Fires, smoke damage, and explosions can pose serious risks to your home and safety. Understanding what your UK buildings insurance covers in these situations is essential for ensuring comprehensive protection and peace of mind.

When you own a home, protecting it from unexpected incidents is crucial. Buildings insurance is specifically designed to protect the structure of your property against a variety of potential risks, including fire, smoke, and explosion. These perils can cause significant damage, resulting in financial burdens and disruptions to your daily life.

In this article, we’ll explore how these perils are covered under a standard buildings insurance policy, highlight common exclusions, and provide real-life examples to help you understand what is and isn’t covered.

Fire Damage

Fire is one of the most devastating events that can affect a home, leading to severe destruction of both the structure and contents. At PCLA we are regularly appointed to represent client’s whose property has suffered fire damage, we see first hand the severe impact this can have.

Most standard buildings insurance policies offer coverage for fire damage, including repair or rebuilding costs for structural elements such as walls, roofs, and permanent fixtures that are affected by the fire.

What’s Covered?

A typical home insurance policy will cover accidental fires, electrical faults, and gas explosions that cause damage to your property. This includes repairs to the building’s structure, including walls, ceilings, and floors. Policies may also extend to cover the cost of removing debris and temporary accommodation if the home is uninhabitable.

One fire damage claim that PCLA managed involved a property in Lurgan, where a tumble dryer in a kitchen caught fire. The blaze caused extensive damage to the plasterboard ceilings, joists, kitchen units, wall plaster, and electrical systems, while smoke spread throughout the property. With PCLA’s assistance, the client successfully obtained a settlement that allowed them to restore the property to its original state.

Common Exclusions

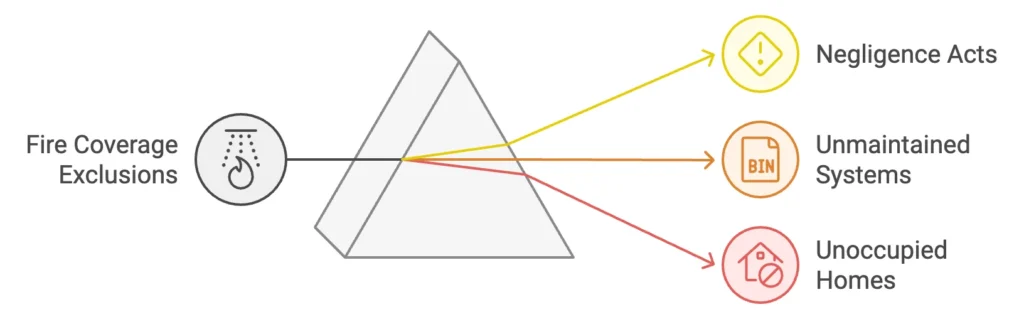

While fire coverage is comprehensive, there are important exclusions to be aware of:

- Negligence or Intentional Acts: Fires caused by negligence—such as using faulty electrical appliances without maintenance—or intentional acts, such as arson by the policyholder, are not covered.

- Unmaintained Systems: If essential systems like electrical wiring are not properly maintained and contribute to a fire, insurers may deny your claim. For instance, outdated wiring that has not been inspected could lead to a rejected claim.

- Unoccupied Homes: If your home is unoccupied for 30 to 60 days, fire coverage may lapse unless specific precautions are taken or the insurer is notified.

Smoke Damage

Even a small fire can result in significant smoke damage. Smoke residue (soot) can settle on surfaces throughout the home, leaving stains and odours that require professional cleaning. Smoke damage is often more extensive than the fire itself, affecting rooms that were not directly involved.

What’s Covered?

Most standard home insurance policies include coverage for smoke damage from fire or explosions. This includes professional cleaning and restoration to remove stains, eliminate odours, and return your home to a habitable state.

For example, if a kitchen fire is quickly extinguished, smoke may still stain walls and ceilings throughout the ground floor. Your policy will likely cover the cost of deep cleaning and redecorating the affected areas.

