A house fire is stressful enough without the additional stress of dealing with an insurance company. In this article, we take a look at the different steps involved in making a successful fire damage insurance claim.

Do you need help and advice regarding a home insurance claim for fire damage? Call PCLA today and arrange a free survey.

A house fire has the potential to have a devastating impact on your life. Firstly, it is imperative to make sure that everyone is safe, but after that you may need to make an insurance claim. This can be an extremely difficult and stressful process on it’s own.

The stress and anxiety that follows a house fire can be crippling. But have you considered the financial side of things? You will have the cost to repair the property, the cost to replace any damaged contents and potentially the cost to find and secure alternative accommodation.

Unfortunately, we know all too well the emotional and physical pain a fire can have. We’ve been insurance loss assessors for many years, and have helped many clients deal with the effects of these terrible catastrophes.

If your home has been damaged or destroyed by fire and you are planning to make a claim, make sure you follow these steps for making a successful home insurance claim.

Understanding Fire Damage and Insurance Policies

What is Fire Damage Insurance?

Fire damage is typically covered as a stand alone peril under most insurance policies. This peril provides cover for the damage caused due to a fire, e.g. if an electrical fault occurs in a property resulting in a fire, all the damage that has occurred is typically covered under the ‘fire’ peril of the policy.

Buildings Insurance

Buildings insurance protects the physical structure of your home. According to the Association of British Insurers, it covers costs associated with repairing or rebuilding your home if it is damaged or destroyed, including walls, roofs, and permanent fixtures such as kitchens and bathrooms. Fire damage falls under this policy, so it’s essential to confirm that your buildings insurance is sufficient to cover potential losses.

Key Points About Buildings Insurance:

- Coverage Types: Ensure your policy covers the structure and any permanent fixtures.

- Rebuilding Costs: Understand that the insurance should cover current rebuilding costs, which may have increased since you initially took out the policy. The value needs to be adequate to take into consideration the works required should the worst case scenario occur, such as knocking down the building, rebuilding it from it foundations up and to include all drives, paths, garages, etc.

- Exclusions: Be aware of any exclusions that might limit your coverage in the event of a fire, such as damage due to lack of maintenance or improper use of electrical appliances.

Contents Insurance

Contents insurance, on the other hand, covers your personal belongings within the home. This includes furniture, appliances, clothing, and valuable items. In the unfortunate event of a fire, your contents insurance should ideally reimburse you for damaged items, allowing you to replace what was lost.

Key Points About Contents Insurance:

- Replacement Value: Check whether your policy offers replacement value or actual cash value. Replacement value covers the cost of purchasing new items, while actual cash value deducts depreciation.

- Valuable Items: Ensure that high-value items (e.g., jewellery, art) are covered either within the policy or as separate endorsements.

- Documentation Needs: You may need to provide proof of ownership and value, so maintaining a detailed inventory is beneficial.

Assessing Your Coverage

Before making a claim, it’s crucial to understand what your policy covers. Here are some questions to consider:

- Do you have both buildings and contents insurance?

- Are the limits of your coverage sufficient for your property and belongings?

- Are there specific exclusions that you should be aware of, such as damage caused by negligence or lack of maintenance?

- How often do you update your policy to reflect renovations or significant purchases?

Having this information readily available will streamline the claims process and ensure you are adequately prepared.

Northern Ireland's Leading Loss Assessor - Don't Settle for Less

Ask PCLA to provide you with expert assistance for your fire damage insurance claim.

Understanding the Different Types of Fire Damage

When a fire occurs, it can cause a variety of damages, each requiring different approaches for repair and recovery. Understanding these types of damage can help in assessing the extent of your losses.

Structural Damage

This refers to any damage to the physical structure of your home, including walls, roof and foundation. Structural damage often requires professional evaluation and repair to ensure the safety and integrity of the building.

Smoke Damage

Even if the flames do not directly affect certain areas of your home, smoke can seep into walls, ceilings, and furnishings, causing significant damage. Smoke damage can lead to lingering odours and deterioration of materials, necessitating thorough cleaning and potentially replacement of items.

Water Damage

The firefighting efforts often result in water damage. Water from hoses can flood areas, leading to further complications such as mould growth and structural instability. Addressing water damage promptly is essential to prevent additional loss.

Content Damage

Fire can destroy or damage personal belongings, including furniture, clothing, electronics, and appliances. Contents insurance typically covers these losses, but documentation is critical to ensure you receive adequate compensation.

