How do I make a storm damage insurance claim?

Making a storm damage claim can be difficult. Storms can cause significant damage to properties, from roof damage to flooding. Navigating the insurance claims process can be challenging and overwhelming. This guide will help you understand how to make a storm damage insurance claim, what steps are involved, and how PCLA can support you throughout the process.

Let the experts help

The easiest way to make a storm damage claim is to get PCLA to do it for you. Our team manages the claims process on your behalf, so you don’t have to.

PCLA will check your insurance policy documents to confirm the cover you have in place. We will undertake surveys of your property to identify the full extent of damage caused by the storm.

We can also arrange for emergency works to be undertaken such as temporary repairs to the roof, drying of the property or making it secure.

If you appoint PCLA as soon as possible, we can start building your case and answering your questions. We will present your claim in the best way possible to ensure you receive your full entitlement under the terms of your policy.

How do storm damage claims work?

The first step in a storm damage claim is to notify your insurance company about the incident. You should provide them with as much detail as possible regarding the damage, including photographs and descriptions. The insurance company will ask for the date when the damage occurred and cross-reference it with local weather records to verify that a storm was present in your area at that time.

The insurer may assign a Loss Adjuster to assess the damage and determine whether it is covered under your policy. You may need to provide additional documentation, such as a report from a qualified surveyor or roofing contractor.

Once the damage is verified, the insurer will calculate the compensation based on repair estimates and the terms of your policy. Throughout the process, it is important to communicate effectively with your insurer to ensure all necessary information is provided promptly.

What happens when I have a storm damage claim?

Should you wish for us to assist you with your claim we will initially review your policy and, if cover is in place, will contact the insurance company to notify them of the incident. The Insurer may ask for a report detailing the full extent of storm damage and to confirm the damage has indeed been caused by a storm, PCLA can provide this if needed.

If a Loss Adjuster is appointed by the Insurer, PCLA will liaise with them and present them with all claim details required. PCLA will meet with the Loss Adjuster on site if necessary to go over the circumstances of the loss and damage. PCLA will compile a fully costed schedule of claim using current market rates based on the damage evidenced to the property, meaning there is no need for you to obtain builders quotations to present to your Insurer. PCLA will then negotiate the best possible settlement for you under the terms of your insurance policy.

How do I make sure I get what my policy entitles me to?

Contact PCLA as soon as possible. We will assess the damage to your property, cost the works required and negotiate with your insurer. That is why, with PCLA acting on your behalf, we can ensure you get everything you are entitled to under your insurance policy.

Should you use a Loss Assessor?

Making an insurance claim can be very time consuming and often frustrating. We’re here to help. As experienced loss assessors we work on your behalf to manage the entire claim process, so you don’t have to, and to ensure you receive everything you are entitled to.

When should I call the insurance company after I have storm damage?

You should contact PCLA as soon as possible and before you contact your insurance company. As professional loss assessors, it is our job to make sure your claim is submitted properly and as fast as possible. However, If you have already contacted your insurer, PCLA can still be appointed at any stage of the claim.

How do you deal with an insurance company after a storm incident?

PCLA take the stress out of dealing with insurance companies. It’s our job to liaise with the insurance company on your behalf. We’ll keep you up to date on the progress of your claim. You can contact us at any time to discuss your case.

PCLA will notify the insurer of your loss and arrange to meet with their appointed Loss Adjuster. As qualified Building Surveyors, PCLA have the skill and expertise to assess any damage that has been sustained to your property.

We compile fully costed schedules of the damage which form the basis of the claim which we use in the negotiation with your insurer. There is nothing for you to do and PCLA take away all the stress of dealing with your insurer.

Why are storm damage claims rejected?

It is important to read the terms and conditions of your insurance policy to understand what is and is not covered. PCLA’s expert knowledge and experience will guide you through your Insurance claim.

The most common reason why storm damage cases are rejected is because the insurer states the damage is caused by wear and tear or that the date given to the Insurer as to when the damage occurred does not correlate with weather records showing a storm to be prevalent in the area at the time.

