave early can be challenging because the symptoms often resemble those of subsidence. Key indicators include:

- Cracks in walls that are vertical, rather than diagonal, and do not taper.

- Doors and windows that are misaligned, though in this case, they may appear lifted rather than sinking.

- Bulging floors, as the ground below pushes upwards.

Heave in Your Insurance Policy

Heave is less common than subsidence, but it is generally covered under a standard buildings insurance policy. The coverage is typically similar to that for subsidence, covering repairs to the damaged structure. However, exclusions to watch out for include:

- Damage due to poor construction: If your property was not built on suitable foundations or the groundwork was not properly prepared, your insurer might deny your claim.

- Tree-related issues: Some insurers may exclude claims where the cause of heave is related to poor tree management or inadequate soil assessment.

What is Landslip?

Landslip refers to the downward sliding of a mass of earth, rocks, or debris along a slope. In the UK, properties built on or near hillsides are particularly at risk of landslip, which can cause entire sections of a building to shift, resulting in catastrophic damage.

Causes of Landslip

Landslip is usually triggered by natural events or changes in the landscape. Common causes include:

- Heavy Rainfall: Prolonged or intense rainfall can saturate the ground, making it heavy and unstable, particularly on slopes.

- Erosion: The natural wearing away of earth, whether due to wind, water, or human activity, can destabilise the ground around a property.

- Construction Activity: Nearby building projects, roadworks, or excavation can sometimes trigger landslips by disturbing the soil.

Signs of Landslip

Because landslip can occur suddenly and with little warning, it’s essential to monitor the stability of your property if you live in an area prone to this peril. Warning signs might include:

- Cracks in the ground around the property or driveway.

- A sudden tilting of walls or fences.

- Visible movement of the land around the house, especially after heavy rain.

Landslip in Your Insurance Policy

Landslip is usually covered under standard home insurance policies, but as with subsidence and heave, there are potential exclusions:

- Negligence: If you fail to maintain your property adequately, especially in high-risk areas, your insurer may reject the claim.

- Building on unstable ground: If your property was built on land known to be unstable without the necessary precautions, you may not be covered.

In addition, landslip claims can also be subject to a higher excess, similar to subsidence claims.

Exclusions to Be Aware Of

While subsidence, heave, and landslip are covered perils under most buildings insurance policies, it is essential to thoroughly read through the terms of your coverage. Some key exclusions to watch out for include:

- General Wear and Tear: Insurers will not cover damage that results from the natural ageing of your home or neglect.

- Unapproved Building Work: Any damage that occurs due to unauthorised or poorly executed building work may not be covered.

- Pre-existing Conditions: If you were aware of structural issues, including previous subsidence or poor foundation quality, before taking out your insurance, your claim may be denied.

How Property Claims Loss Assessors (PCLA) Can Help You

As a homeowner, the thought of dealing with subsidence, heave, or landslip can be overwhelming. Not only can these events cause significant structural damage, but navigating the claims process can also be a stressful and complicated task. This is where Property Claims Loss Assessors (PCLA) come in.

At PCLA, we work directly with homeowners to manage the entire claims process. Unlike your insurance company, which represents their own interests, PCLA acts on your behalf to ensure you receive the compensation you are entitled to. We have years of experience handling claims related to subsidence, heave, and landslip, and our expertise allows us to negotiate with insurers to get the best possible outcome for you.

From the initial assessment of your property to gathering the necessary documentation, and even managing the repair process, PCLA is with you every step of the way. Our team ensures that no detail is overlooked, and that all damage is accounted for in your claim, so you don’t end up out of pocket.

If you find yourself facing the daunting task of making a claim for subsidence, heave, or landslip, don’t hesitate to get in touch with PCLA. We’re here to make the process as smooth and stress-free as possible, giving you the peace of mind that your home is in safe hands.

Conclusion

Dealing with the perils of subsidence, heave, and landslip can be a homeowner’s worst nightmare, but having the right insurance coverage in place can provide much-needed financial protection and peace of mind. By understanding what these perils entail, the warning signs to watch for, and the potential exclusions within your policy, you can be better prepared for any eventuality.

However, if you find yourself needing to make a claim, remember that help is available. PCLA can assist you in navigating the often-complex claims process, ensuring that you receive the support and compensation you deserve. Protecting your home is essential, and with the right approach, you can face these challenges head-on.