Emotional and Psychological Effects

The emotional impact of a house fire can be profound. Survivors often experience trauma, anxiety, and uncertainty about the future. It’s vital to address not only the physical rebuilding of your home but also the emotional recovery process. Consider the following:

- Support Systems: Lean on family and friends for emotional support. Joining a support group can also provide comfort and understanding.

- Professional Help: Speaking with a mental health professional can be beneficial for processing trauma and coping with anxiety or depression.

- Rebuilding with Care: Consider that rebuilding your home may involve rethinking your space to create a more comfortable environment that supports your recovery.

Steps to Take After a House Fire

The immediate aftermath of a fire can be chaotic. However, taking certain steps can significantly ease the claims process and help ensure that you receive the compensation you are entitled to.

1. Ensure Safety First

The first priority after a fire should be the safety of all individuals involved. Make sure everyone is safe and account for all family members. Avoid entering the property until it has been declared safe by the fire department.

Important Safety Measures:

- Emergency Services: Ensure that emergency services have assessed the scene and declared it safe for re-entry.

- Medical Attention: Seek medical attention for anyone affected by smoke inhalation or injury.

- Avoid Hazardous Areas: Stay clear of areas that may have unstable structures or lingering smoke.

2. Document Everything

As soon as it is safe to do so, begin documenting the damage. Take photographs and videos of all affected areas, noting the extent of the destruction. This visual evidence will be crucial for your insurance claim.

Documentation Tips:

- Photographic Evidence: Capture wide-angle shots of rooms and close-ups of damaged items.

- Written Records: Keep a written account of events, including dates and descriptions of damages.

- Witness Accounts: If neighbours or witnesses saw the fire, consider gathering their accounts to support your claim.

3. Secure Your Home

To prevent further damage, take steps to secure your home. This may include boarding up windows or covering holes in the roof. An independent loss assessor like PCLA can provide guidance on how to best secure your property while ensuring your insurance claim is unaffected.

Recommended Actions for Securing Your Home:

- Temporary Repairs: Engage professionals for emergency repairs, if necessary, to protect against weather or vandalism.

- Inventory of Damage: Create a list of items that need immediate attention, such as damaged plumbing or electrical systems.

- Safety Checks: Ensure that gas lines and electrical systems are inspected before reoccupying the home.

4. Notify Your Neighbours

Inform your immediate neighbours about the situation. If your fire has spread or damaged neighbouring properties, this could lead to further complications. Maintaining open communication can help in dealing with any subsequent issues.

Helpful Communication Strategies:

- Written Notices: Provide written notices to neighbours detailing the incident and any potential hazards.

- Offer Assistance: If your neighbours were affected, offer assistance or check in on their wellbeing.

- Collective Support: Consider collaborating with neighbours for shared resources or support services.

5. Get Professional Assessments

Engaging professional assessors to evaluate the damage is essential. PCLA’s team of qualified building surveyors can provide a thorough assessment of your property, ensuring that no hidden damage is overlooked. This is particularly important, as undiscovered damage can significantly affect your claim’s outcome.

Professional Assessment Benefits:

- Expertise in Damage Evaluation: PCLA can identify structural issues that may not be visible to the untrained eye.

- Comprehensive Reports: Professional assessments can provide detailed reports that strengthen your insurance claim.

- Guidance for Repairs: Assessors can recommend qualified contractors for repairs, ensuring that the work is done to a high standard.

The Claims Process: Why Appoint an Independent Loss Assessor?

The insurance claim process can be daunting, especially following a traumatic event like a fire. This is where an independent loss assessor, such as PCLA, can make a significant difference.

Benefits of Hiring PCLA

- Expertise and Experience: PCLA specialises in fire damage claims, with a team of experienced loss assessors who understand the complexities of insurance policies.

- Negotiation Skills: PCLA can negotiate on your behalf with your insurance provider, ensuring you receive a fair settlement based on the full extent of your losses.

- Documentation Assistance: They can assist in compiling necessary documentation, such as loss inventories, which are crucial for substantiating your claim.

- Ongoing Support: PCLA provides ongoing support throughout the claims process, helping to alleviate the stress of dealing with insurance companies.

Step-by-Step Guide to Filing a Claim with PCLA

Step 1: Locate Your Insurance Documents

Before making a claim, locate your insurance policy documents. These will detail your coverage, limits, and any specific procedures for filing a claim.

