How to make a successful insurance claim

Do you want to make sure you receive everything you are entitled to from your insurance claim?

We understand that many people find the insurance claims process frustrating. We are here to help!!!

As a team of expert loss assessors, PCLA will make sure your claim is dealt with in your best interests.

PCLA will manage the claim process for you. From reporting the claim to your Insurer to meeting with the Loss Adjuster to costing out the works required to negotiating the best possible settlement, PCLA will do everything to minimise any stress and inconvenience to get you back on track as quickly as possible.

Our expert loss assessors are available today to offer advice and support for your insurance claim. Ask PCLA to take the stress out of your insurance claim today.

Let PCLA help you get the settlement you deserve.

Do you need to make a household insurance claim?

PCLA can help you:

- Our first survey is free and carried out within 24 hours.

- No claim is too big or too small.

- We fully assess the damage and carry out any necessary tests e.g. a moisture survey after a pipe leak.

- We will contact your insurance company on your behalf… so you don’t have to.

- We arrange a suitable appointment for the insurance company’s loss adjuster to come and view the damage.

- We will be on site to meet the loss adjuster and agree the full scope of works needed to get your property back to its pre-loss condition.

- We help you with any paperwork needed by insurers, this can range from a claim form to a plumbers report.

- We compile a detailed estimate so you don’t have to acquire multiple estimates from various trades.

- We will negotiate the best possible settlement under the terms of your policy.

- The settlement payment goes directly to you, so you are always in control.

- We only get paid when you have received your payment from your insurer.

What our clients say

EXCELLENTTrustindex verifies that the original source of the review is Google. PCLA were very fast to respond and to act on our behalfPosted onTrustindex verifies that the original source of the review is Google. Excellent service from Jordan, he did absolutely everything to do with the claim which took all the hassle out of the process making the whole experience effortless for me. Would absolutely recommend him and his company again. First classPosted onTrustindex verifies that the original source of the review is Google. I was struggling and frustrated with insurance claim then called in Jordan who took over and handled everything with a very successful outcome. Highly recommendedPosted onTrustindex verifies that the original source of the review is Google. This company is 1st class from start to finish fast/friendly and reliable and gets the job done highly recommendedPosted onTrustindex verifies that the original source of the review is Google. .can fully recommend Declan and PCLA 100%Posted onTrustindex verifies that the original source of the review is Google. Our loss assessor Declan was very professional and kept us informed throughout our claim and his expertise secured a settlement far and beyond what we could have achieved on our own. For a stress free claim experience! I would highly recommend PCLA with your claim!Posted onTrustindex verifies that the original source of the review is Google. Excellent service by Declan of PCLA. He liaised with the insurers on our behalf and took care of everything. We believe he achieved a better settlement than we would have got had we dealt with the insurers ourselves. 100% recommendedPosted onTrustindex verifies that the original source of the review is Google. Declan from PCLA was brilliant throughout. We had an issue with storm damage, he came within a numbers of days to inspect and then the following week with the insurer. Within 24hrs we had a settlement! Great communication and really easy to work with. Appreciate all Declan done for us!Posted onTrustindex verifies that the original source of the review is Google. Had a really great experience with this company. Declan was friendly and reassuring right from the first call, which made a stressful situation much easier to handle. He gave solid advice throughout, and everything ended up being really straightforward in the end. Would definitely recommend!

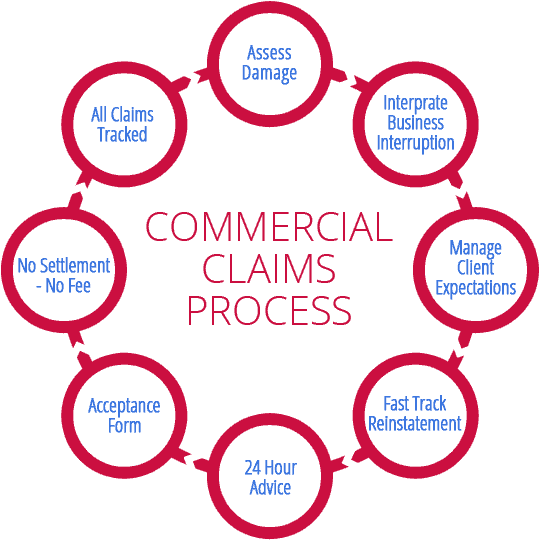

Commercial Insurance Claim?

