Home Insurance: Everything you need to know about storm damage

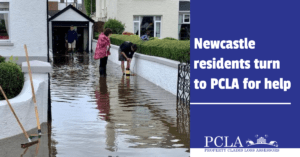

Northern Ireland gets its fair share of bad weather. Wind, rain, hail and even lightning can cause serious and devastating storm damage to your home. In this article we’ll answer some of the most popular storm damage insurance claim questions and explain the best way to make a claim on your home insurance.