Having a water damage claim denied can be financially devastating for UK homeowners. While water damage is one of the most common types of home insurance claims, it’s also one of the most frequently rejected. Understanding why claims are denied and how professional claims management services can help prevent rejection is crucial for protecting your interests.

With expert guidance, you can understand the complex claims process more effectively and improve your chances of a successful outcome.

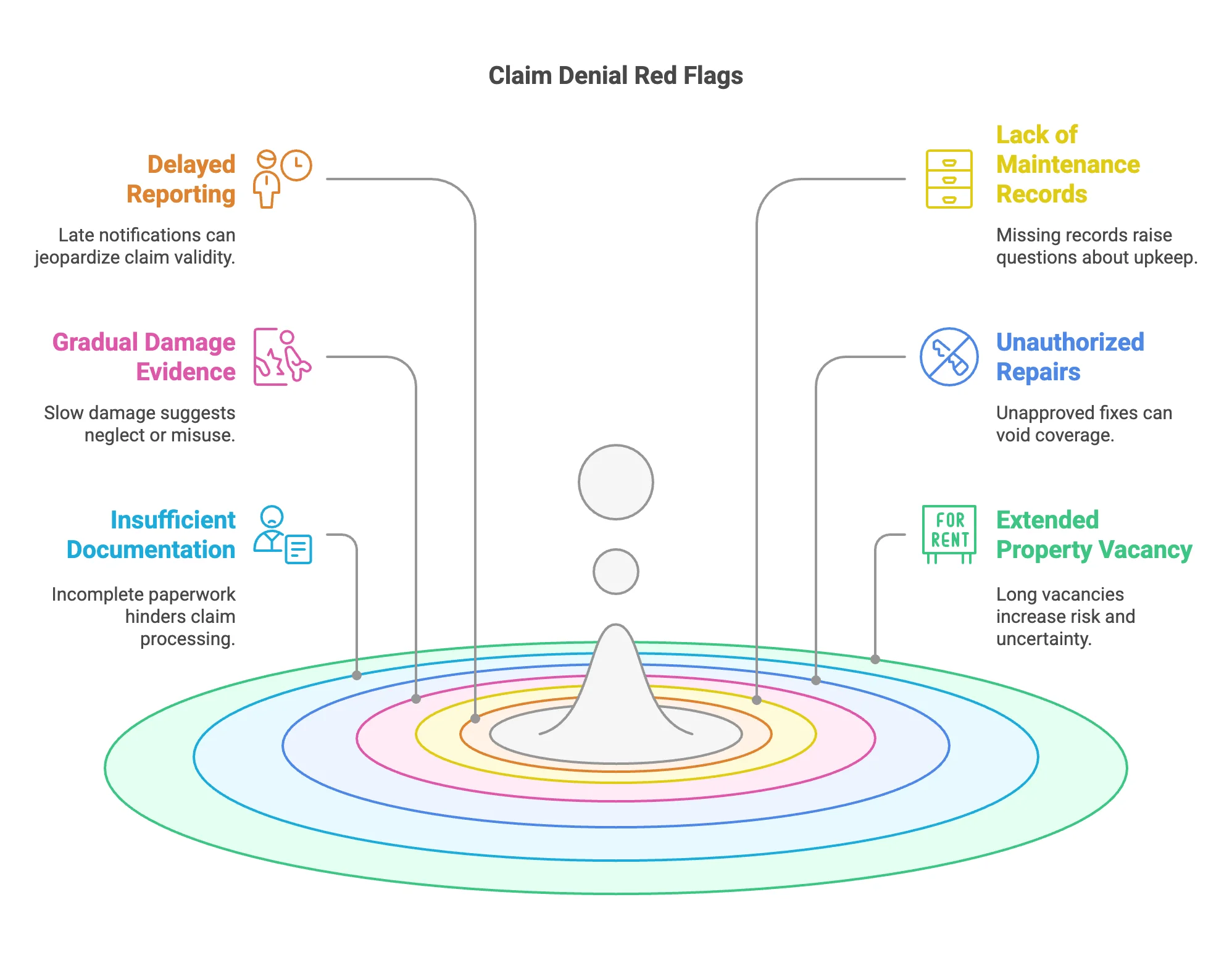

Water damage claims frequently encounter denial in the UK due to issues such as neglect of maintenance, delayed reporting, and policy exclusions that cover gradual leaks or flooding. Insurance companies meticulously examine documentation and may reject claims that lack adequate evidence or professional assessments.