Step 2: Contact Your Insurance Provider

Notify your insurance company as soon as possible about the fire. Most insurers have specific time frames for reporting claims, and delays can jeopardise your entitlement to coverage.

Step 3: Provide Required Documentation

Your insurance provider will require specific information to process your claim. This may include:

- A detailed account of the incident.

- Photos or videos of the damage.

- A list of lost or damaged items.

- Receipts for any temporary accommodation or repairs.

Step 4: Keep Track of All Expenses

It’s essential to keep an accurate record of any expenses incurred due to the fire. This includes costs for temporary accommodation, meals, and other living expenses. Your policy may cover these additional costs, so maintaining detailed records will help you maximise your claim.

Step 5: Work with PCLA Throughout the Process

Throughout this process, PCLA will liaise with your insurance company on your behalf. They will handle negotiations and ensure all aspects of your claim are thoroughly documented and submitted correctly.

Understanding the Claims Assessment

The Role of the Loss Adjuster

Once you submit your claim, your insurance company will likely appoint a loss adjuster. These professionals assess the validity of your claim and estimate repair costs. Understanding their role is essential, as they work for the insurance company and may not always have your best interests in mind.

Responsibilities of the Loss Adjuster:

- Reviewing Claims: They will review the details of your claim, including documentation and evidence submitted.

- Estimating Costs: Loss adjusters will estimate the costs of repairs based on industry standards.

- Reporting Findings: They will compile a report detailing their findings and submit it to your insurance company.

Preparing for the Loss Adjuster’s Visit

To prepare for the loss adjuster’s visit:

- Compile Evidence: Ensure you have all documentation ready, including photos, a detailed inventory list, and any other supporting materials.

- Be Clear and Honest: Clearly explain the extent of the damage and any additional expenses incurred. Provide the loss adjuster with a comprehensive view of your situation.

- Highlight Hidden Damage: If you suspect there may be hidden damage, make sure PCLA is present to highlight these issues during the assessment.

Common Challenges During the Assessment

Understanding the common challenges you might face during the assessment can help you be prepared:

- Disputes Over Damage: Loss adjusters may underestimate certain damages, so it’s essential to have comprehensive documentation.

- Negotiation Tactics: Insurance companies may use tactics to minimise payouts. Having PCLA on your side can help counter these strategies.

- Time Constraints: The assessment process can take time, and pressure from your insurer to settle quickly can be overwhelming.

Common Pitfalls in Fire Damage Claims: Reasons for Claim Denials

Insurance claims can be denied for various reasons. Here are some common pitfalls to avoid:

- Lack of Documentation: Failing to provide sufficient evidence of damage can lead to claim denial. Always document thoroughly.

- Not Understanding Your Policy: Not being fully aware of your policy’s terms and conditions can result in misunderstandings about what is covered.

- Neglecting to Report the Fire Promptly: Delays in reporting the incident can jeopardise your claim. Always notify your insurer as soon as possible.

- Failure to Maintain an Inventory: Clients often underestimate the value of their belongings or neglect to maintain an accurate inventory, making it difficult to substantiate claims for lost items.

How PCLA Can Mitigate Risks

PCLA can help mitigate these risks by ensuring that your claim is complete, well-documented, and presented accurately to your insurance provider. They have the expertise to guide you through the complexities of fire damage claims and can advocate on your behalf.

What to Expect After Filing a Claim

Claim Processing Time

The time it takes for an insurance claim to be processed can vary. Factors influencing this duration include:

- The complexity of the damage.

- The thoroughness of your documentation.

- The responsiveness of your insurance provider.

- PCLA will keep you informed throughout the process, ensuring you understand what to expect.

Possible Outcomes of Your Claim

After the claim is reviewed, you can expect one of several outcomes:

- Full Settlement: The insurance company agrees to your claim in full, covering all repair costs and losses.

- Partial Settlement: The insurer may only cover a portion of your claim, citing exclusions or limits within your policy.

- Claim Denial: If your claim is denied, you have the right to appeal. PCLA can assist you in understanding the reasons for denial and help you navigate the appeals process.

The Importance of an Appeals Process

If your claim is denied, it’s crucial to understand the appeals process:

- Gather Evidence: Collect any additional evidence or documentation that may support your case.

- Seek Clarification: Request a detailed explanation from your insurer as to why your claim was denied.

- Consult with PCLA: PCLA can help you formulate a strong appeal and advocate for your rights.