Along with Household Claims we also specialise in Commercial Insurance Claims a.k.a Business claims. Loss of Business can be detrimental to lots of people along with their families so we, as a team, know that Speed of Service is of utmost importance in these instances. Our qualified team are more than equipped to deal with even the most complex of claims in record timing – Read more about our team on the About Us page.

- Our first survey is free & carried out within 24 hours.

- We fully assess the damage to your business & carry out any necessary tests.

- We work quickly & effectively to get your business reopened as soon as possible.

- We will contact your Insurance Company on your behalf & insist on having a Loss Adjuster on-site within 24 hours of notification.

- We arrange a suitable appointment for the insurance loss adjuster to come and view the damage.

- We are on site to meet the loss adjuster and agree the full scope of work needed to get your property back to its pre-loss condition.

- We can compile a claim for you under the Business Interruption element of your policy. This is a complex element that needs a comprehensive understanding.

- We assist you in any paperwork needed for insurers. This can range from a claim form to a plumbers report.

- We compile a detailed estimate for you so you don’t have the stress of acquiring multiple estimates from various trades.

- We will negotiate the best possible settlement under the terms of your policy.

- The payment goes directly to you, meaning you are always in control.

- We only get paid when you have received your payment from insurers.

- 24 hour advice on project work.

Types of Claims

We offer help and advice with all instances of Commercial and Domestic Property Damage. Learn more about the different types of insurance claims that PCLA can help you with by clicking the links below.

House Fire

One of the most devastating events that can happen to a family is when their home has been damaged by fire. Getting your life back to normal can be complicated and time consuming. Find out how PCLA can help.

Water Damage

Water damage claims come in all forms. The most common include leaking pipes, leaking roofs, dish washer leaks, washing machine leaks, and drainage leaks.

Storm Damage

With the increasing amount of storms and the damage they cause, it is more important than ever to have a qualified professional, such as Property Claims Loss Assessors, acting on your behalf to represent you through the claim process.

Accidental Damage

If you have suffered any damage to your home or contents then your best course of action is to call us and speak to us over the phone, where we can tell you if your accidental damage incident is likely to be covered.

Flood Damage Claim

Did you know that the average domestic flood claim is around £31,000? It is imperative that you have a qualified professional such as Property Claims Loss Assessors (PCLA) acting on your behalf should your property be affected by flooding and you need to make a claim.

Impact Damage

Impact damage is exactly as it sounds, when something impacts your property and causes damage. The two main causes are from vehicles colliding with your property or heavy machinery, for example diggers, hitting your boundary wall.

Oil damage

Oil Spill damage is probably the most underestimated and most devastating type of damage to your health and property. If you think you may have an oil leak at your property, call Property Claims Loss Assessors (PCLA) today and arrange for one of our Assessors to visit your property to undertake a no obligation free survey.

Theft and Burglary Insurance Claim

Unfortunately, these types of claims are on the rise. Your insurance company may only be willing to pay for some of the stolen items. They might ask you questions, which if not answered correctly, might result in them withholding the full settlement. Contact us to get professional advice on your claim before contacting your insurance company.

Related Articles

Northern Ireland Loss Assessor

PCLA are a leading Loss Assessor firm operating throughout Northern Ireland. As an independent company with over 20 years experience, we know how to make sure our clients get their full entitlement.

Is My House Insured? Simple Ways to Check Your Cover

You may think your home is insured, but if your home is not insured or is underinsured, you could face a bill for property damage worth thousands of pounds.

What’s the difference between a loss adjuster and a loss assessor?

The easiest way to explain the difference is to understand their respective roles. A loss adjuster works for the insurance company.

A loss assessor works for you (the policy holder).