Claims management services can assist in navigating these challenges by compiling essential documentation, coordinating specialist evaluations, and advocating for fair treatment. Their expertise in managing complex cases significantly enhances the likelihood of successful settlements. Being aware of the common pitfalls and potential solutions can make a significant difference.

Key Takeaways

- Claims are often denied when homeowners fail to maintain comprehensive maintenance records or document regular property inspections and repairs.

- Delayed reporting beyond 24 hours of discovering water damage significantly reduces the chances of a successful claim and raises suspicions with insurers.

- Gradual leaks and long-term seepage issues are typically excluded from coverage, as they are deemed preventable through proper maintenance.

- Properties left unoccupied for more than 30 days may lose coverage unless specific precautions and notifications are communicated to insurers.

- Claims management services enhance the likelihood of approval by providing expert documentation, coordinating assessments, and negotiating with insurance companies.

Understanding Water Damage Coverage in UK Home Insurance Policies

While a home insurance policy may appear straightforward at first glance, it actually requires careful attention to detail.

Related: Read our full water damage claim process guide.

Different types of water damage are treated distinctly by insurers, and coverage limits can vary significantly between policies.

Most standard policies cover sudden events such as burst pipes and leaking appliances under “escape of water” provisions.

Regular maintenance and inspection can help identify potential issues before they become costly claims that get denied.

However, have you checked if your policy includes protection against gradual leaks or sewer backups?

The distinction between sudden and gradual damage is crucial.

While a burst pipe flooding your kitchen will typically be covered, that slow drip beneath your sink may not qualify for compensation.

Many homeowners are surprised to learn that flood damage often necessitates separate coverage through specialised programmes like Flood Re.

Pre-existing Issues and Maintenance-Related Claim Denials

Property owners must remain vigilant for tell-tale warning signs of potential water damage, such as discoloured walls, musty odours, or unexplained increases in water bills.

Insurance companies expect homeowners to maintain detailed records of all property maintenance activities, including receipts for repairs, photographs of completed work, and documentation of regular inspections.

These maintenance records serve as essential evidence when filing water damage claims, as they demonstrate responsible property management and help prevent claim denials based on negligence. Regular inspections can identify structural deficiencies early on before they develop into major issues requiring costly insurance claims. Discover the reasons why you should get professional claim support for water damage claims.

Neglected Property Warning Signs

Three essential warning signs can alert homeowners to potential water damage claim denials before they occur.

- Property neglect often manifests through visible signs such as peeling paint, water stains, or musty odours – all indicators that could void future claims.

- Second, the importance of maintenance cannot be overstated, particularly regarding gutters and downpipes that show obvious blockages or damage.

- Third, persistent small leaks that seem minor but worsen over time can signal pre-existing conditions.

These warning signs are particularly vital because insurers scrutinise claims for evidence of ongoing issues.

Regular property inspections and prompt repairs demonstrate responsible homeownership. Insurers expect homeowners to conduct regular maintenance checks to prevent issues that could lead to claims.

By addressing these indicators early, homeowners can protect their right to claim while maintaining their property’s value. Remember: what might seem like a minor issue today could become grounds for claim denial tomorrow.

Related: Check out our guide to coverage and exclusions.

Maintenance Documentation Requirements

Maintaining detailed records of property upkeep can make the difference between an approved or denied water damage claim. Following maintenance best practices isn’t sufficient – you need to document everything. Insurance companies expect evidence of regular inspections, repairs, and system maintenance.

The importance of documentation cannot be overstated in terms of protecting your investment. Keep records of all plumbing checks, roof inspections, and appliance servicing. Take photographs before and after repairs. Save receipts and contractor reports. Gradual damage leaks that develop slowly over time are typically excluded from coverage, making thorough documentation even more critical.

Why is this so essential? Insurance policies typically exclude damage from gradual wear and tear or pre-existing conditions. Without proper maintenance records, your claim could be denied if the insurer suspects the damage resulted from neglect rather than a sudden incident.

