Severe storms can cause significant damage to your UK home, from broken windows to roof damage. Knowing what your home insurance covers in storm-related claims is vital to ensure you’re prepared and protected when bad weather strikes.

Owning a home is a substantial investment, and ensuring that it is protected from the unexpected is crucial. A buildings insurance policy provides financial security by covering structural damage to your home caused by various perils, one of which is storms. Storm damage can result in significant repair costs, but understanding the extent of your coverage is essential for peace of mind.

In this article, we’ll look into the specifics of storm coverage under a standard home buildings insurance policy. We’ll explore what is covered, potential exclusions, and some real-life scenarios to help you better understand your policy.

What Is Storm Damage?

Storm damage refers to the destruction or impairment of your home caused by extreme weather conditions, such as heavy rainfall, high winds, hail, and snow. The UK frequently experiences storms, and while they can vary in intensity, even moderate storms can lead to damage that requires costly repairs.

Defining a Storm

While most of us know what a storm looks like, insurance policies require a clear definition of a storm to determine coverage. Generally, a storm is classified as severe weather involving:

- Wind speeds exceeding 55 mph.

- Heavy rainfall of at least 25mm within an hour.

- Hail of such intensity that it causes damage to hard surfaces or breaks glass.

- Snowfall heavy enough to cause damage to property.

These technical details are important because they form the basis on which insurers evaluate claims for storm damage. If weather conditions do not meet these thresholds, a claim may be denied.

Coverage for Storm Damage in a Standard Buildings Insurance Policy

Most standard buildings insurance policies cover storm damage to the main structure of your home, including the roof, walls, ceilings, windows, and doors. If a storm causes damage to these parts of your home, your insurance should help cover the cost of repairs or rebuilding. This ensures that homeowners can maintain the structural integrity of their property without facing financial ruin after a storm.

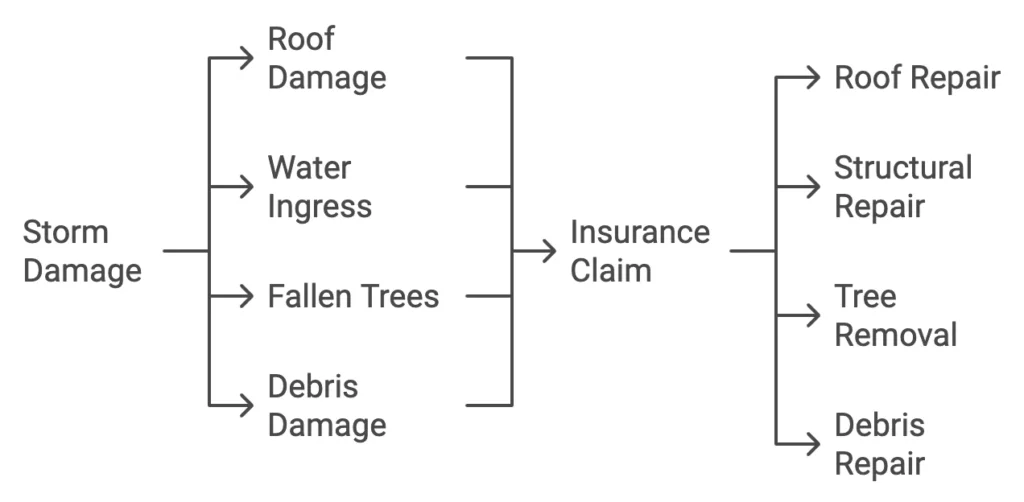

What Is Typically Covered?

- Roof Damage: High winds can dislodge tiles or even rip sections of roofing entirely. Your policy will generally cover the cost of replacing tiles or repairing the roof to prevent further water ingress.

- Water Ingress: If a storm leads to water entering your home—whether through a damaged roof or walls—your insurance is likely to cover the resulting structural damage. This could include repairs to ceilings, walls, and insulation.

- Fallen Trees: If a storm causes trees to fall onto your home, damaging the structure, the cost of removing the tree and repairing the damage is usually covered.

- Debris Damage: During storms, flying debris like tree branches or roof tiles from other properties can damage your home. Any repairs needed due to such impact are generally covered.

Real-Life Example of Storm Damage

Imagine a situation where a violent storm hits your area, and the high winds tear tiles off your roof. Rainwater enters your loft, damaging the ceilings and walls of your home. In this scenario, your standard buildings insurance policy should cover the cost of roof repairs, replacing the tiles, and any damage caused by water ingress to the interior structure.

Additional Living Costs

If storm damage renders your home uninhabitable, many policies also cover the cost of alternative accommodation while repairs are underway. This can include paying for a hotel or rental property while your home is being fixed, ensuring that you and your family are not left without a place to live during a stressful time.

Common Exclusions in Storm Damage Coverage

While storm damage coverage is comprehensive, there are certain exclusions you need to be aware of. Understanding these exclusions will help you manage expectations when filing a claim and avoid any surprises during the claims process.

1. Fences, Gates, and Hedges

A significant exclusion in most storm damage policies is coverage for fences, gates, and hedges. These external elements are often the first to suffer damage in a storm, but unfortunately, they are typically not covered. Insurance providers argue that these are less critical to the structural integrity of the home and are more prone to damage from minor weather events.

