Making a home insurance claim can feel daunting, especially when you’re dealing with the emotional and physical aftermath of an incident that has affected your home. If you’re wondering, “How do I make a home insurance claim?”, whether it’s for water damage from a burst pipe, a fire, storm damage, or even theft, understanding the process is crucial. This guide will walk you through everything you need to know, from making a claim to understanding the role of a Loss Assessor and why their assistance can be invaluable.

What Is a Home Insurance Claim?

A home insurance claim is a request made to your insurance company asking for compensation for damage following an event covered by your home insurance policy. These policies typically cover events such as fire, theft, water damage, and storm damage. When you make a claim, your insurance company will assess the validity of the request and, if approved, cover the repair or replacement costs up to the policy’s limit.

Why Is It Important to Act Fast After Damage?

When disaster strikes your home, acting quickly is essential to avoid further damage. For example, if a burst pipe floods your home, failing to turn off the water supply or take immediate steps to contain the flood can lead to structural damage, increasing the cost of repairs and complicating the insurance claim process. Here are some key steps to follow right after an incident:

| Step | Action | Reason |

|---|---|---|

| 1 | Document the damage (take photos) | Provides visual evidence for your insurance claim |

| 2 | Contact a Loss Assessor | They can guide you through the process and maximise your claim |

| 3 | Make temporary repairs if safe to do so | Prevents further damage but remember to document all repairs |

| 4 | Notify your insurer immediately | Timely notification is crucial to expedite your home insurance claim |

Making a home insurance claim should be prompt to avoid additional complications.

The Role of a Loss Assessor in Your Home Insurance Claim

Managing a home insurance claim can be challenging, especially if you’re unfamiliar with the terminology, the paperwork, or the technicalities involved in proving the damage. This is where a Loss Assessor can prove invaluable. They work for you, not the insurance company, ensuring you receive the maximum payout you are entitled to under your policy.

Loss Assessors:

- Assess the damage to your home and provide expert advice.

- Prepare and submit the claim on your behalf, handling the complicated paperwork.

- Negotiate with the insurer to ensure you get the best settlement.

- Help you obtain your full entitlement, ensuring all aspects of your home and belongings are covered.

Hiring a Loss Assessor is particularly beneficial when dealing with large or complex claims. For example, if you’ve experienced extensive water damage that has affected the structure of your home, it may be difficult to understand the full scope of repairs needed. A Loss Assessor can evaluate this for you and make sure everything is included in your insurance claim.

Over the years, PCLA has assisted thousands of property owners in receiving their full entitlement during the claims process. Our expertise has consistently proven invaluable, whether it’s negotiating more favourable settlements when initial offers from insurers were inadequate or successfully overturning claims that were initially denied. We take pride in ensuring our clients receive the fair treatment and compensation they deserve.

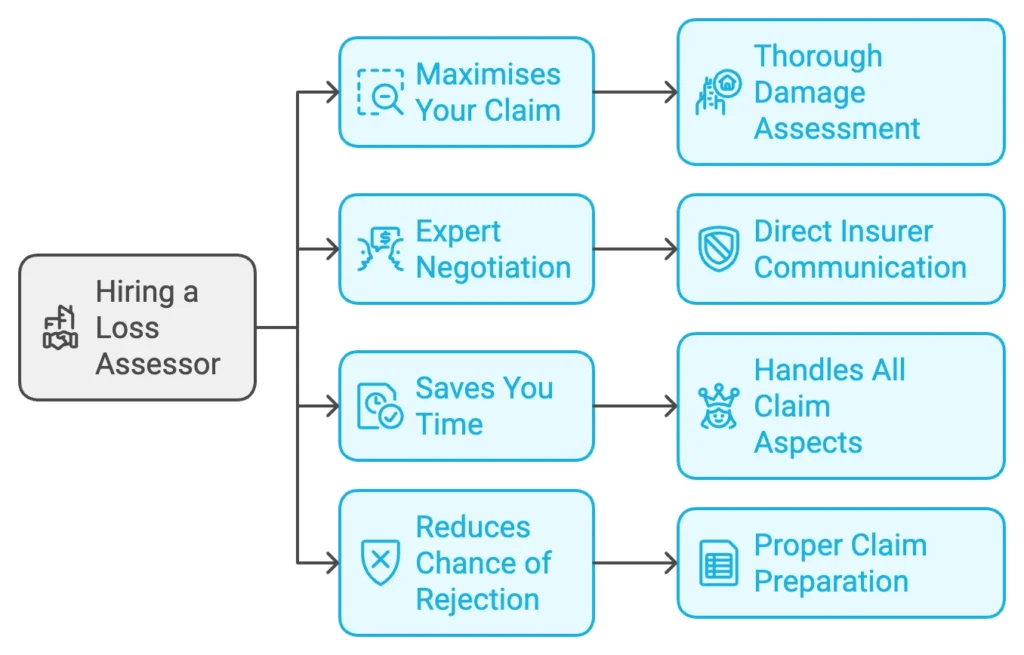

Benefits of Using a Loss Assessor:

| Benefit | Description |

|---|---|

| Maximises your claim | They understand how to assess damage thoroughly, ensuring nothing is missed. |

| Expert negotiation | They deal with the insurer directly, meaning you avoid stressful negotiations. |

| Saves you time | They handle all aspects of the claim, allowing you to focus on recovering. |

| Reduces the chance of rejection | Their expertise ensures your claim is prepared properly, reducing the likelihood of it being denied due to missing documentation or errors. |