A thorough paper trail demonstrates your commitment to property care and strengthens your position during the claims process.

The Impact of Delayed Reporting on Water Damage Claims

When filing water damage claims, timing can significantly affect your case, as most insurers require notification within 24 hours of discovering the issue.

Each passing day makes it more difficult to accurately document the initial damage and could raise questions about whether secondary problems have developed subsequently.

Insurance companies often view delayed reporting with suspicion, frequently assuming that homeowners may have contributed to the damage by not taking immediate action. Prompt reporting increases your chances of a successful insurance claim settlement. The easiest way to do this is to hire a claims management service as they will take care of everything for you.

Time Limits Matter Most

Time is the most critical factor in water damage insurance claims. The urgency of reporting can significantly influence the success of your claim, as most insurers require notification within 24 hours. While the Limitation Act 1980 allows up to six years to file, delaying for such a long period rarely works in your favour.

| Timeframe | Action Required | Impact |

|---|---|---|

| 24 Hours | Report incident | Best chance of approval |

| 1 Week | Document damage | Evidence still fresh |

| 1 Month | Process claim | May face complications |

Prompt reporting ensures better evidence collection and quicker processing. Consider water damage like a ticking clock – every hour that passes can exacerbate the situation. By acting swiftly, you’re not only adhering to policy requirements; you’re also safeguarding your property and bolstering the validity of your claim. Delaying your report can lead to worsening damage, particularly in cases involving floods or leaks.

Evidence Quality Deteriorates Daily

Evidence gathered in water damage claims experiences a rapid decline in quality with each passing day. Proper evidence preservation becomes increasingly challenging as time progresses, making it harder to demonstrate the true extent of the damage to insurers.

Consider these critical factors that affect damage assessment when reporting is delayed:

- Water-damaged materials begin to deteriorate immediately, obscuring the original damage patterns.

- Initial evidence may be compromised by necessary emergency repairs or clean-up efforts.

- Forensic investigations become less reliable as physical traces fade or change.

With 26% of claims involving water damage, insurers scrutinise evidence particularly carefully in these cases.

The impact of delayed documentation can seriously undermine the credibility of your claim.

When water damage occurs, swift action in recording evidence through photographs, videos, and professional assessments is essential.

Remember that insurers view prompt reporting as a sign of responsible homeownership.

Related: Emergency Steps to Minimise Water Damage for UK Homeowners

Insurer Trust May Decline

Reporting delays in water damage claims can seriously erode the trust between homeowners and their insurance providers. When incidents aren’t promptly documented, insurer scepticism naturally increases as the quality of evidence diminishes and damage potentially worsens.

This decline in trust often manifests in various ways. Insurance companies may question whether the damage occurred as reported or if proper maintenance could have prevented it. They might wonder if the delay allowed the problem to escalate unnecessarily. In one notable case, a family endured nine months of delays while their kitchen leak remained unfixed, severely damaging insurer relationships.

The impact extends beyond just the current claim. Insurers tend to view delayed reporting as a red flag that could affect future claims handling.

Simple actions such as taking immediate photographs, maintaining detailed records, and reaching out to claims management services can help preserve the essential trust relationship with your insurer.

Common Policy Exclusions That Lead to Denied Claims

While homeowners may assume their insurance policies cover all types of water damage, many standard policies include specific exclusions that can lead to denied claims.

Understanding policy language and claims procedures is vital to avoid disappointment when filing a claim.

Common reasons insurers deny water damage claims include:

- Unoccupied property damage – Homes left vacant for over 30 days may lose coverage unless specific precautions are taken.

- Gradual damage from slow leaks that could have been prevented through regular maintenance.

- Pre-existing conditions or structural issues not disclosed when the policy commenced.

Regular property inspections and proper maintenance documentation are important.

Insurers expect homeowners to take reasonable steps to prevent water damage.

When in doubt about coverage, it’s wise to review your policy details or consult with an insurance professional.

Poor maintenance or neglected wear and tear issues often result in claim denials without specific policy add-ons.

