Making an insurance claim can be a frustrating experience and the last thing you want to do is try and figure out the difference between a loss adjuster and a loss assessor. The easiest way to explain the difference is to understand their respective roles.

- A loss adjuster works for the insurance company.

- A loss assessor works for you (the policy holder).

It’s important not to get these two roles mixed up. If you need to make an insurance claim for damage to your property, you definitely want to employ a loss assessor to work for you. Once your claim is submitted a loss adjuster will be appointed by your insurance company to investigate the value of your claim. It’s always in the best interests of the policy holder (you) to make sure you have a professional loss assessor working on your behalf.

Loss Assessors vs Loss Adjusters

Responsibilities of a Loss Adjuster

To understand why you should appoint a loss assessor, let’s find out what a loss adjuster will do for the insurance company.

- Loss adjusters work for your insurance company.

- They review your insurance policy and determine the level of insurance cover you have.

- The loss adjuster will visit your property to assess the damage themselves. They are responsible for finding the cause of the damage and determining whether your policy covers this. However, they might not be able to check the full extent of the damage or they may miss something.

- A loss adjuster is required to provide your insurance company with a report detailing the damage to your property and an estimate of the cost of repairs. This report may adjust the value of any claim you make.

- They are expert claims negotiators – remember, they work for the insurance company.

As you can see, it’s really important to have an experienced loss assessor working for you.

Why Do Insurers Appoint Loss Adjusters?

To put it simply, insurance companies appoint loss adjusters to adjust a claim made by the policyholder. Since loss adjusters work for the insurance company, their job is to evaluate your claim from the perspective of the insurance company. In other words, a loss adjuster will try to find ways to reduce your payment. However, a good loss assessor will be able to negotiate your claim and make sure everything is taken into consideration.

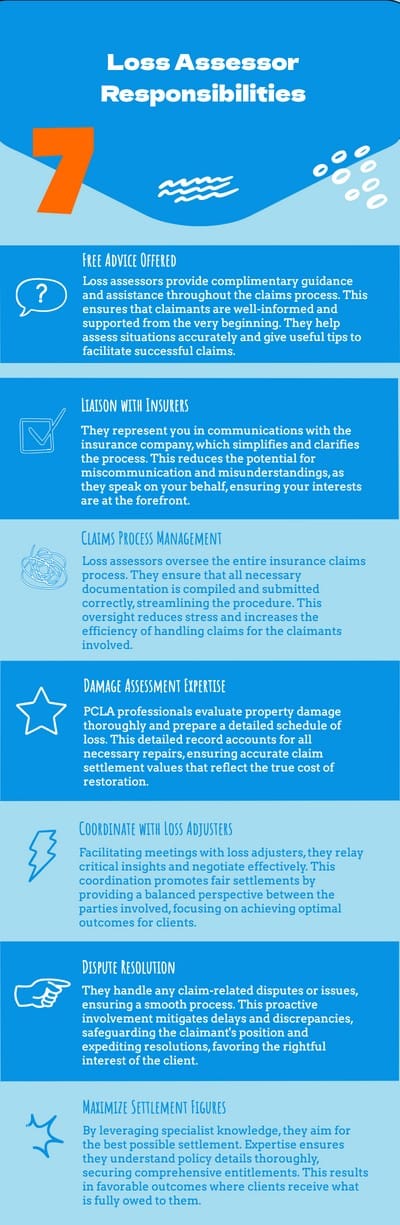

Responsibilities of a Loss Assessor

It’s important to remember that a loss assessor represents you, the policyholder – they work on your behalf. What can a PCLA loss assessor do for you?

- We offer free advice and support for all claims.

- We will speak to the insurance company on your behalf.

- Our loss assessors will manage the insurance claim process for you, and compile the necessary paperwork.

- PCLA are Building Surveyors and certified insurance practitioners who will assess the damage to your property and draw up a schedule of loss.

- We will meet with the loss adjuster and talk to the insurance company representative.

- PCLA will also handle any disputes or issues that may arise with the claim.

- We will use our specialist insurance claims knowledge to get you the best possible settlement figure. As an independent company with over 20 years experience, we know how to make sure our clients get their full entitlement.

Choosing the right professional makes all the difference—get tips on selecting the best loss assessor for your needs.