Recovering from Fire Damage: Beyond the Insurance Claim

Emotional and Psychological Recovery

The emotional aftermath of a house fire can be challenging. It’s essential to seek support from friends, family, or professionals to help process the trauma.

Strategies for Emotional Recovery:

- Therapeutic Support: Consider engaging a therapist specialising in trauma to assist with emotional recovery.

- Community Resources: Look for local support groups or organisations that provide resources for fire victims.

- Journaling: Keeping a journal can help you process your thoughts and feelings during recovery.

Long-Term Restoration

In addition to immediate repairs, consider the long-term implications of fire damage. This includes potential structural issues and the psychological impact on you and your family. A professional restoration service can assist with repairs, ensuring that your home is safe and comfortable again.

Steps for Long-Term Restoration:

- Comprehensive Inspections: Schedule thorough inspections of your home to identify any underlying issues that may arise after repairs.

- Renovations and Upgrades: Consider making upgrades to your home during repairs, such as fire-resistant materials or modern electrical systems.

- Ongoing Maintenance: Establish a regular maintenance schedule to ensure that your home remains safe and well-maintained.

Fire Damage Claims: Get Your Full Entitlement, Stress-Free

Managing the aftermath of a house fire is undoubtedly overwhelming. However, by understanding your insurance coverage, meticulously documenting damage, and engaging with an experienced loss assessor like PCLA, you can successfully manage the claims process.

Remember, you do not have to face this challenge alone. With the right support, you can work towards rebuilding your life and home after such a devastating event.

If you’ve experienced a fire in your home, don’t hesitate to reach out to PCLA for expert help and support. Call us today at 028 9581 5318 and let us assist you in navigating your fire damage insurance claim successfully.

Final Thoughts on Fire Safety and Preparedness

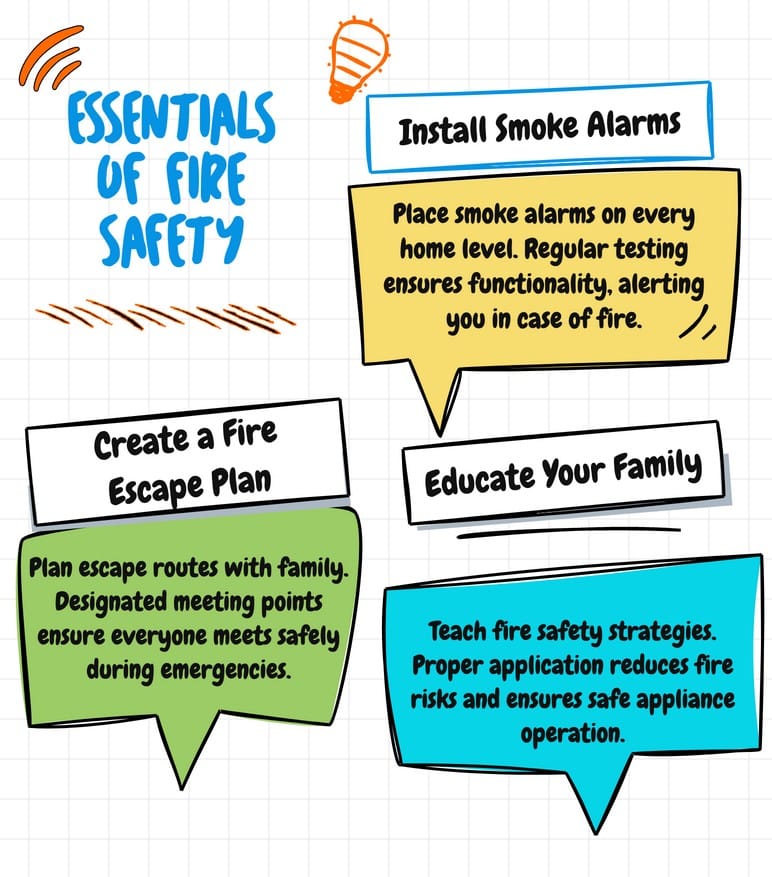

In addition to recovery, consider taking proactive measures to enhance fire safety in your home:

- Install Smoke Alarms: Ensure that smoke alarms are installed on every level of your home and are tested regularly.

- Create a Fire Escape Plan: Develop a fire escape plan with your family, including designated meeting points outside your home.

- Educate Your Family: Teach your family about fire safety practices, including the proper use of electrical appliances and fire extinguishers.

By taking these proactive steps, you can reduce the risk of future incidents and ensure a safer living environment for you and your loved ones.