Essential Documentation Requirements for Successful Claims

Successful water damage claims hinge on proper documentation from the moment water enters a home. Proper organisation of documents ensures claim accuracy and maximises the chances of approval.

| Required Documents | Purpose | Timeline |

|---|---|---|

| Photos/Videos | Visual proof of damage | Immediate |

| Detailed Inventory | List of affected items | Within 24 hours |

| Repair Estimates | Cost assessment | First week |

| Communication Log | Track interactions | Ongoing |

Every homeowner should maintain a thorough file of receipts, plumber reports, and correspondence with insurers. Consider documentation as telling the story of your property – the more detailed it is, the clearer the image becomes for claim adjusters. Remember to update records regularly and keep digital copies of everything. When in doubt, document more rather than less.

The Role of Professional Assessments in Water Damage Claims

Professional assessments serve as the cornerstone of successful water damage claims. By employing advanced moisture detection methods and professional assessment techniques, specialists can uncover hidden damage that might otherwise go unnoticed. These thorough evaluations protect homeowners while strengthening their insurance claims. Early identification through professional assessment helps prevent long-term impacts of water damage.

When faced with water damage, professional assessors bring essential tools and expertise:

- Moisture meters and infrared cameras reveal concealed water damage behind walls.

- Hygrometers monitor humidity levels to prevent secondary issues like mould.

- Specialist software creates detailed moisture maps for precise restoration planning.

The documentation gathered during these assessments is crucial for insurance claims. Not only does it validate the extent of the damage, but it also demonstrates your commitment to proper maintenance and swift action – factors that insurance companies value highly when processing claims.

How Claims Management Services Negotiate Complex Denials

Because insurance companies frequently deny water damage claims, homeowners need skilled guidance to navigate the complex appeals process. Claims management services specialise in understanding common denial reasons and developing effective strategies to address them.

These professionals excel at documenting pre-existing conditions and maintenance records to counter potential claim rejections. They know exactly what evidence insurers require and how to present it effectively during the claims process.

When facing coverage disputes, claims management services thoroughly review policy exclusions and identify potential grounds for appeal. They assist homeowners in gathering proper documentation, maintaining communication records, and meeting strict reporting deadlines.

Their proficiency proves particularly significant when managing complex situations involving multiple denial factors, such as maintenance issues combined with coverage limitations.

Strategies for Appealing Rejected Water Damage Claims

When insurance companies reject water damage claims, homeowners have several avenues for contesting the decision through the appeals process. Successful appeal strategies require a systematic approach to evidence collection and professional support.

Here are three essential steps to strengthen your appeal:

- Document everything extensively with photographs, videos, and detailed notes of the damage.

- Obtain independent expert assessments from qualified surveyors or loss assessors.

- Create a comprehensive inventory of all damaged items with supporting evidence.

Building a robust case means staying organised and meeting all deadlines.

Professional claims management services can guide you through each stage of the appeal process. They know precisely what evidence insurers look for and how to present it effectively.

Keep in mind that challenging a denial works best when you combine thorough documentation with expert guidance.

Preventing Future Claim Denials Through Property Maintenance

Taking proactive steps to maintain your property can significantly reduce the likelihood of water damage claim denials. Implementing preventive measures through regular inspections and maintenance schedules helps identify potential issues before they escalate into serious problems.

| Maintenance Task | Recommended Frequency |

|---|---|

| Gutter Cleaning | Every 6 months |

| Plumbing Check | Annually |

| Roof Inspection | Every 2 years |

| Appliance Service | According to manufacturer’s guidelines |

Keeping detailed records of all maintenance activities provides essential evidence when filing claims. This includes photographs, repair receipts, and professional inspection reports. It is important to remember that gradual damage caused by neglected maintenance issues often leads to claim denials, while properly documented upkeep strengthens your position with insurers. Regular maintenance not only protects your property but also demonstrates responsible ownership to insurance providers.

Conclusion

The success of your water damage claim often hinges on proper documentation, timely reporting, and expert handling of the claims process. While insurers may seem quick to deny claims, many rejections can be prevented through proper preparation and professional support. A claims management service can be invaluable in:

- Ensuring comprehensive documentation

- Meeting critical reporting deadlines

- Identifying covered damage versus exclusions

- Maintaining effective communication with insurers

- Negotiating fair settlements

Remember, prevention is always better than cure. Regular maintenance, proper documentation, and prompt action when issues arise are your best defences against claim denial. When water damage does occur, having professional claims management support can make the difference between approval and rejection.