Hiring a Loss Assessor for your home insurance claim ensures you get the settlement you deserve.

How to Make a Home Insurance Claim in the UK

Filing a home insurance claim can be a detailed process but breaking it down into manageable steps makes it easier to handle. Here’s a step-by-step guide to filing your claim:

1. Contact Your Insurer

As soon as you’ve assessed the situation and taken steps to prevent further damage, the next step is to contact your home insurance provider. Many insurers have a time limit for reporting incidents (often within 48 hours), so it’s essential to act fast.

When you contact them, have your policy number ready and provide as much detail as possible about the damage. If you’ve already contacted a Loss Assessor, they can handle this process for you.

2. Document the Damage

Before you make any permanent repairs, ensure you’ve thoroughly documented the damage. Take photographs from multiple angles and make a list of all affected areas and items. This step is crucial because the more evidence you have, the stronger your home insurance claim will be.

Key Documentation to Gather:

- Photographs of the damage (including close-ups)

- Receipts for any repairs or replacements

- A copy of your home insurance policy

- Any communication with contractors or emergency services

3. Make Temporary Repairs

While waiting for your insurance claim to be processed, you may need to make temporary repairs to prevent further damage. For example, if a storm has damaged your roof, covering it with a waterproof tarpaulin can prevent water from seeping into your home. However, it’s important to note that these repairs should be temporary and not permanent fixes until your insurer has had a chance to assess the situation.

4. Work with a Loss Assessor

Engaging a Loss Assessor at this point can greatly simplify the process. They will ensure your home insurance claim is properly documented, negotiate with the insurer on your behalf, and maximise your settlement. Their expert advice is invaluable, especially in complex cases such as subsidence claims or storm damage.

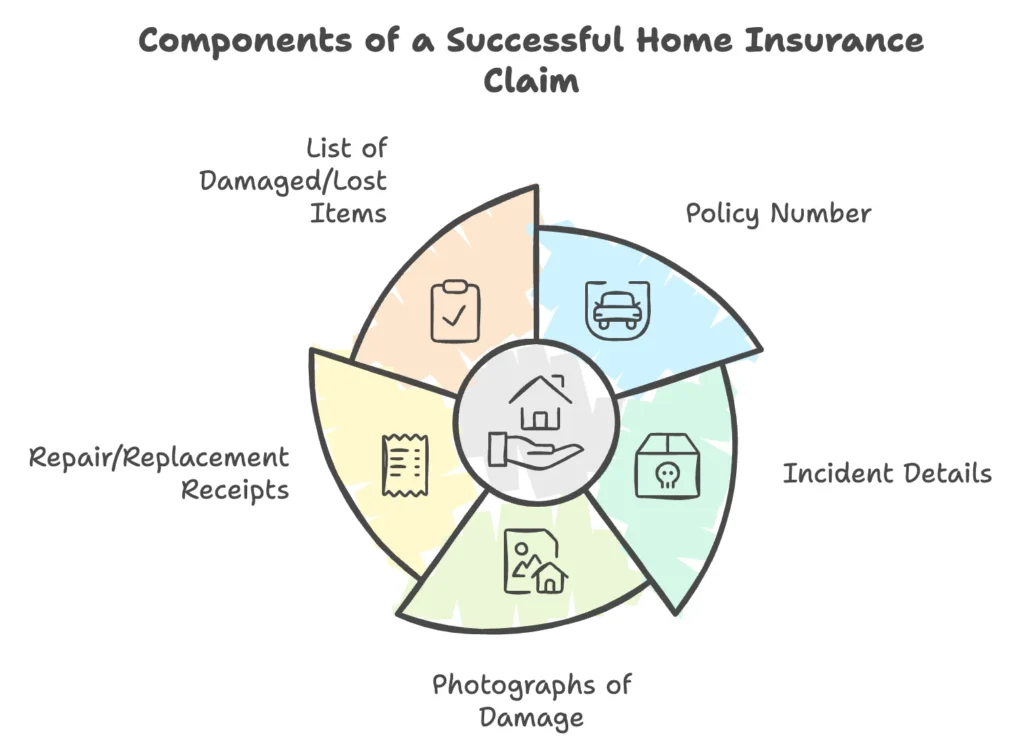

What Information Do You Need to Make a Home Insurance Claim?