If a storm knocks down your garden fence or damages your hedges, you will likely have to cover the cost of repair or replacement out of your own pocket.

2. Pre-Existing Damage or Poor Maintenance

Homeowners are expected to maintain their properties in a good state of repair. If your roof was missing tiles or your home had pre-existing structural weaknesses before the storm, insurers may deny your claim. This is because they consider these issues to be the result of neglect, rather than the storm itself.

For example, if your roof was already in disrepair with several missing tiles, and a storm worsened the situation, the insurer may argue that the storm exacerbated existing damage rather than causing it outright. Regular maintenance and inspections can help ensure your home is in good condition, reducing the risk of claim rejections.

3. Damage to Outbuildings and Detached Structures

While the main structure of your home is typically covered, detached structures such as sheds, garages, and greenhouses may not be included in standard storm damage coverage. You may need additional insurance to cover these structures, or check if they are included as part of an outbuilding clause in your policy.

4. Storm Surge and Coastal Impact

If your home is located near the coast, strong winds and airborne debris during a storm can cause damage to property. Coastal homes are especially vulnerable to saltwater corrosion, which can degrade building materials over time. Standard storm coverage may include damage from high winds and airborne debris, but it’s important to verify if your insurance provides protection against gradual damage like saltwater corrosion, particularly if you live in a coastal area.

5. Uninhabitable Home Due to Maintenance Failures

If storm damage results in your home becoming uninhabitable, most policies will cover the cost of alternative accommodation. However, if the damage was preventable with proper maintenance (such as repairing a leaky roof before the storm), the insurer may not cover the cost of temporary housing. As always, regular upkeep is essential to ensure that you’re fully protected in the event of a storm.

How to Minimise the Risk of Storm Damage

Although storms are beyond your control, there are steps you can take to reduce the risk of severe damage to your home. By proactively maintaining your property, you can ensure that your insurance coverage remains valid and reduce the likelihood of needing to make a claim.

1. Regular Roof Inspections

Since roof damage is one of the most common forms of storm-related damage, conducting regular inspections is crucial. Check for missing or damaged tiles, and repair any issues promptly. Addressing small problems before they escalate can prevent more severe damage during a storm.

2. Clear Gutters and Drains

Blocked gutters and drains can lead to water backing up and entering your home during heavy rainfall. Regularly clear your gutters of debris and ensure that your drainage system is working effectively.

3. Trim Trees and Remove Dead Branches

Fallen trees and branches are another common source of storm damage. Trim overhanging branches that could fall onto your home during a storm, and remove any dead or diseased trees from your property.

4. Secure Loose Items

During high winds, loose items such as garden furniture, tools, or even toys can become projectiles that damage your home. Secure these items or move them indoors before a storm is forecast.

The Claims Process for Storm Damage

If your home suffers storm damage, it’s important to act quickly to prevent further deterioration and ensure that your claim is processed smoothly.

1. Document the Damage

As soon as it is safe to do so, take photographs or videos of the damage. This will serve as evidence to support your claim and help your insurer assess the extent of the damage.

2. Make Temporary Repairs

While you should not undertake any permanent repairs until your insurer has assessed the damage, it is important to make temporary repairs to prevent further damage. For example, you could place a tarpaulin over a damaged section of your roof to stop water from entering your home. Keep receipts for any materials you purchase, as these costs may be reimbursed by your insurer.

3. Contact Your Insurer

Notify your insurer as soon as possible after the storm. They will advise you on the next steps and may send a loss adjuster to assess the damage. The sooner you make contact, the quicker the claims process will begin.

4. Keep All Receipts and Records

If your home becomes uninhabitable and you need to stay elsewhere, keep all receipts related to accommodation and living expenses. Your insurer may cover these costs, but you will need to provide evidence.

PCLA – Here to Help

At this stage, you might feel overwhelmed by the claims process, and this is where PCLA can help. As a homeowner, understanding the complexities of insurance claims can be challenging, especially after experiencing a stressful event like storm damage. At PCLA we help simplify the claims process and ensure you receive the settlement you’re entitled to.

We act on your behalf, liaising directly with your insurer, documenting the damage, and managing the entire process from start to finish, so you can focus on getting your life back to normal. Whether it’s assessing the damage, submitting the paperwork, or negotiating with your insurance company, we’re here to make the journey as smooth as possible.

Conclusion

Storms can cause significant and costly damage to homes, but with the right buildings insurance policy, you can have peace of mind knowing that you are financially protected. However, understanding what is covered and what is excluded is crucial. While structural damage to your home is typically covered, elements like fences, gates, and poorly maintained roofs may not be.

By maintaining your property and regularly reviewing your insurance policy, you can ensure that you are fully prepared for storm-related perils. Taking proactive steps, such as securing loose items and trimming overhanging branches, can also help minimise the risk of damage.

If storm damage does occur, avoid making any permanent repairs until your insurer has assessed the damage to ensure that your claim is processed smoothly. Instead, make temporary repairs to prevent further deterioration and document everything thoroughly.

Knowing how to navigate the claims process and seeking assistance from professionals like PCLA can make a huge difference in helping you get back on your feet as quickly as possible.