Common Exclusions

Exclusions for smoke damage include:

- Smoking-Related Fires: If smoke damage is caused by smoking inside the home, insurers may refuse to pay, especially if negligence is involved.

- Gradual Damage: Long-term smoke damage caused by repeated incidents, such as a poorly ventilated fireplace, is often considered wear and tear and is not covered.

Explosion Damage

Explosions are rare but can occur due to gas leaks or faulty appliances, causing structural damage to walls, ceilings, and roofs. Severe explosions may require part or all of the home to be rebuilt.

What’s Covered?

Home insurance policies generally cover damage caused by explosions, including the cost of repairs or rebuilding. This also includes debris removal and coverage for temporary accommodation if the home is uninhabitable.

For example, if a gas boiler explodes, damaging the walls and foundation, your policy would cover the repair or rebuilding of these areas. If the home is unsafe, alternative accommodation may also be covered.

Common Exclusions

Exclusions for explosions may include:

- Negligence in Gas or Electrical Systems: Failure to maintain gas or electrical systems could void coverage. For instance, if a gas system hasn’t been serviced and causes an explosion, the insurer may refuse to pay.

- Faulty Appliances: If an explosion is caused by knowingly using a faulty appliance, this may invalidate your claim.

How These Perils Can Impact Your Life

A fire, smoke, or explosion event can be life-altering. In addition to property damage, you may be displaced for an extended period while repairs are carried out. Insurance covers repair costs and provides financial support for temporary living arrangements, easing some of the burden during these disruptive times.

Consider the stress involved in an explosion incident. You may need to vacate your home, replace lost possessions, and navigate the insurance process, all while securing alternative accommodation. Having comprehensive coverage can make this process smoother and provide vital financial relief.

Additional Costs and Considerations

When considering coverage for fire, smoke, and explosion damage, it’s important to understand the potential additional costs involved. Insurance policies typically cover the primary damage caused by these incidents, but there are often supplementary expenses that need to be considered.

Debris Removal and Site Clearance

The cost of removing debris after a fire or explosion can be substantial. In the event of a large fire, there may be considerable amounts of charred debris that must be cleared before repairs can begin. This is typically covered under most building insurance policies, but homeowners should understand that such costs may vary depending on the extent of the damage.

In the aftermath of an explosion, the structure may become unsafe, and professional demolition or site clearance may be required. These services can be costly, but they are essential to ensure the site is ready for rebuilding. Knowing whether your policy provides sufficient funds for these activities can make a big difference in how quickly you can begin the rebuilding process.

Alternative Accommodation Costs

As previously mentioned, if your home becomes uninhabitable due to fire, smoke, or explosion damage, your insurer may provide alternative accommodation coverage. However, it is important to understand the limits of this coverage. Some policies provide a set amount or limit the duration of the accommodation they cover.

For example, if your home is extensively damaged by fire and requires several months to rebuild, the accommodation costs can quickly add up. If your policy limits are insufficient, you may find yourself out of pocket. Always review your policy to determine if the alternative accommodation limits will realistically cover your needs.

Preventive Measures to Reduce Risk

Electrical Safety Checks

One of the best ways to prevent fire and explosion is to have regular electrical safety checks. Faulty wiring is a common cause of house fires, but this risk can be minimised by ensuring your home’s electrical systems are up to standard. Hiring a qualified electrician to conduct an inspection every few years is a worthwhile investment in your safety and may even help you secure lower premiums by demonstrating your commitment to maintaining a safe home.

Gas Safety Inspections

If you have a gas supply in your home, regular inspections of gas appliances and piping are crucial. Gas leaks are dangerous not only because they can lead to explosions but also because they can cause carbon monoxide poisoning. Ensuring all gas appliances are serviced by a Gas Safe registered engineer will reduce the likelihood of a gas-related incident, protect your family, and improve the likelihood of any related claims being paid out by your insurer.