Having the right information on hand can significantly speed up your home insurance claim. Here’s a checklist of the most important documents and details:

| Information Required | Why It’s Important |

|---|---|

| Policy number | Identifies your insurance contract |

| Details of the incident | The more information you provide, the smoother the process |

| Photographs of the damage | Visual evidence to support your claim |

| Receipts for repairs/replacements | Proof of the costs incurred |

| List of damaged/lost items | Helps quantify the claim |

A well-documented home insurance claim can make the process faster and more successful. Discover The Easy Way to Understand Home Insurance Terms.

Common Reasons for Home Insurance Claims in the UK

In the UK, there are several common reasons for filing a home insurance claim. Understanding these can help you anticipate what your policy might cover:

- Water Damage/Escape of Water: Leaking pipes, overflowing appliances, or floods can cause significant damage. Does Home Insurance Cover Underfloor Leaks?

- Storm Damage: Heavy winds and rain can damage roofs, windows, and outdoor structures.

- Fire Damage: Fires can devastate a home, destroying personal belongings and the structure itself.

- Theft or Vandalism: Burglaries or acts of vandalism can lead to property loss or damage.

- Subsidence: Ground movement that affects your home’s foundations is a serious and costly issue.

Why Your Claim Might Be Rejected and How to Avoid It

Unfortunately, not every home insurance claim is successful. There are several common reasons claims are denied:

- Policy Exclusions: Certain types of damage may not be covered by your policy. Always read the fine print.

- Wear and Tear: Damage due to general wear and tear is not covered. For example, an old roof that collapses due to age would not qualify.

- Incomplete Documentation: If you fail to provide adequate evidence, your claim may be rejected.

- Delayed Reporting: If you don’t report the damage within the timeframe specified by your insurer, you may lose out on coverage.

How to Avoid Rejected Claims

- Read Your Policy Carefully: Understand what is and isn’t covered by your insurance.

- Document Everything: Photos, receipts, and written evidence strengthen your case.

- Report Quickly: Don’t delay in reporting the damage to your insurer.

- Work with a Loss Assessor: Their expertise can prevent errors that might lead to a rejected claim.

How Long Do You Have to File a Home Insurance Claim in the UK?

In most cases, you should report any damage to your insurer as soon as possible, often within 24-48 hours. However, the window to submit a formal claim can vary, with many insurers allowing up to one year to file.

Tip: Check your home insurance policy to ensure you understand the exact timeline for reporting damage and submitting a claim. Waiting too long can result in your home insurance claim being denied.

Related: Can You Claim for Burst Water Pipes?

What to Do if Your Home Insurance Claim is Rejected

If your home insurance claim is rejected, don’t panic. You have several options to pursue, including:

- Review the Rejection Letter: Insurers will provide a reason for the rejection, so review this carefully.

- Provide Additional Evidence: Sometimes, simply providing more documentation can turn a rejection into an acceptance.

- Appeal the Decision: Most insurers have an appeals process if you feel your claim was unfairly rejected.

- Seek Legal Advice or Contact the Financial Ombudsman: If you’re still unsatisfied, consider seeking independent advice.

Working with a Loss Assessor can also be beneficial in this situation. They can help you understand why the claim was rejected and provide guidance on how to appeal the rejection effectively. Their expertise in handling home insurance claims ensures that all the necessary details and documentation are presented clearly, increasing the likelihood of overturning the decision.

4 Benefits of Using a Loss Assessor for Home Insurance Claims

By now, it should be clear that hiring a Loss Assessor can be incredibly beneficial when making a home insurance claim. Let’s explore the specific advantages in more detail.

1. Expert Knowledge of the Claims Process

Navigating the world of home insurance claims can be confusing, especially if you are unfamiliar with the jargon, policies, and procedures involved. A Loss Assessor brings expert knowledge of the claims process and can act as your guide. They know exactly what documentation is required, how to assess the damage, and how to ensure you meet your insurer’s requirements.

PCLA, with over 30 years of experience in dealing with claims, knows what is and isn’t covered by a policy. We’ve have helped thousands of clients over the years, providing invaluable support throughout the claims process.

2. Maximising Your Settlement

One of the biggest benefits of working with a Loss Assessor is their ability to maximise your insurance claim. They work on your behalf, ensuring that all aspects of the damage are fully accounted for and that nothing is overlooked. This is particularly important for larger claims where the true extent of the damage may not be immediately visible.

At PCLA, we are qualified Building Surveyors with the knowledge and expertise to uncover damage that may not be immediately apparent. By conducting a thorough assessment, we can secure a higher payout than you might be able to achieve on your own.

