Home insurance terms can feel like a different language — especially when you need to claim. Understanding definitions like “excess,” “peril,” “trace and access,” and “accidental damage” helps you avoid surprises and make better decisions. Here’s everything you need to know about the most common home insurance terms in your policy.

What are the most common home insurance claims?

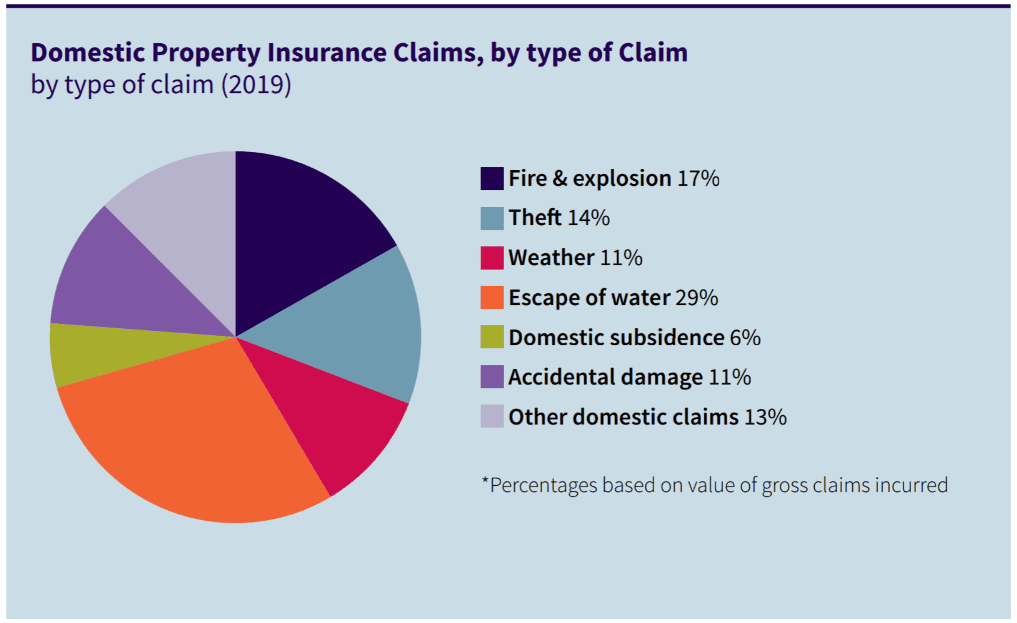

Before we start to explore what home insurance terms actually mean, we can reveal the most frequent types of insurance claims.

According to the Association of British Insurers these are the seven most frequent types of domestic property insurance claims in the UK:

- Fire & explosion 17%

- Theft 14%

- Weather 11%

- Escape of water 29%

- Domestic subsidence 6%

- Accidental damage 11%

- Other domestic claims 13%

While these are the most common, it may be surprising to learn that your policy might not provide cover for all these types of claims. According to the ABI the home insurance claims acceptance rate has fallen to 82% – meaning that it is becoming harder to make a successful claim on your home insurance policy.

Did you know that using a loss assessor will increase the chance of you making a successful claim? Our experienced loss assessors work for you and will strive to get you the best possible settlement figure based on your level of cover. If you need free home insurance claims advice, speak to PCLA today on 028 9581 5318.

What are the categories typically covered by homeowners insurance?

Home insurance is typically covered by two separate policies:

The buildings policy will provide cover for the physical structure of your home as well as the fixtures and fittings e.g. doors, floors, showers etc. Your contents policy provides cover for your possessions e.g. if you suffer loss or damage to items such as jewellery, laptops, TVs, tools etc. You can find out more about the type of insurance you have [link to are you insured].

The types of losses covered by homeowners insurance include:

- Fire damage

- Water damage

- Storm damage

- Accidental Damage

- Flood Damage

- Impact Damage

- Oil damage

- Structural Damage

- Theft and Burglary

Home insurance terms you need to know

With the help of this glossary you can understand the most common insurance terms.