Fire Drills and Emergency Planning

Another way to minimise the risk of injury during a fire or explosion is to establish a clear emergency plan. Conduct regular fire drills, especially if you live with children or elderly family members. Having an emergency plan helps ensure that everyone knows how to exit the home quickly and safely in the event of a fire or explosion.

Fire Extinguishers and Smoke Alarms

Smoke alarms are critical for early fire detection, but having fire extinguishers placed strategically throughout your home can also make a big difference. A small fire can quickly become a big problem if not managed promptly. Ensure that you have functional smoke alarms in every major area of your home and that they are tested regularly.

Fire extinguishers should be kept in easily accessible areas, such as the kitchen and garage. Knowing how to use a fire extinguisher can prevent a minor incident from becoming a total loss.

The Claims Process: What to Expect

If you experience fire, smoke, or explosion damage, understanding the claims process is crucial. After ensuring everyone’s safety, follow these steps:

- Contact Your Insurer: Inform your insurer as soon as possible to initiate the claims process.

- Document the Damage: Take photos or videos of the damage and keep receipts for emergency repairs.

- Get a Professional Assessment: Your insurer will likely send a loss adjuster to evaluate the damage and estimate repair costs.

- Understand Policy Limits: Be aware of policy limits and any exclusions that apply, as some insurers may cap payouts for specific types of damage.

- Temporary Accommodation: If your home is uninhabitable, check if your policy covers alternative accommodation.

Working with Loss Assessors

Loss assessors, such as PCLA (Property Claims Loss Assessors), play a crucial role in helping homeowners manage the insurance claims process. Unlike loss adjusters, who are appointed by the insurer to assess damage, loss assessors work solely on behalf of the homeowner. This means that their primary focus is to ensure that you receive the full settlement you are entitled to under your policy.

PCLA is an independent loss assessing company that specialises in assisting homeowners with claims for damage caused by incidents such as fire, smoke, and explosions. By working with PCLA, homeowners can benefit from expert advice, support throughout the claims process, and effective negotiation with insurers to ensure that every aspect of the loss is accounted for.

One of the main advantages of working with a loss assessor like PCLA is our expertise in identifying both visible and hidden damages. For example, after a fire, there may be secondary damage, such as water damage from firefighting efforts, which can lead to mould growth if not properly addressed. Loss assessors ensure these issues are identified and included in your claim, maximising the settlement you receive.

PCLA can handle the complex paperwork and communication with the insurance company, reducing the stress involved in the claims process. We advocate on your behalf, ensuring that your insurer doesn’t overlook or undervalue any part of your claim. This can make a significant difference, especially in larger claims where the costs of repairs, temporary accommodation, and other associated expenses can add up quickly.

Overall, partnering with a professional loss assessor such as PCLA provides peace of mind, knowing that your best interests are represented and that you are likely to receive the settlement offer necessary to restore your home to its original condition.

Conclusion

Fire, smoke, and explosion are significant perils that can lead to extensive damage and stress. Understanding your buildings insurance coverage is crucial for protecting yourself when the unexpected happens. While insurance provides financial support for recovery, taking preventive steps—such as maintaining key systems and installing safety devices—helps protect your home and family.

Review your policy regularly, understand the inclusions and exclusions, and maintain your home to reduce the risk of denied claims. A well-maintained home is safer and more likely to be fully covered by your insurer when disaster strikes. Additionally, preparing for emergencies by installing safety devices and creating an emergency plan can help mitigate the damage and ensure your family’s safety.

Working with a professional loss assessor, such as PCLA, can make a significant difference in ensuring that your insurance claim is handled effectively. Loss assessors work on your behalf to secure the full compensation you’re entitled to, identify hidden damages, and manage the often complex claims process. Their support can alleviate stress and ensure that no part of your claim is undervalued or overlooked.

By combining proactive maintenance, emergency preparedness, and professional assistance, you can navigate the challenges of fire, smoke, and explosion incidents with greater confidence and security. Remember, the key to managing the impact of these perils is proactive maintenance, preparedness, understanding your coverage, and seeking professional help when needed to avoid any surprises when you need it most.