This was the case when we handled a recent claim in Banbridge for a client who had a leaking pipe in the concrete floor of their home. We were able to undertake a full moisture survey of the property, highlighting areas that were damaged that had not been apparent to the naked eye and if missed would likely have led to secondary damages. This allowed for all these areas to be included in the claim so work could take place to bring the property back to its condition before the leak.

3. Time-Saving and Stress Reduction

Handling a home insurance claim can be time-consuming and stressful, particularly if you’re trying to manage repairs and disruptions to your home life at the same time. A Loss Assessor takes the burden off your shoulders by managing the entire claims process from start to finish. They handle all communication with your insurer, gather evidence, and negotiate the settlement on your behalf.

4. Avoiding Underinsurance

Underinsurance is a common problem that many homeowners face. It occurs when your insurance policy does not provide sufficient coverage for the value of your home and possessions. This can lead to reduced payouts or rejected claims. A Loss Assessor can review your policy and ensure that your coverage is adequate, helping you avoid being underinsured in the event of a claim.

Frequently Asked Questions About Home Insurance Claims in the UK

How Long Does It Take to Process a Home Insurance Claim?

The time it takes to process a home insurance claim can vary depending on the complexity of the claim and the insurer’s procedures. On average, straightforward claims (such as those for minor water damage or theft) can take anywhere from a few weeks to a couple of months. More complex claims, such as those involving subsidence or extensive storm damage, can take longer.

Tip: Stay in regular contact with your insurer to monitor the progress of your claim. Working with a Loss Assessor can also help speed up the process, as they can handle much of the administrative work and ensure that all necessary documentation is submitted promptly.

Will My Insurance Premium Increase After a Claim?

One of the most common concerns homeowners have when making a home insurance claim is whether their premium will increase. The answer is: it depends. Insurers often increase premiums after a claim is made, especially if the claim is significant or if you have made multiple claims within a short period.

To mitigate the impact on your premiums, consider the following:

- Weigh the cost of the claim: If the damage is minor and the cost to repair it is close to your excess, it may be more cost-effective to cover the repair costs yourself rather than filing a claim.

- Compare insurance policies: After making a claim, shop around to ensure you’re still getting the best deal on your home insurance.

Can I Claim Online or Do I Need to Call My Insurer?

Many UK home insurance companies offer both online and phone claim submission options. If you’re comfortable with technology, submitting your claim online can be quick and convenient. However, if you prefer speaking to someone directly or have a complex situation, calling your insurer may provide more immediate support and answers.

What Happens If I’m Underinsured?

Being underinsured can have serious consequences. If your home insurance policy does not cover the full value of your home and its contents, you may receive a reduced payout or, in some cases, your claim may be denied altogether. For example, if your home is insured for £200,000 but its actual value is £300,000, the insurer may only cover a portion of the damage, leaving you to pay the difference.

How Can I Avoid Being Underinsured?

To avoid underinsurance, review your policy regularly, especially after making significant improvements or additions to your home (such as extensions or renovations). A Loss Assessor can help assess whether your current coverage is adequate and make recommendations for adjustments.

Common Types of Home Insurance Claims in the UK

Knowing the most common types of home insurance claims in the UK can help you prepare for the unexpected and understand what your policy covers. Below is a table highlighting the most frequent claims:

| Claim Type | Description | Common Causes |

|---|---|---|

| Water Damage | Damage caused by leaking pipes, faulty appliances, or flooding | Burst pipes, overflowing appliances, floods |

| Storm Damage | Damage from severe weather conditions | High winds, heavy rain, fallen trees |

| Fire Damage | Destruction of property due to fire | Electrical faults, kitchen fires, arson |

| Theft | Loss of belongings due to burglary | Break-ins, vandalism |

| Subsidence | Structural damage due to ground movement | Soil erosion, construction work nearby |

The Importance of Hiring a Loss Assessor for Your UK Home Insurance Claim

Making a home insurance claim in the UK can be a complex and stressful process, but it doesn’t have to be. With the right approach and assistance, you can navigate the process smoothly and ensure you receive the compensation you’re entitled to. Hiring a Loss Assessor is one of the most effective ways to maximise your claim, reduce stress, and avoid common pitfalls such as underinsurance or claim rejection.

Key Takeaways:

- Act fast: Document the damage, make temporary repairs, and notify your insurer as soon as possible.

- Hire a Loss Assessor: Their expertise can help you navigate the process, maximise your claim, and ensure you are not underinsured.

- Know your policy: Regularly review your home insurance policy to ensure it covers the full value of your home and belongings.

- Prepare for the unexpected: Understanding the most common types of home insurance claims can help you anticipate potential risks and protect your home.

By following these steps and considering the assistance of a Loss Assessor, you can take control of your home insurance claim and secure the compensation you deserve. Whether you’re dealing with water damage, storm damage, or something more complex, having the right support makes all the difference.