Accidental damage cover

This is protection for unexpected damage caused to your property or possessions.

Additional Coverage

This refers to add-ons that you may wish to include with your policy such as accidental damage.

Buildings Insurance Cover

This covers the physical building and the cost of repairs caused by damage. How do you know if your home has the correct level of cover?

Contents Insurance

This provides cover for damage or loss to your household possessions. Anything that is not considered to be part of the structure of the house should be covered by the contents policy.

Excess (voluntary excess)

This is the amount you pay if you make a claim.

Fire Damage

Damage caused to a property as a result of a fire. This could include smoke damage.

Flood Damage

This is when water enters your property from outside e.g. a river bursting its banks.

Heave

This is the upward movement of the ground supporting your property. This is relevant when investigating structural damage claims.

Home

This is the insured property as identified by its address in the policy.

Impact Damage

This is most likely to have been caused by a car or other vehicle ‘impacting’ your property e.g. the wall of your house or a boundary wall or fence.

Insurance Claim

When the policyholder requests compensation from the insurance company under the terms of their policy. Do you need help with your insurance claim?

Inventory

We would recommend that everyone compiles a list of their home contents. This inventory is useful in the event of a claim. However, PCLA can do this for you as part of our claims assessor service.

Legal Expenses

This is additional insurance you can buy to protect you against legal costs incurred when making a claim or defending yourself against a claim.

Level of Coverage

This determines how much the rebuild cost of your property is and the total value of your possessions.

Oil Damage

Damage caused by a leak or crack in your home heating oil tank or fuel line. Find out how to make a claim for oil damage.

Period of Cover

This is how long your insurance cover lasts. Typically 12 months.

Personal Property (or possessions)

Things that you have and use regularly e.g. your clothes, electronic gadgets, wallets, credit cards, jewellery, mobile phones etc.

Peril

The insurance peril is the specific cause of property damage e.g. fire, water, storm etc. PCLA assist with many types of insurance perils.

Policy Documents

These include everything you are required to know. They include the terms of your policy; the general exclusions; and your legal liabilities. These can be tricky to understand. If you have any questions about your policy, please call PCLA for free impartial advice.

Policy Owner

The named person on the insurance policy.

Property Damage

Damage caused to your property by any of the insurance perils.

Rebuild Cost or Value

This should not be thought of as the market value of your home. Rather, this is the actual cost to rebuild the property if it has been completely destroyed.

Settlement

This is the payout you receive in accordance to the level of coverage you have in your policy. We recommend that you use a loss assessor to ensure you get the maximum settlement under the terms of your policy.

Storm Damage

Damage caused to your property as a result of a storm e.g. fallen trees, broken windows, damage to your roof. If you experience storm damage, call PCLA to find out how we can help.

Structural Damage

Structural damage happens when the property incurs damage to its foundations. These types of claims are usually very complex.

Structural Survey

A qualified building surveyor will conduct a thorough examination of your property to assess the damage. PCLA have a team of qualified buildings surveyors who will provide an initial survey free of charge.

Subsidence

The downward movement of the ground beneath your property.

Theft and Burglary

This is when your home contents are stolen as a result of someone entering your home illegally. Home insurance should cover instances of theft and burglary.

Trace and Access

You would need this if you have trouble identifying the origin of a leak.

Water Damage (Escape of water)

Usually caused by leaks e.g. water tanks, baths, showers, pipes etc. This is a common type of insurance claim. If you discover a leak and need help making a claim, call PCLA and arrange an appointment.

Let experts help you make sense of your policy

At PCLA, we know from experience that the insurance claims process can be extremely frustrating. We’re here to help. As experienced loss assessors we work on your behalf to manage the entire claim process, so you don’t have to, and to ensure you receive everything you are entitled to. Ask PCLA to take the stress out of your insurance claim today. Call 028 9581 5318.