You may have heard the term Loss Assessor before and wondered what are the reasons to hire one.

When the unexpected happens and you need to make a home insurance claim in Northern Ireland, it’s essential to ensure you receive fair compensation. Insurance policies are technical contracts and without a knowledge of these it may be difficult to obtain all that you are entitled to.

Managing the complexities of an insurance claim can be challenging, but there’s a smart way to make the process smoother and more successful—by hiring a loss assessor.

In this blog post, we’ll explore the reasons why it’s wise to use a loss assessor to handle your home insurance claim. We’ll also delve into the crucial question: “When might a loss assessor be appointed?” to help you understand when their expertise can make a significant difference in your insurance journey.

Why Hire a Loss Assessor?

After your property has been damaged, whether by a storm, fire, or some other event, navigating the insurance claim process can feel overwhelming. You’re already dealing with the shock of seeing your home or business affected, and then you’re faced with the added pressure of figuring out paperwork, documentation, and working with adjusters.

The process can feel confusing and time-consuming, especially when all you want is to restore your property and get your life back on track. Knowing what to expect and how to approach each step can make it easier to regain a sense of control during a challenging time.

Here’s why enlisting the services of a loss assessor is a smart move:

Expertise in Insurance Policies

Loss assessors are insurance claim experts. They understand the intricacies of insurance policies, which can often be full of technical language and clauses that may be challenging for the average homeowner to decipher. With their knowledge, they can help you interpret your policy and ensure you receive the coverage you’re entitled to.

Accurate Assessment of Damages

A crucial aspect of the insurance claim process is assessing the extent of the damage.

At PCLA, we are qualified Building Surveyors, which gives us the expertise to thoroughly evaluate the damage sustained, ensuring that nothing is overlooked. Our attention to detail is vital in ensuring that you receive a fair settlement. We undertake testing of affected areas to ensure nothing is missed and all damage that can be claimed for is.

Thorough Documentation

The onus is on the homeowner to present their insurance claim. PCLA have over 30 years of experience in doing so and know how this is to be done.

In respect of buildings damage claims, we thoroughly assess the damage which allows us to compile costed scope of works using current market rates. These scope of works form the claim schedule that is presented to the insurance company as the basis of the claim to be made.

For contents claims, we are able to ensure that all documentation that is required to be presented is collated in a way that is acceptable, ensuring that the claims process runs smoothly and efficiently.