Download our free ‘Responsibilities of a Loss Assessor Infographic‘

Making the Decision: When to Hire a Loss Assessor

Deciding whether to hire a loss assessor hinges on several key factors, with claim complexity and potential settlement value being primary considerations.

The cost-benefit analysis typically favours professional help when dealing with high-value claims, complex damage scenarios, or situations where initial insurance offers appear inadequate. Small claims like a stolen bicycle may not warrant professional assistance.

Understanding both the immediate costs and long-term financial benefits of professional representation can help homeowners make informed decisions about securing expert assistance for their insurance claims.

Key Decision Factors

Making an informed decision regarding the hiring of a loss assessor requires careful consideration of several key factors. The complexity of your claim assessment plays a crucial role in this decision. When faced with extensive property damage or business interruption, professional loss evaluation becomes essential for securing fair settlements. Loss assessors provide immediate expert support during emergencies to help secure your property and prevent further damage.

Key considerations when deciding to engage a loss assessor:

- Scale of damage – Large-scale property claims often necessitate skilled handling.

- Claim complexity – Multiple parties or legal issues require professional guidance.

- Business impact – Lost profits and operational interruptions need precise calculation.

- Dispute potential – Contested claims benefit from professional representation.

When your claim involves intricate documentation or negotiations with insurers, a loss assessor’s expertise can make a significant difference. Their professional knowledge ensures all damages are properly documented and accurately valued.

There are key moments when bringing in a professional helps—find out when it’s the right time to hire a loss assessor.

Understanding Cost Benefits

The financial implications of hiring a loss assessor warrant careful consideration before committing to their services. While their fees typically range from 5% to 15% of the claim amount, the potential for claim optimisation often outweighs these costs.

Many loss assessors operate on a ‘no win, no fee’ basis, making their services more accessible to homeowners seeking assistance. Their expert claim knowledge helps identify potential issues early in the process, preventing costly complications. Their expertise in negotiation and thorough damage assessment frequently leads to higher settlements that can offset their fees.

The cost efficiency becomes evident when considering the long-term benefits. Loss assessors manage time-consuming paperwork, alleviate stress, and ensure comprehensive claim documentation.

Their professional representation often results in quicker settlements and prevents overlooked damages that could otherwise lead to future expenses.

How do you appoint a loss assessor?

Anyone who needs to make an insurance claim is entitled to appoint a loss assessor. We recommend that you speak to us before you contact your insurance company. We offer free, impartial and practical advice. Our initial survey is free and we work on a ‘no win no fee’ basis. Call PCLA today on 028 9581 5318 to find out how we can help with your insurance claim.

Not sure what a loss assessor does? Here’s what you need to know about their role in a home insurance claim.

How much does a loss assessor charge?

At PCLA we believe in being upfront about our costs. Our initial survey is free. Even if our survey finds that it’s not actually a claim, there’s still no charge to you. If you appoint PCLA to manage your claim, we work on a ‘no win no fee’ basis. Once your claim is settled our professional fee of 10% plus VAT will be included in your settlement cheque.

If you’re hoping for a better payout, learn how a loss assessor can help boost the value of your insurance claim.

Professional Standards and Regulatory Requirements

Loss assessors are required to meet stringent regulatory compliance obligations set by the Financial Conduct Authority (FCA), ensuring high ethical standards in their services to policyholders.

In contrast, loss adjusters operate under different guidelines as employees of insurance companies.

Key differences in professional requirements include:

- Loss assessors must obtain mandatory FCA authorisation to operate legally.

- Loss adjusters adhere to internal procedures established by their respective insurance companies, rather than external regulations.

- FCA registration verification is crucial for loss assessors but is not applicable to adjusters.

- Membership in a trade body holds greater significance for loss assessors due to the stricter oversight involved.

Why you should appoint PCLA

Ideally, you want a qualified independent claims assessor to work on your behalf. They will review your insurance policy and compile a claim that supports your best interest. In our case, we do all the paperwork, we liaise with the insurance company and meet with the loss adjuster. PCLA will take the stress out of your insurance claim.

Property Claims Loss Assessors (PCLA) are a team of claims assessors dedicated to helping people who have suffered accidental loss or damage to their home or business. With over 20 years of industry experience, we are able to negotiate the best possible settlement for our clients. Our promise is to get you your full entitlement under the terms of your policy.