How long does it take to settle a storm damage insurance claim?

Storm damage claims can be complex. The insurance company will usually require a report from a qualified professional to confirm that the damage has indeed been caused by a storm.

They may ask for photographs of the damage and costings to reinstate.

However, with PCLA working on your behalf we can take away the stress and hassle and deal with the case from start to finish on your behalf.

PCLA will liaise with your Insurer and ensure your claim is dealt with promptly and fairly. All aspects of the claim are handled by PCLA and we work on your behalf to ensure the process is as seamless and stress free as possible.

Tips to deal with a storm damaged house

- It is important after heavy winds and rain to check the roof of your property for any damage. Damage to the roof may not become apparent until a later date when rainwater gets into the house.

- Take photos of any damage.

- Arrange for temporary repairs to be undertaken to damaged roofs to secure them and prevent any water getting into the property.

- Remove any ceilings that have been affected and look unstable.

- Install dehumidifiers to dry out any affected areas.

- Remove any contents items that could be affected and document and photograph all those that have been.

What our client's say

EXCELLENTTrustindex verifies that the original source of the review is Google. PCLA were very fast to respond and to act on our behalfPosted onTrustindex verifies that the original source of the review is Google. Excellent service from Jordan, he did absolutely everything to do with the claim which took all the hassle out of the process making the whole experience effortless for me. Would absolutely recommend him and his company again. First classPosted onTrustindex verifies that the original source of the review is Google. I was struggling and frustrated with insurance claim then called in Jordan who took over and handled everything with a very successful outcome. Highly recommendedPosted onTrustindex verifies that the original source of the review is Google. This company is 1st class from start to finish fast/friendly and reliable and gets the job done highly recommendedPosted onTrustindex verifies that the original source of the review is Google. .can fully recommend Declan and PCLA 100%Posted onTrustindex verifies that the original source of the review is Google. Our loss assessor Declan was very professional and kept us informed throughout our claim and his expertise secured a settlement far and beyond what we could have achieved on our own. For a stress free claim experience! I would highly recommend PCLA with your claim!Posted onTrustindex verifies that the original source of the review is Google. Excellent service by Declan of PCLA. He liaised with the insurers on our behalf and took care of everything. We believe he achieved a better settlement than we would have got had we dealt with the insurers ourselves. 100% recommendedPosted onTrustindex verifies that the original source of the review is Google. Declan from PCLA was brilliant throughout. We had an issue with storm damage, he came within a numbers of days to inspect and then the following week with the insurer. Within 24hrs we had a settlement! Great communication and really easy to work with. Appreciate all Declan done for us!Posted onTrustindex verifies that the original source of the review is Google. Had a really great experience with this company. Declan was friendly and reassuring right from the first call, which made a stressful situation much easier to handle. He gave solid advice throughout, and everything ended up being really straightforward in the end. Would definitely recommend!

Related Articles

Home Insurance: Everything you need to know about storm damage

Northern Ireland gets its fair share of bad weather. Wind, rain, hail and even lightning can cause serious and devastating storm damage to your home. In this article we’ll answer some of the most popular storm damage insurance claim questions and explain the best way to make a claim on your home insurance.

What types of property claims does a loss assessor manage?

A loss assessor will manage any type of insurance claim covered by an insurance policy. In this article, we’ll uncover the reasons why you should consider working with a loss assessor if you need to make an insurance claim for property damage.

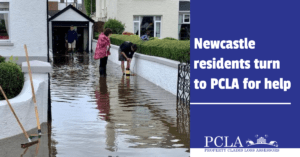

How a local firm helped Newcastle residents through the aftermath of Storm Francis

In August 2020 storm Francis hit the UK causing a lot of damage to property throughout the country. Particularly affected was Newcastle, Co. Down.

We offer help and advice for all instances of Commercial or Domestic Property Damage. Use the links below to learn more about how a loss assessor can take the stress out of your insurance claim.