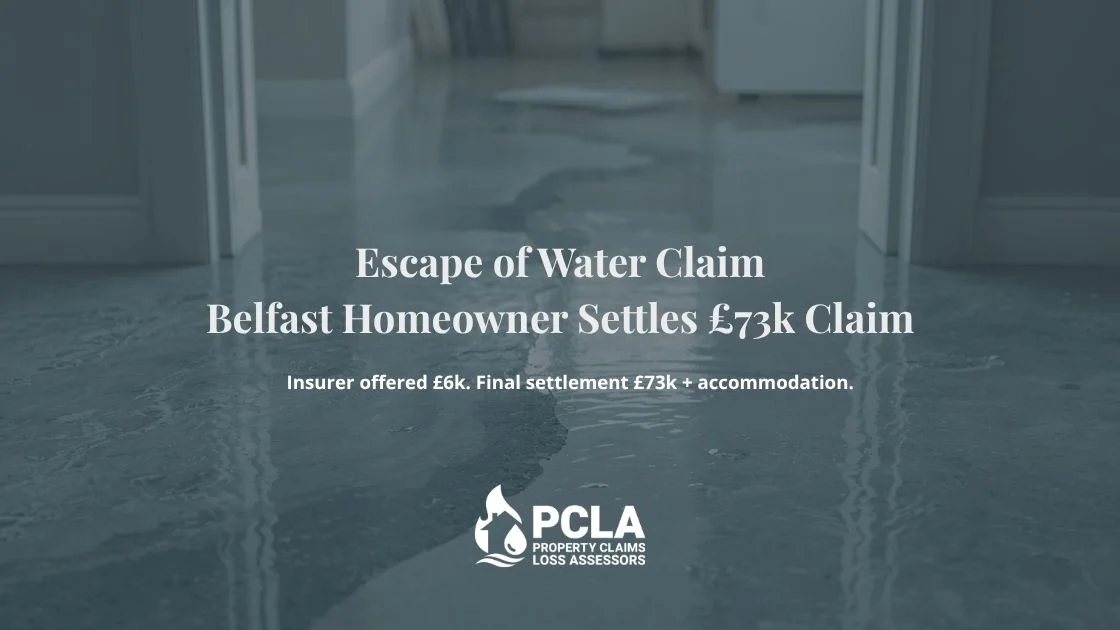

Negotiation Skills

The process of dealing with a home insurance claim can sometimes turn into a negotation between the parties. Insurance companies use loss adjusters to negotiate on their behalf so it is prudent that you also have someone representing you.

Loss Assessors are experienced negotiators of claim matters and always strive to ensure that the full entitlement that their client’s can get are achieved.

Time and Stress Reduction

Handling an insurance claim can be a time-consuming and stressful process. By entrusting the task to a loss assessor, you can free up your time and alleviate the stress associated with managing the claim process. This allows you to focus on rebuilding your life.

Ensuring you Receive Your Full Entitlement

Loss assessors are dedicated to ensuring their client’s receive their full entitlement. They know how to present the evidence effectively and make compelling arguments to insurance companies. This significantly increases your chances of receiving a favourable outcome and one that ensures you are not left out of pocket to pay for repairs or replacement of contents yourself.

When Might a Loss Assessor Be Appointed?

Understanding when to appoint a loss assessor is crucial to making the most of their services. Here are some scenarios in which hiring a loss assessor is particularly advantageous:

Large Losses

In cases of extensive damage, such as fire, flooding, or significant structural issues, it can be wise to appoint a loss assessor as soon as possible. They can ensure that you’re not undercompensated for your losses, which can be substantial in these situations.

PCLA have great experience of dealing with large commercial claims such as hotel fires, flooding to shops, extensive water damage in food production facilities to name a few. We always find that the sooner we are instructed the better. If we are present for the loss adjuster’s first visit it typically helps the claim run more smoothly.

Complex Claims

If your insurance claim involves multiple elements, such as damage to both your property and personal belongings, it can become complex to navigate. Loss assessors have the expertise to streamline the process and ensure that all aspects of your claim are properly assessed.

Disputes with Insurers

If you find yourself in a dispute with your insurance company regarding coverage or the value of your claim, a loss assessor can act as your advocate. They can mediate and negotiate on your behalf to resolve the disagreement.

Limited Insurance Knowledge

Not everyone is well-versed in the intricacies of insurance policies. If you have doubts about understanding your policy or the claims process, it’s advisable to involve a loss assessor from the beginning to avoid potential pitfalls.

Time Constraints

Dealing with the aftermath of a loss can be time-consuming, and managing the insurance claim adds another layer of complexity. Hiring a loss assessor allows you to offload the administrative burden, allowing you to focus on other important aspects of your life.

Uncertain Loss Evaluation

Sometimes, it’s challenging to determine the full extent of your losses immediately after an incident. Loss assessors can conduct a thorough assessment to uncover hidden damages, ensuring that you don’t miss out on compensation you’re entitled to.

Conclusion

In Northern Ireland, handling a home insurance claim can be a daunting task, especially when you’re already dealing with the emotional and logistical challenges of a loss or disaster. However, you don’t have to navigate this complex process alone. Hiring a loss assessor is a smart decision that can significantly improve your chances of receiving a fair and just settlement.

Don’t leave your claim to chance. With our expertise in insurance policies, damage assessment skills, and negotiation abilities, PCLA are your dedicated allies in the quest for a successful insurance claim.

So, the next time you wonder when might a loss assessor be appointed, remember that their assistance can make a world of difference in your insurance journey. Take control and ensure you receive the compensation you deserve by enlisting the help of Property Claims Loss Assessors today.